Introduction

As a seasoned trader in the dynamic world of foreign exchange, I’ve witnessed firsthand the impact of fluctuating TT rates on market movements. In May 2019, these rates experienced significant shifts, shaping the strategies of investors and traders alike. This article delves into the intricacies of forex TT rates, providing a comprehensive analysis of their trends and developments during that specific period.

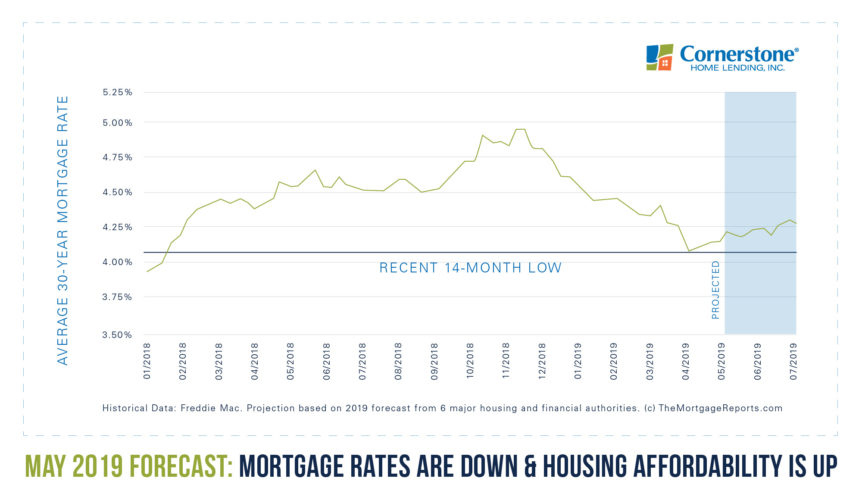

Image: www.houseloanblog.net

Understanding Forex TT Rates

TT rates, short for telegraphic transfer rates, are the interbank exchange rates used for transferring funds between international accounts. They differ from spot rates, which represent the immediate exchange of currencies, and play a crucial role in determining the cost of cross-border transactions.

May 2019 TT Rate Trends

The month of May 2019 marked a period of notable volatility in forex TT rates. The US dollar strengthened against most major currencies during the early part of the month, driven by expectations of an interest rate hike by the Federal Reserve. However, as concerns over a potential trade war between the US and China escalated, investors sought refuge in safe-haven assets such as the Japanese yen and the Swiss franc, pushing the dollar lower.

By the end of May, the dollar had regained some ground but remained below its earlier highs. The euro and the British pound also experienced fluctuations, reflecting economic and political uncertainty in Europe.

Influencing Factors on TT Rates

A multitude of factors influence TT rates, including:

- Central bank policies: Interest rate changes and monetary policy adjustments impact currency values.

- Economic data: Unemployment rates, GDP growth, and inflation figures can affect investor sentiment and drive currency movements.

- Political events: Wars, elections, and changes in government can introduce uncertainty and volatility into the market.

- Risk appetite: Investors’ perception of risk influences their demand for safe-haven currencies, which can lead to fluctuations in TT rates.

Image: wallpapersafari.com

Expert Advice for Traders

Amidst the uncertainties of the forex market, seasoned traders emphasize the importance of:

- Regular monitoring: Keeping abreast of TT rate trends and economic indicators is crucial for informed decision-making.

- Risk management: Implementing appropriate risk management techniques, such as stop-loss orders and position sizing, mitigates potential losses.

- Flexibility: Adaptability is key in the dynamic forex market. Traders should adjust their strategies based on changing conditions.

FAQ on Forex TT Rates

Q: What is the difference between spot rates and TT rates?

A: Spot rates are for immediate currency exchange, while TT rates are for interbank transfers.

Q: What factors influence TT rates the most?

A: Central bank policies, economic data, political events, and risk appetite play significant roles.

Q: How can I forecast TT rate movements?

A: It’s challenging to predict future rates with certainty, but analyzing past trends, economic data, and geopolitical events can provide insights.

Forex Tt Rates In May 2019

Conclusion

Understanding the complexities of forex TT rates is essential for success in the foreign exchange market. By monitoring trends, considering influencing factors, and implementing sound trading strategies, investors and traders can navigate the fluctuations and seize opportunities.

Are you eager to delve deeper into the world of forex and master the nuances of TT rates? Explore our comprehensive resources and connect with fellow traders to stay informed and empowered in this ever-evolving market.