Introduction

Forex (foreign exchange) trading, a global market for currency exchange, has witnessed a surge in popularity in recent years. This cross-border activity entails the buying and selling of currencies to profit from fluctuations in their relative values. In India, the legality of forex trading has been a subject of discussion and scrutiny, with regulators striving to strike a balance between fostering foreign exchange market development and protecting investors from financial risks.

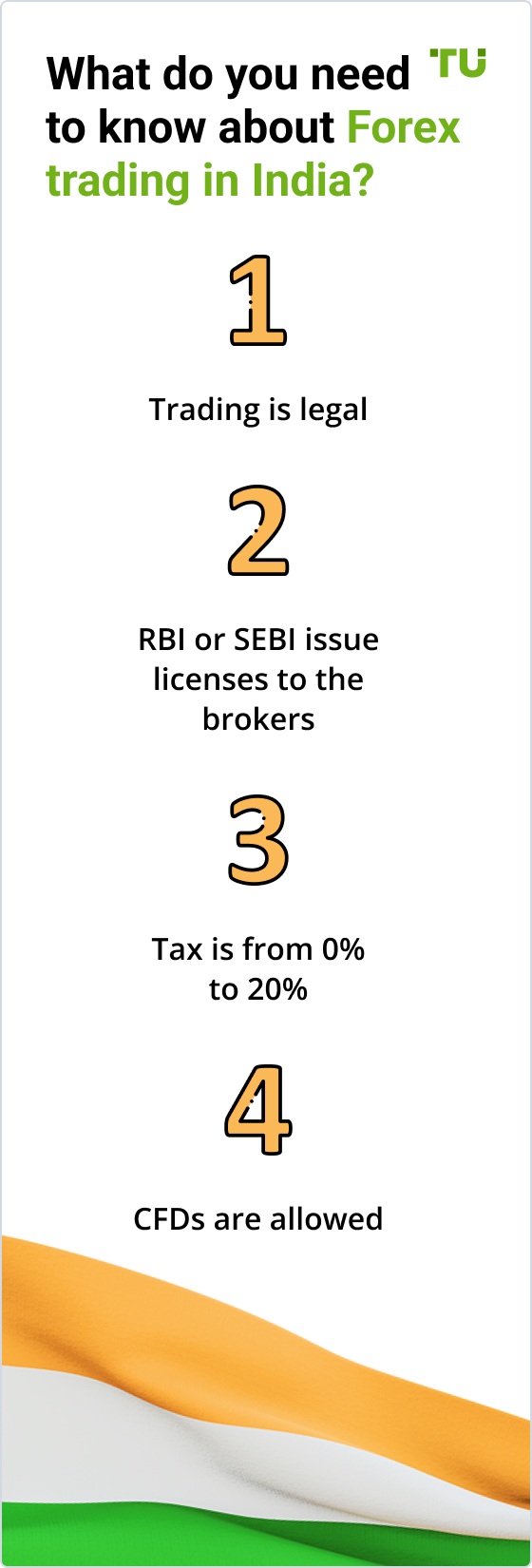

Image: tradersunion.com

This comprehensive guide delves into the legal landscape of forex trading in India as of 2015. We will explore the legal framework, governing regulations, and essential guidelines that investors must comply with to engage in forex trading activities within the Indian jurisdiction. By understanding the legal implications and adhering to regulatory requirements, Indian traders can participate in forex trading with confidence and mitigate potential risks.

Legal Framework for Forex Trading in India

The Foreign Exchange Management Act (FEMA), enacted in 1999, serves as the primary legal framework governing foreign exchange transactions in India. FEMA aims to facilitate external trade and payments while conserving foreign exchange reserves and promoting the orderly development of the forex market. According to FEMA provisions, all forex transactions in India must comply with the regulations set forth by the Reserve Bank of India (RBI), the central banking institution.

The RBI is empowered to issue guidelines, circulars, and regulations to govern forex trading activities. These regulatory measures are designed to prevent illegal activities such as money laundering, terrorist financing, and market manipulation. They also seek to protect investors from fraudulent practices and ensure the integrity and stability of the forex market.

Regulatory Guidelines for Forex Trading

The RBI has issued a comprehensive set of guidelines that outline the dos and don’ts of forex trading in India. These guidelines cover various aspects of forex trading, including:

- Eligible Participants: Only authorized dealers (ADs), recognized stock exchanges, and banks can engage in forex trading in India.

- Permitted Transactions: The RBI specifies the permitted forex transactions, which include current account transactions related to international trade, travel, and education expenses, among others.

- Documentation Requirements: Traders must maintain proper documentation for all forex transactions, including invoices, contracts, and bank statements.

- Reporting Obligations: ADs and banks must report all forex transactions to the RBI on a regular basis.

Failure to comply with RBI guidelines can result in penalties and legal consequences. Therefore, it is crucial for Indian traders to familiarize themselves with these regulations and strictly adhere to them to avoid any legal complications.

Is Forex Trading Legal for Retail Investors in India?

While forex trading in itself is legal in India, it is important to note that retail investors are prohibited from directly participating in the interbank forex market, where large-scale currency transactions take place. This restriction is imposed to protect retail investors from the inherent risks and complexities of the forex market.

Retail investors who wish to trade forex in India can do so through authorized dealers (ADs) or brokers regulated by the RBI. These intermediaries provide platforms and services to retail traders, enabling them to access the forex market with smaller investments and reduced risk exposure.

Image: www.iplaneducation.com

Choosing a Regulated Forex Broker in India

When selecting a forex broker in India, it is essential to consider the following factors:

- RBI Authorization: Ensure that the broker is authorized by the RBI to conduct forex trading activities.

- Credibility and Reputation: Research the broker’s track record, client reviews, and industry standing.

- Trading Platform: Choose a broker that offers a user-friendly and reliable trading platform.

- Fees and Commissions: Compare the fees and commissions charged by different brokers to find the best deal.

- Customer Support: Consider the broker’s customer support capabilities and response times.

By choosing a reputable and regulated forex broker, retail investors can enhance their trading experience, minimize risks, and benefit from the potential rewards of forex trading.

Forex Trading Legal In India 2015

Conclusion

Forex trading in India operates within a legal framework established by the Foreign Exchange Management Act (FEMA) and regulated by the Reserve Bank of India (RBI). While retail investors cannot directly access the interbank forex market, they can participate through authorized dealers (ADs) or regulated brokers. By adhering to RBI guidelines and choosing a reputable broker, Indian traders can engage in forex trading while mitigating potential risks and maximizing their chances of success in this dynamic and challenging market.

We recommend that investors conduct thorough research, seek professional advice when necessary, and approach forex trading with caution. Remember, forex trading involves inherent risks, and it is essential to manage your investments wisely and responsibly.