Unlocking Enhanced Performance and Profitability

In the dynamic realm of forex trading, meticulous analysis and evaluation are indispensable for navigating market intricacies and maximizing returns. The forex trading performance report card template emerges as a transformative tool, empowering traders to scrutinize their trading strategies, pinpoint areas for improvement, and optimize their overall performance. By systematically tracking key metrics and identifying strengths and weaknesses, traders gain invaluable insights into their trading approach, enabling them to refine their strategies and elevate their profitability.

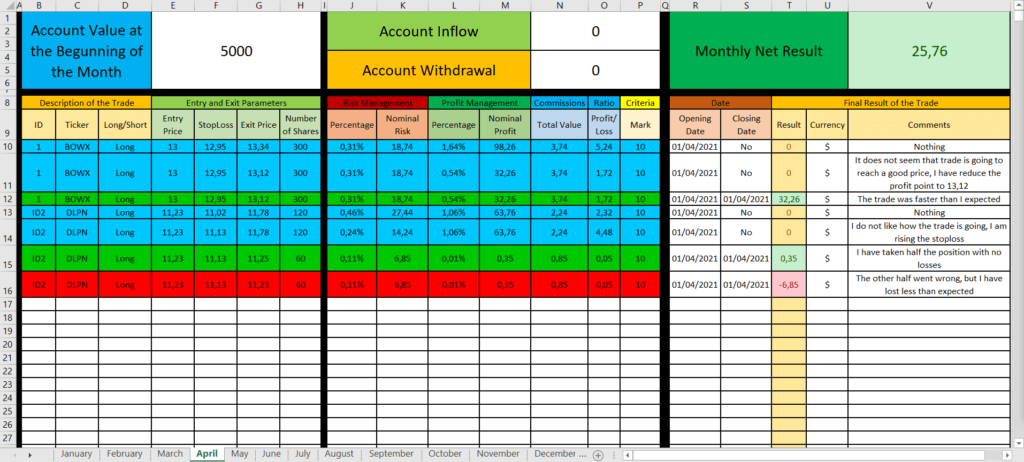

Image: www.warsoption.com

Comprehensive Evaluation: Diving into the Metrics

The forex trading performance report card template provides a comprehensive framework for assessing various aspects of trading performance, encompassing key metrics such as:

-

Win Rate: Uncover the percentage of successful trades compared to total trades executed, gaining insights into overall strategy effectiveness.

-

Profit Factor: Assess the ratio of cumulative profits to cumulative losses, providing a comprehensive measure of profitability and risk management.

-

Average Profit Per Trade: Determine the average profit generated per successful trade, offering valuable insights into the potential profitability of the strategy.

-

Average Loss Per Trade: Quantify the average loss incurred per losing trade, highlighting areas for improvement in risk management.

-

Sharpe Ratio: Measure the trade-off between return and risk, providing a comprehensive indicator of overall trading performance and efficiency.

-

Maximum Drawdown: Analyze the largest decline from peak equity, shedding light on the strategy’s ability to withstand market volatility and potential risks involved.

Customizable Parameters: Tailored to Individual Needs

The flexibility of the forex trading performance report card template allows traders to customize parameters and tailor it to their specific trading style and objectives. This customization enables:

-

Timeframe Adjustment: Adjust the timeframe for performance evaluation, whether focusing on daily, weekly, monthly, or any desired interval.

-

Currency Pair Selection: Select specific currency pairs for targeted analysis, catering to traders specializing in particular markets.

-

Strategy Comparison: Compare multiple trading strategies side by side, identifying the most effective approach and potential areas for optimization.

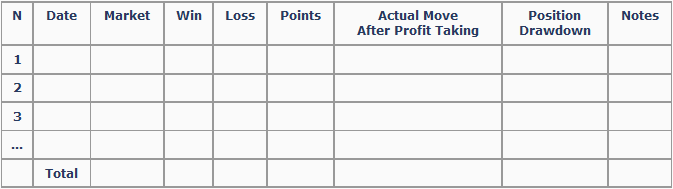

Empowering Analysis: Unveiling Strengths and Weaknesses

Beyond quantifying performance, the forex trading performance report card template empowers traders to delve into their winning and losing trades, revealing valuable insights into their trading approach. By examining winning trades, traders can identify the common denominators contributing to success, while analyzing losing trades provides crucial lessons for mitigating risks and enhancing future performance.

Image: www.forexpeacearmy.com

Continuous Improvement: A Catalyst for Enhanced Performance

The forex trading performance report card template promotes continuous improvement by facilitating the identification of areas for refinement and optimization. Traders can leverage the insights gained from the report card to:

-

Refine Entry and Exit Strategies: Optimize trade entry and exit points, maximizing profit potential while minimizing losses.

-

Enhance Risk Management Protocols: Strengthen risk management measures, effectively controlling potential losses and preserving capital.

-

Develop Trading Discipline: Improve adherence to trading rules and avoid impulsive decisions, fostering consistency and profitability.

Forex Trading Performance Report Card Template

Conclusion: Embracing Performance Measurement for Success

The forex trading performance report card template serves as an indispensable tool for traders seeking to elevate their performance and unlock enhanced profitability. By embracing this systematic approach to performance measurement, traders gain an unparalleled understanding of their strengths and weaknesses, enabling them to refine their strategies, optimize risk management, and achieve consistent success in the dynamic forex market.