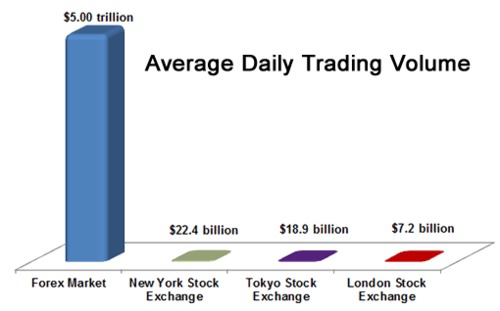

The foreign exchange market (Forex) is the largest financial market in the world, accounting for trillions of dollars in daily transactions. In 2017, the volume of forex trading reached record highs, driven by a number of factors, including political uncertainty, economic volatility, and technological advancements.

Image: forextraininggroup.com

Forex Market Overview

Forex is a decentralized market where currencies are traded against each other. The most commonly traded currency pairs are the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), and Swiss franc (CHF). Forex trading takes place 24 hours a day, five days a week, making it one of the most accessible and liquid financial markets for traders of all experience levels.

Factors Driving Forex Trading Volume

In 2017, a number of factors contributed to the surge in forex trading volume. These included:

-

Political Uncertainty:

The election of Donald Trump as US President in 2016 created a great deal of uncertainty in the global markets. This uncertainty led to increased demand for safe haven currencies, such as the USD and JPY, and increased volatility in the forex markets.

-

Image: forexarrowsystem.blogspot.comEconomic Volatility:

The global economy experienced a number of challenges in 2017, including slowing growth in China, political unrest in Europe, and rising inflation in the United States. This volatility led to increased demand for forex trading as investors sought to protect their assets and hedge against risk.

-

Technological Advancements:

Advancements in technology have made it easier than ever to trade forex. The rise of online trading platforms and mobile trading apps has made it possible for anyone with an internet connection to participate in the forex markets. This increased accessibility has led to a significant increase in trading volume.

Breakdown of Forex Trading Volume by Brokers

According to data from the Bank for International Settlements (BIS), the total daily volume of forex trading in 2017 was $5.1 trillion. This represented a significant increase from the $4.7 trillion traded in 2016.

The largest players in the forex market are the major investment banks, who account for the majority of trading volume. The top five forex brokers in 2017, in terms of market share, were:

- Citigroup

- Deutsche Bank

- UBS

- JPMorgan Chase

- HSBC Holdings

These brokers accounted for over 50% of the total daily forex trading volume.

Forex Trading Volume Per Day 2017 By Brokers

Conclusion

The forex market experienced record-breaking growth in 2017, driven by a number of factors, including political uncertainty, economic volatility, and technological advancements. The total daily trading volume reached $5.1 trillion, and the major investment banks continued to dominate the market. As the forex market continues to evolve, it is likely that we will see even more growth and innovation in the years to come.