Investing has become indispensable for individuals seeking financial stability and growth. However, navigating the labyrinth of investment options can be daunting, especially for beginners. This comprehensive guide delves into three popular investment avenues: forex, stocks, and commodities, empowering investors to make informed decisions tailored to their financial goals and risk appetite.

Image: tradingbot.info

Understanding Investment Avenues

Forex (Foreign Exchange Market)

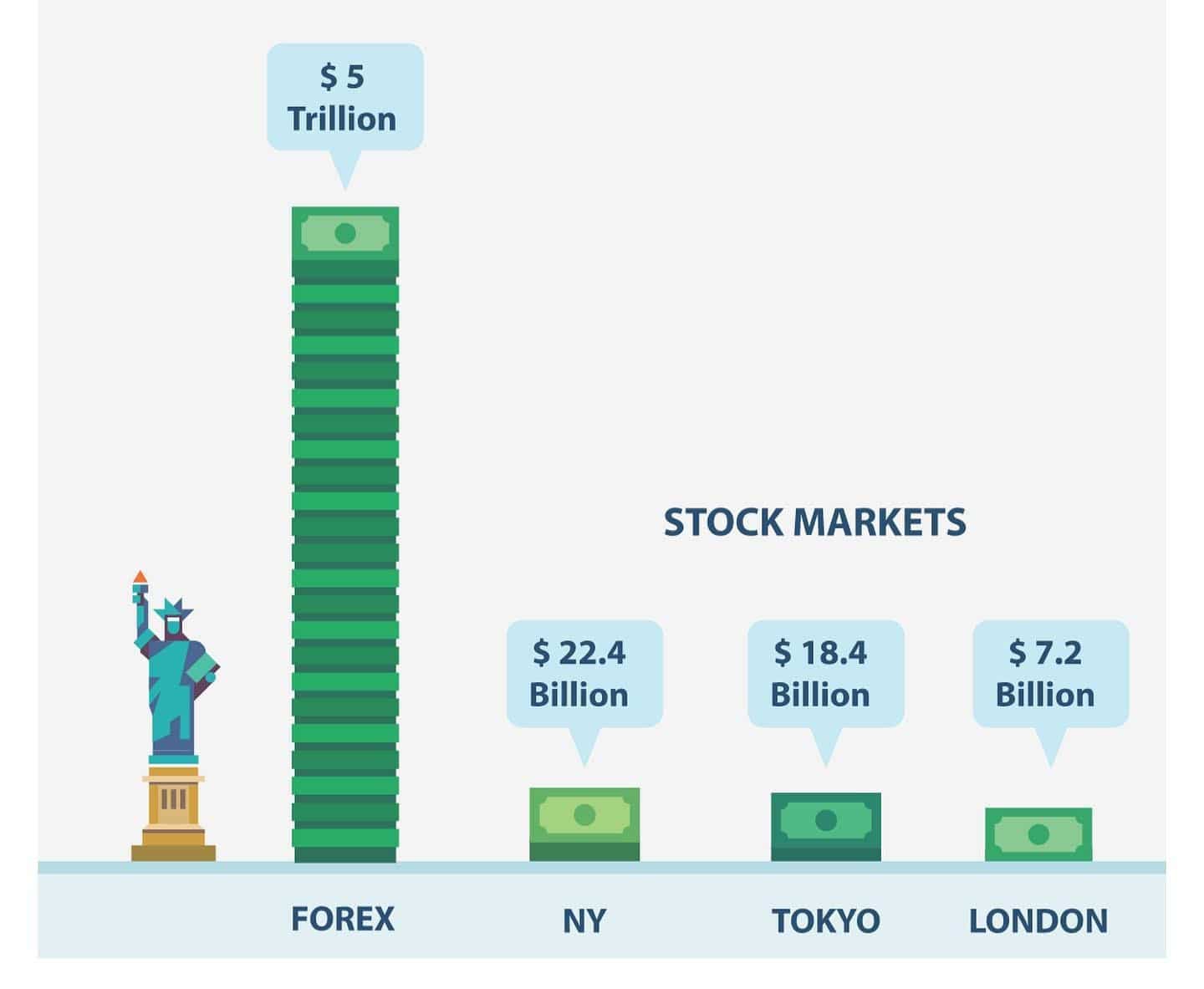

The forex market is the largest financial market globally, facilitating the exchange of currencies between nations. With a daily trading volume exceeding $6 trillion, forex offers unparalleled liquidity and volatility, making it attractive to short-term traders and speculators.

Stocks (Equity Market)

Stocks represent ownership in a company, предоставляя investors with a share of the company’s assets and earnings. The stock market encompasses publicly traded companies, offering a wide range of investment opportunities across industries and sectors. Dividends and capital appreciation drive investor returns in the stock market.

Commodities (Commodity Market)

Commodities are raw materials or физические активы, such as gold, oil, and wheat, which are bought and sold to meet basic human needs or industrial requirements. The commodity market offers diversification benefits and can serve as an inflation hedge, making it an appealing choice for long-term investors.

Key Considerations for Selecting an Investment Avenue

1. Risk Tolerance

Forex trading carries higher risk due to its inherent volatility, while stocks offer moderate risk levels depending on the specific company and industry. Commodities tend to be less volatile than stocks, making them a more conservative option.

2. Investment Horizon

Forex traders typically engage in short-term trades, often within a day or a week. Stocks can be held for various durations, from days to years, depending on the investor’s strategy. Commodities usually require longer investment horizons, from months to years.

3. Financial Goals

Short-term market fluctuations drive forex traders’ goals, focusing on capital gains. Stock investors aim for dividend income and long-term capital appreciation, diversifying their portfolios across multiple companies. Commodity investors seek diversification and inflation protection.

4. Market Knowledge and Trading Skills

Forex trading requires a deep understanding of currencies and geopolitical events. Stock market participation benefits from fundamental and technical analysis skills. Knowledge of commodity supply and demand dynamics is essential for successful commodity trading.

Benefits and Considerations for Each Investment Avenue

Forex

Advantages:

- High liquidity and volatility

- Potential for high returns

- 24/7 trading hours

Considerations:

- High risk

- Requires significant knowledge and experience

- Currency fluctuations can impact returns

Stocks

Advantages:

- Ownership in companies

- Dividend income

- Access to various industries and sectors

- Potential for significant growth

Considerations:

- Market volatility

- Company-specific risks

- Requires due diligence and research

Commodities

Advantages:

- Diversification benefits

- Inflation hedge

- Low correlation with stocks and bonds

Considerations:

- Limited liquidity in some commodities

- Storage and transportation costs

- Price fluctuations due to supply and demand dynamics

Image: www.fxpipsguru.com

Forex Vs Stocks Vs Commodities

Conclusion

The choice between forex, stocks, and commodities hinges on an investor’s risk tolerance, investment horizon, financial goals, and market knowledge. Forex trading suits short-term high-risk takers, while stock investing caters to both short-term speculators and long-term growth-oriented individuals. Commodities provide diversification and inflation protection, appealing to investors seeking stability. By understanding the unique characteristics and considerations of each investment avenue, investors can make wise decisions that align with their financial objectives.