Embark on an enlightening journey into the realm of forex trading, guided by the enigmatic Fibonacci sequence. This celestial phenomenon has captivated traders for centuries, revealing ethereal patterns in market movements that hold the key to unlocking profitable opportunities. In this comprehensive guide, we delve into the intricacies of Fibonacci trading, empowering you to harness its mystifying powers to your advantage.

Image: www.ebookphp.com

Fibonacci’s Divine Ratio: A Tapestry of Symmetry

At the heart of Fibonacci’s brilliance lies the Golden Ratio, an enigmatic number approximately equal to 1.618. Throughout nature and architecture, this enchanting proportion manifests itself in spiraling galaxies, swirling seashells, and harmonious buildings. In the financial markets, Fibonacci numbers emerge as pivotal support and resistance levels, offering a glimpse into the underlying order beneath the chaotic dance of prices.

Charting the Fibonacci Landscape

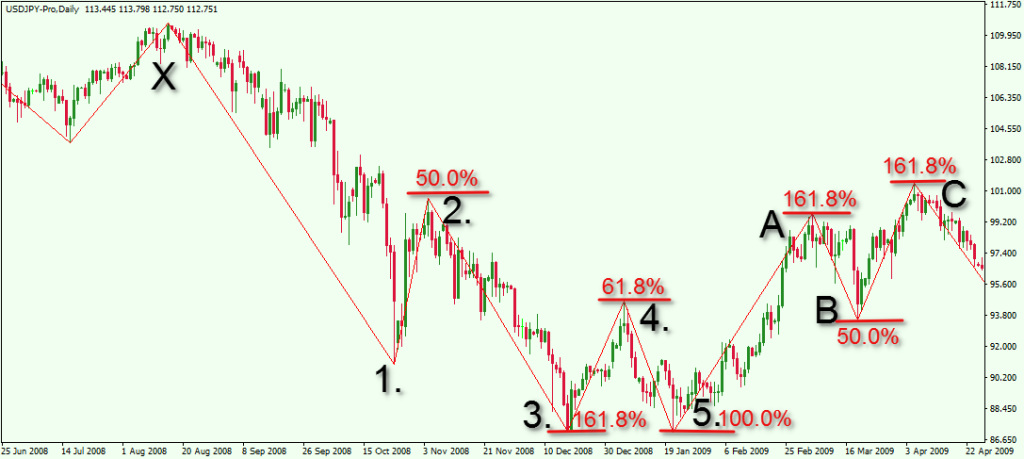

Traders employ a range of Fibonacci tools to uncover these hidden patterns. Among the most prominent are Fibonacci retracement lines, which connect significant highs and lows to identify potential pullback zones. Fibonacci extensions project these retracements beyond the initial swing points, revealing targets for potential breakouts. The power of Fibonacci also extends to time analysis, with Fibonacci fan lines illuminating potential turning points based on time intervals.

Trading Strategies: Dancing with the Fibonacci Rhythms

Armed with this Fibonacci repertoire, traders can devise a myriad of trading strategies. By identifying Fibonacci support and resistance zones, they can anticipate market reversals and enter trades with greater confidence. Fibonacci retracements serve as ideal targets for trailing stops, maximizing profit potential while minimizing risk. The convergence of multiple Fibonacci indicators, such as retracements, extensions, and time projections, further enhances the accuracy of these strategies.

Image: irexapezoren.web.fc2.com

Case Study: Navigating Market Swings with Fibonacci

Let’s examine a real-world example. Suppose the GBP/USD currency pair is trading at 1.3200. A recent swing high of 1.3500 and a swing low of 1.2900 create a Fibonacci retracement sequence. The 38.2% retracement level falls at 1.3289, while the 61.8% retracement level is at 1.3111. If the market reaches the 38.2% level, it indicates potential support and an opportunity to buy, targeting the 1.3500 high. Conversely, if the price retreats to the 61.8% level, it suggests resistance and a potential sell signal.

Beyond the Golden Ratio: Expanding the Fibonacci Toolkit

In addition to the fundamental Fibonacci tools, traders can explore advanced techniques to enhance their trading prowess. These include Fibonacci arcs, which connect key price points to create potential reversal zones, and Fibonacci wave analysis, which identifies potential market cycles based on Fibonacci retracements. The integration of Fibonacci principles with other technical indicators, such as candlestick patterns or moving averages, further deepens one’s analytical prowess.

Forex Trading With Mighty Fibonacci Complete Guide

https://youtube.com/watch?v=5nqfFoZCLBY

Conclusion: Unlocking the Enigma of Fibonacci in Forex Trading

The enigmatic Fibonacci sequence offers traders an unparalleled lens into the intricate dance of market movements. By harnessing the power of Fibonacci retracements, extensions, time projections, and advanced techniques, you can elevate your forex trading to new heights. Embark on this intellectual quest, embrace the Fibonacci enigma, and unlock the secrets that lie within the financial markets. Let the celestial harmony guide your trading strategies and propel you towards financial success.