Immerse yourself in the world of forex trading with the revolutionary trendline strategy devised by the renowned Kelvin Lee. Let’s delve into the depths of this powerful technique and unlock the secrets to maximizing your trading potential.

Image: howtotrade.com

Unveiling the Trendline Strategy

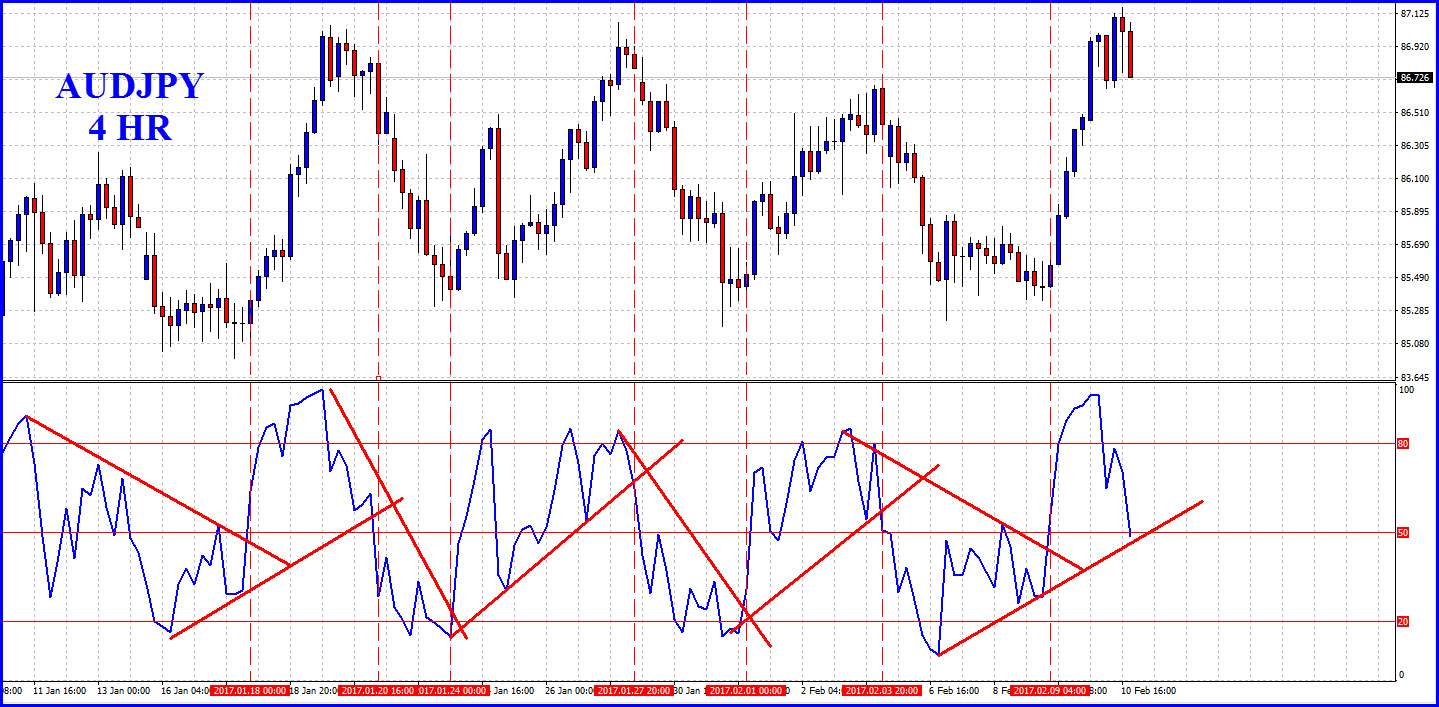

The trendline strategy is an indispensable tool for forex traders, guiding them in identifying and capitalizing on market trends. As the name suggests, it involves drawing trendlines on a price chart that connect a series of price lows (uptrend) or highs (downtrend). These trendlines establish the overall direction of the market and provide valuable insights into future price movements.

By understanding the principles of trendline analysis, traders can anticipate potential breakouts, identify support and resistance levels, and optimize their entry and exit points. It’s a technique that empowers traders with the foresight to navigate the volatile forex market with confidence.

Trading with the Trendlines

To successfully execute the trendline strategy, it’s crucial to identify valid trendlines. Look for trendlines that connect at least three consecutive price points and exhibit a clear angle. The steeper the trendline, the stronger the trend. Once a trendline has been established, traders can employ it as a reliable guide for their trading decisions.

When a price crosses a trendline, it often signals a potential change in market direction. If the price breaks above an uptrend line, it could indicate a bullish breakout, while a break below a downtrend line suggests a bearish reversal. Traders can use these breakouts to enter or exit positions with optimal timing.

The Power of Support and Resistance

Trendlines also serve as dynamic support and resistance levels. Prices tend to bounce off trendlines, especially if they have been respected for an extended period. Identifying these levels allows traders to set up their trades in anticipation of potential reversals. When a price approaches a trendline support or resistance level, it creates an opportunity for profitable trades.

By combining trendline analysis with other technical indicators, traders can further enhance their trading accuracy. Moving averages, Fibonacci retracements, and stochastic oscillators can provide additional confirmation for trendlines and help traders refine their entry and exit points.

Image: bestbuygateopenerautomatic.blogspot.com

Expert Tips for Success

- Choose the Right Timeframe: Different timeframes offer different perspectives on the market. Choose a timeframe that aligns with your trading style and risk tolerance.

- Identify Multiple Trendlines: Don’t rely solely on a single trendline. Confirm the trend by drawing additional trendlines to multiple price points.

- Apply Risk Management: Use stop-loss orders to limit potential losses and protect your trading capital.

- Practice Patience: Trendlines are not foolproof. Wait for clear breakouts or pullbacks before entering or exiting trades.

FAQs about Trendline Strategy

- Q: What is a valid trendline?

- Q: How do I identify a potential trend reversal?

- Q: Can I use trendlines with other indicators?

A: A valid trendline connects at least three consecutive price points and has a clear angle of inclination.

A: A break above an uptrend line or below a downtrend line can indicate a potential change in market direction.

A: Yes, combining trendlines with other technical indicators can enhance trading accuracy and provide additional confirmation for trading decisions.

Forex Trendline Strategy By Kelvin Lee

Conclusion

Mastering Kelvin Lee’s trendline strategy is an essential step towards becoming a successful forex trader. By understanding the principles of trendline analysis, identifying support and resistance levels, and implementing expert advice, you can gain a competitive edge in the volatile forex market. Embrace the power of trendlines and unleash your trading potential.

Are you ready to delve deeper into the world of forex trendline trading? Explore our comprehensive resources, connect with experienced traders, and unlock a wealth of knowledge to maximize your trading success.