Navigating the Dynamic Forex Market

Immerse yourself in the captivating world of foreign exchange trading, where currency pairs dance in a perpetual rhythm. The daily volumes traded in this realm unveil a mesmerizing spectacle, reflecting the ebb and flow of global economies. In this article, we endeavor to demystify the forex trading volume phenomenon, delving into its intricacies and exploring its implications on market dynamics.

Image: westbrookradio.com

Deciphering Forex Trading Volume

Forex trading volume, the lifeblood of the market, gauges the total value of currency transactions executed within a specific period. This metric serves as a barometer of market activity, liquidity, and overall sentiment. A surge in volume signifies heightened interest, while a dip may indicate waning enthusiasm or periods of consolidation.

Understanding Market Liquidity

Forex trading volume directly impacts market liquidity, which measures the ease with which currencies can be bought and sold without causing substantial price fluctuations. High volume ensures ample liquidity, facilitating smoother and more efficient trading. Conversely, low volume can lead to wider spreads and reduced market depth.

Interpreting Market Sentiment

Volume data offers valuable insights into market sentiment. Elevated volume during periods of bullish sentiment signifies increased buying pressure, driving prices higher. In contrast, dwindling volume amidst bearish trends suggests a lack of conviction, potentially leading to price reversals.

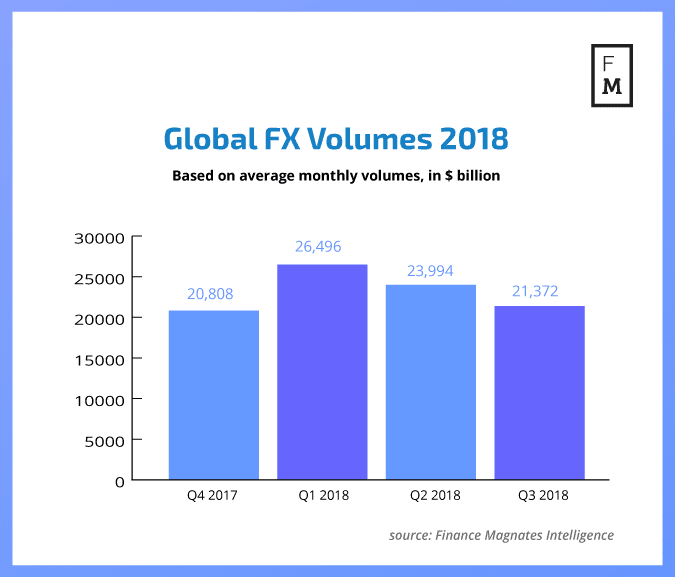

Image: www.financemagnates.com

Analyzing Forex Trading Volume in 2016

2016 witnessed a remarkable surge in forex trading volume, propelled by several macroeconomic factors. The Brexit vote, US presidential election, and Chinese yuan devaluation created significant market volatility, attracting traders seeking opportunities to capitalize on price movements.

- According to the Bank for International Settlements (BIS), global forex trading volume in April 2016 reached a staggering $5.3 trillion per day.

- The euro-dollar pair accounted for the lion’s share of volume, with transactions valued at $2.3 trillion.

- The British pound experienced significant volatility following the Brexit referendum, leading to a spike in trading volume for GBP-related pairs.

Expert Tips for Navigating Forex Volume

Understanding forex trading volume is crucial for informed decision-making. Here are some expert tips to leverage volume data effectively:

Identify Market Trends

Volume data can reveal potential trends in the market. Consistently high volume over time indicates a sustained trend, while fluctuating volume may suggest potential reversals or consolidation phases.

Gauge Market Sentiment

Volume analysis can provide valuable clues about market sentiment. Surging volume during bullish trends signifies buying pressure, while waning volume in bearish markets suggests potential selling pressure.

FAQs on Forex Trading Volume

Q: How does trading volume impact market volatility?

A: High trading volume generally reduces volatility, as it indicates increased liquidity and smoother trading. Conversely, low volume can amplify volatility, leading to more significant price fluctuations.

Q: Are there any limitations to using forex trading volume?

A: Trading volume data provides valuable insights, but it’s essential to consider other market factors, such as news and economic events, for a comprehensive analysis.

Q: How can I access forex trading volume data?

A: Brokers, data providers, and financial platforms often provide forex trading volume information. You can also find historical volume data on the websites of central banks and regulatory authorities.

Forex Trading Volume Per Day 2016

Conclusion

Forex trading volume plays a vital role in understanding market dynamics, liquidity, and sentiment. By deciphering this key metric, traders can gain valuable insights and make informed decisions. Whether you’re a seasoned professional or a novice in the forex realm, a thorough grasp of trading volume will enhance your trading strategy and boost your chances of success in this ever-evolving financial landscape.