In the tempestuous sea of global financial markets, where volatility reigns supreme, discerning the ebb and flow of currency fluctuations is paramount for prudent traders. Amidst the plethora of technical analysis indicators, forex trend indicators stand out as indispensable tools, providing a beacon of guidance in the often-unpredictable waters of currency exchange.

Image: picclick.co.uk

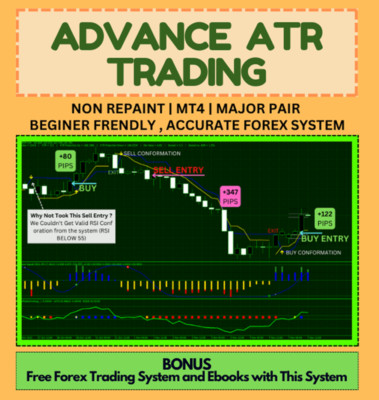

A forex trend indicator, in essence, endeavors to identify the prevailing direction of a currency pair’s price movement, enabling traders to make informed decisions by pinpointing potential buy or sell opportunities. Unlike conventional indicators, “no repaint” trend indicators incorporate a crucial feature – the ability to maintain their accuracy even when applied retrospectively, ensuring traders avoid falling victim to false or misleading signals.

Delving into the Heart of Forex Trend Indicators

Forex trend indicators harness a diverse array of mathematical calculations to dissect historical price data, revealing patterns and trends that would otherwise remain hidden to the naked eye. Common indicators include moving averages, Bollinger Bands, and the relative strength index (RSI).

Moving averages smooth out price fluctuations by calculating the average price over a specified period, providing a trendline that helps identify market direction. Bollinger Bands construct an envelope around the moving average, highlighting periods of volatility and potential trend reversals. On the other hand, the RSI measures the momentum of price changes, indicating overbought or oversold conditions.

The Ever-Evolving Landscape of Forex Trend Indicators

The world of forex trend indicators is a constantly evolving panorama, with new and innovative indicators emerging to meet the ever-changing demands of the market. Some recent advancements include:

-

Adaptive Trend Lines: These indicators automatically adjust their parameters in response to market conditions, providing more dynamic and accurate trends.

-

Breakout Indicators: Designed to detect potential breakout points, these indicators anticipate significant price movements, allowing traders to capitalize on emerging trends.

-

Volume-Weighted Moving Averages: By incorporating volume data into the calculations, these indicators prioritize high-volume trades, offering a more accurate representation of market sentiment.

Empowering Your Trading Decisions: Unlocking the Potential of Forex Trend Indicators

Forex trend indicators serve as invaluable allies in the quest for profitable trading, yet their true worth lies in their seamless integration with other analytical tools. Here’s how you can leverage these indicators to enhance your trading prowess:

-

Trend Confirmation: Combine multiple trend indicators to confirm the prevailing market trend and minimize the risk of false signals.

-

Support and Resistance Identification: Use trend indicators to identify areas of support and resistance, providing valuable insights into potential reversal points.

-

Momentum Measurement: Assess the strength of a trend using momentum indicators like the RSI, gauging whether the trend is likely to continue or exhaust itself.

Image: www.youtube.com

Forex Trend Indicator No Repaint Mt5

Conclusion: Mastering the Art of Trend Trading

The art of trend trading hinges upon the ability to identify and capitalize on prevailing market movements. Forex trend indicators serve as a cornerstone in this endeavor, empowering traders with the wisdom to navigate the complexities of the global currency markets. By harnessing the power of these indicators and embracing a prudent trading strategy, traders can unlock a world of opportunity, riding the waves of forex trends to financial success.