Introduction

The world of finance offers a vast array of investment opportunities, each with its unique set of advantages and risks. Among the most popular and widely accessible options are forex trading and the Indian stock market. This article aims to delve into the nuances of each, providing a comprehensive comparison to help investors make informed decisions. Whether you’re a seasoned trader or just starting your investment journey, this guide will shed light on the key differences and similarities between forex and the Indian market, empowering you to choose the path that best suits your financial goals and risk tolerance.

Image: www.keenbase-trading.com

Foreign Exchange (Forex) Trading

Foreign exchange, commonly known as forex, refers to the decentralized global market where currencies are traded. It’s the world’s largest and most liquid financial market, with trillions of dollars exchanged daily. Forex trading involves buying and selling currencies in pairs, such as the euro against the US dollar (EUR/USD), speculating on their price movements. The flexibility and accessibility of forex trading have attracted a vast number of participants, from individual retail traders to large financial institutions.

Advantages of Forex Trading:

- Global Reach: Forex is a truly global market, open 24 hours a day, five days a week.

- High Liquidity: The enormous volume of transactions in forex ensures high liquidity, making it easy to enter and exit trades swiftly.

- Leverage: Forex brokers often provide leverage, allowing traders to control larger positions with a relatively small amount of capital.

- Diversification: Trading multiple currency pairs offers diversification benefits, reducing risk by spreading investments across different markets.

Indian Stock Market

The Indian stock market, often referred to as the “Bombay Stock Exchange” (BSE), is a vibrant and growing market representing the Indian economy’s strength. It’s one of the largest emerging markets globally, attracting domestic and international investors alike. The Indian stock market primarily facilitates the trading of stocks issued by publicly listed companies across various sectors.

Image: www.forex.academy

Advantages of the Indian Stock Market:

- Potential for Growth: India’s rapidly developing economy presents potential for sustained growth, which can translate into stock market gains.

- Long-Term Stability: Historically, the Indian stock market has exhibited relative stability over the long term, offering investors a potential avenue for wealth accumulation.

- Tax Benefits: Certain investments in the Indian stock market qualify for tax benefits, making them more attractive for long-term investors.

- Reputable Regulatory Framework: India’s Securities and Exchange Board of India (SEBI) provides a robust regulatory framework, protecting investors’ interests.

Similarities Between Forex Trading and the Indian Stock Market

- Risk Management: Both forex trading and the Indian stock market require proper risk management strategies to mitigate potential losses.

- Fundamental and Technical Analysis: Traders in both markets rely on fundamental and technical analysis to make informed trading decisions.

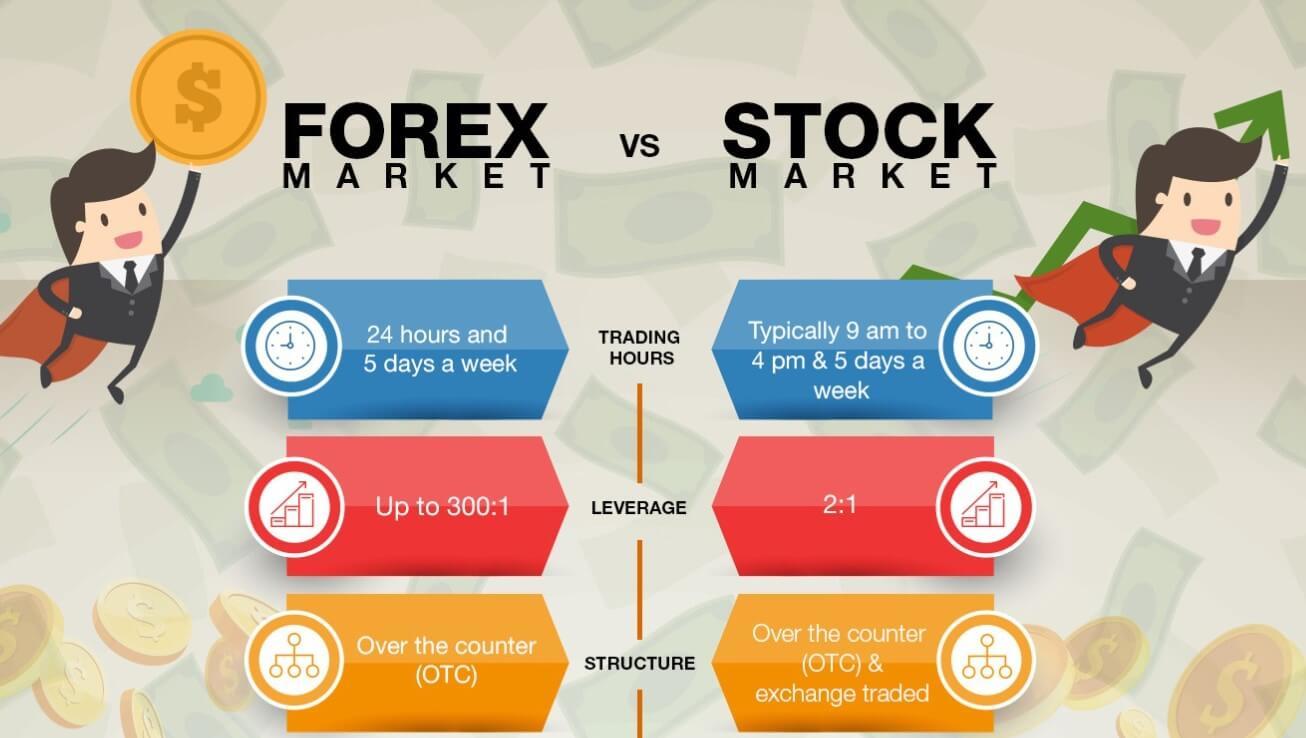

- Leverage: Leverage is available in both forex and the Indian stock market, although the extent and terms can vary between brokers and exchanges.

Key Differences Between Forex Trading and the Indian Stock Market

- Underlying Assets: Forex trading involves currencies, while the Indian stock market centers around company stocks.

- Market Hours: Forex is a 24/5 market, while the Indian stock market operates during specific hours on weekdays.

- Volatility: Forex trading tends to be more volatile than the Indian stock market, with significant price fluctuations common.

- Regulation: The forex market is decentralized and lacks a central authority, while the Indian stock market is regulated by SEBI.

- Accessibility: Forex trading is generally more accessible globally, while the Indian stock market may have specific requirements for foreign investors.

Forex Trading Vs Indian Market

Conclusion

Forex trading and the Indian stock market offer distinct opportunities for investors, each with pros and cons. Forex provides high liquidity, 24/5 access, and leverage, but it also comes with greater volatility and less regulation. The Indian stock market offers potential for growth, long-term stability, and tax benefits, but it has limited trading hours and may require specific qualifications for foreign investors. By understanding the differences and similarities between these markets, investors can make informed choices based on their individual financial goals, risk tolerance, and investment style. Whether you venture into the global arena of forex trading or explore the growth potential of the Indian stock market, a well-thought-out strategy and a commitment to continual learning are key to unlocking financial success.