Are you pondering the merits of forex trading versus day trading? You have embarked on the right path because I have been investigating this subject extensively on Reddit. By delving into the vibrant Reddit community, I have gleaned invaluable insights from seasoned traders. Join me as we decipher the intricacies of these two trading approaches, empowering you to make an informed decision.

Image: www.pinterest.com

The Forex Market: A Global Marketplace

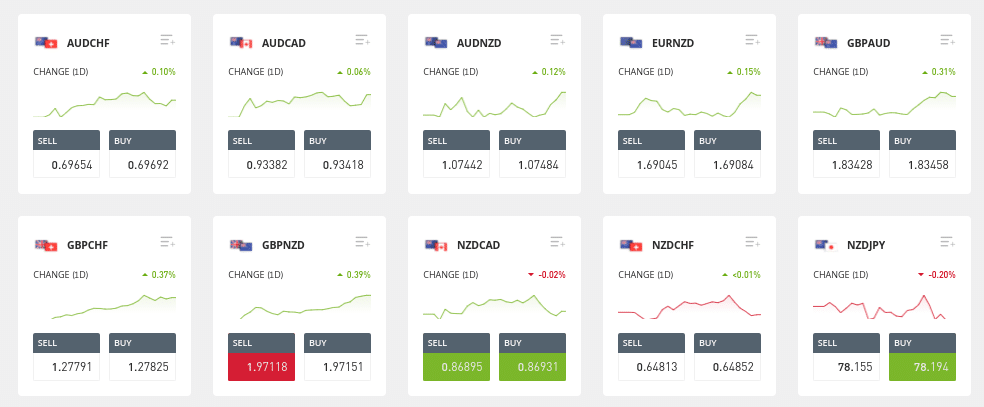

The foreign exchange market, colloquially known as “forex,” is a vast and multifaceted network where currencies of the world are bought and sold. Unlike traditional stock exchanges, forex operates 24 hours a day, 5 days a week, allowing traders to capitalize on market movements around the globe.

With its unparalleled liquidity and leverage options, forex has become a popular trading arena. However, its inherent volatility can also pose significant risks. Understanding the dynamics of the forex market is paramount before engaging in this realm.

Day Trading: Capturing Intraday Market Swings

Day trading involves profiting from short-term price fluctuations within a single trading day. Day traders typically enter and exit multiple positions throughout the day, attempting to capitalize on market movements. This style of trading demands a high level of market expertise, risk management skills, and psychological fortitude.

While day trading offers the potential for quick profits, it also carries substantial risks. The volatile nature of intraday markets can lead to rapid and unpredictable losses. Only seasoned traders with a deep understanding of market dynamics should venture into day trading.

Forex Trading vs. Day Trading

Having explored the nuances of both forex trading and day trading, let’s compare them side-by-side to help you decide which approach aligns better with your trading goals:

- Market Access: Forex offers access to a wider range of currency pairs, while day trading is typically limited to stocks, futures, or currencies traded on specific exchanges.

- Trading Duration: Forex trading allows for flexible trading hours, while day trading necessitates closing all positions before the market closes.

- Volatility: Forex markets tend to be more volatile than day trading markets, potentially leading to larger profits but also greater risks.

- Risk Management: Forex traders can utilize stop-loss orders to mitigate risks, while day traders may have limited risk management tools available.

- Capital Requirements: Forex trading typically requires lower capital compared to day trading, as leverage options can magnify returns with relatively smaller investments.

Image: www.forexcrunch.com

Tips for Choosing Between Forex and Day Trading

When selecting between forex and day trading, several key factors merit consideration:

- Experience and Skills: Day trading requires extensive market knowledge, risk management proficiency, and psychological resilience. Inexperienced traders should exercise caution before venturing into this arena.

- Risk Tolerance: Both forex and day trading involve inherent risks. Determine your risk tolerance level and allocate capital accordingly.

- Trading Goals: Establish clear trading goals. Forex trading may be suitable for long-term currency fluctuations, while day trading caters to short-term profit-taking.

- Capital Availability: Assess your available capital. Forex trading necessitates lower capital, while day trading may require more substantial investments.

- Time Commitment: Forex trading offers flexible trading hours, while day trading demands active monitoring and execution throughout the trading day.

FAQs on Forex vs. Day Trading

Let’s address common queries raised by traders grappling with the choice between forex and day trading:

- Which is more profitable? Both forex and day trading offer profit potential, but profitability depends on individual skills, risk management, and market conditions.

- Which is riskier? Day trading generally entails greater risks due to its short-term focus and potential for rapid market swings.

- Can I learn day trading quickly? Acquiring the skills necessary for successful day trading requires time, dedication, and diligent practice.

- Do I need a lot of money to start forex trading? Forex trading can be initiated with relatively low capital, thanks to the availability of leverage.

- Which requires more time? Day trading demands active involvement throughout the trading day, while forex trading offers greater flexibility.

Forex Trading Vs Day Trading Reddit

Conclusion

Choosing between forex trading and day trading boils down to your individual trading goals, risk tolerance, and available resources. Both approaches offer distinct advantages and challenges. By thoroughly understanding the intricacies of each, you can make an informed decision that aligns with your aspirations. The world of financial trading awaits your exploration. Embark on this journey with a thirst for knowledge, a discerning eye, and a resolute spirit.

Are you intrigued by the complexities of forex and day trading? Share your thoughts and experiences in the comments section below.