In today’s dynamic financial landscape, investors seek avenues that offer high returns to beat inflation and secure their financial future. Among the myriad options, forex trading has emerged as a lucrative investment opportunity with substantial potential for growth. This article will delve into the world of forex trading, exploring its advantages, risks, and strategies to enhance your understanding and empower you to make informed investment decisions.

Image: bestmt4ea.com

Forex Trading: The Realm of Currency Exchange

Forex (Foreign Exchange) trading is the buying and selling of currencies from different countries. It involves exchanging one currency for another, profiting from fluctuations in their exchange rates. Forex trading is conducted over-the-counter (OTC), meaning there is no centralized exchange like stock exchanges. Instead, it takes place electronically through a network of banks and brokers, making it accessible to both retail and institutional investors.

Why Forex Trading Offers High Returns

Forex trading stands out for its exceptional potential for high returns due to several factors. Firstly, the forex market is vast, with trillions of dollars traded daily. This volume creates a high level of liquidity, allowing for quick execution of trades and reducing the risk of slippage (the difference between the expected trade price and the actual execution price).

Secondly, the forex market is volatile, with currencies constantly fluctuating in value. This volatility provides ample opportunities for skilled traders to capitalize on short-term price movements and generate substantial profits.

Moreover, the forex market is leveraged, meaning investors can use borrowed capital to increase their trading power. Leverage can exponentially magnify both profits and losses, making it essential to use it prudently and in accordance with one’s risk tolerance.

Strategies for Successful Forex Trading

While the potential for high returns is alluring, forex trading also involves inherent risks. To navigate the market effectively and increase the likelihood of success, traders employ various strategies.

Technical analysis involves studying historical price data to identify trends and patterns that may indicate future price movements. Traders use technical indicators such as moving averages and support and resistance levels to analyze charts and make informed trading decisions.

Fundamental analysis focuses on economic and geopolitical factors that influence currency values. By monitoring events such as central bank announcements, interest rate changes, and economic indicators, traders can anticipate market movements and position themselves accordingly.

Risk management is paramount in forex trading. Employing proper risk-management techniques, such as setting stop-loss orders and position sizing, helps mitigate potential losses and preserve capital.

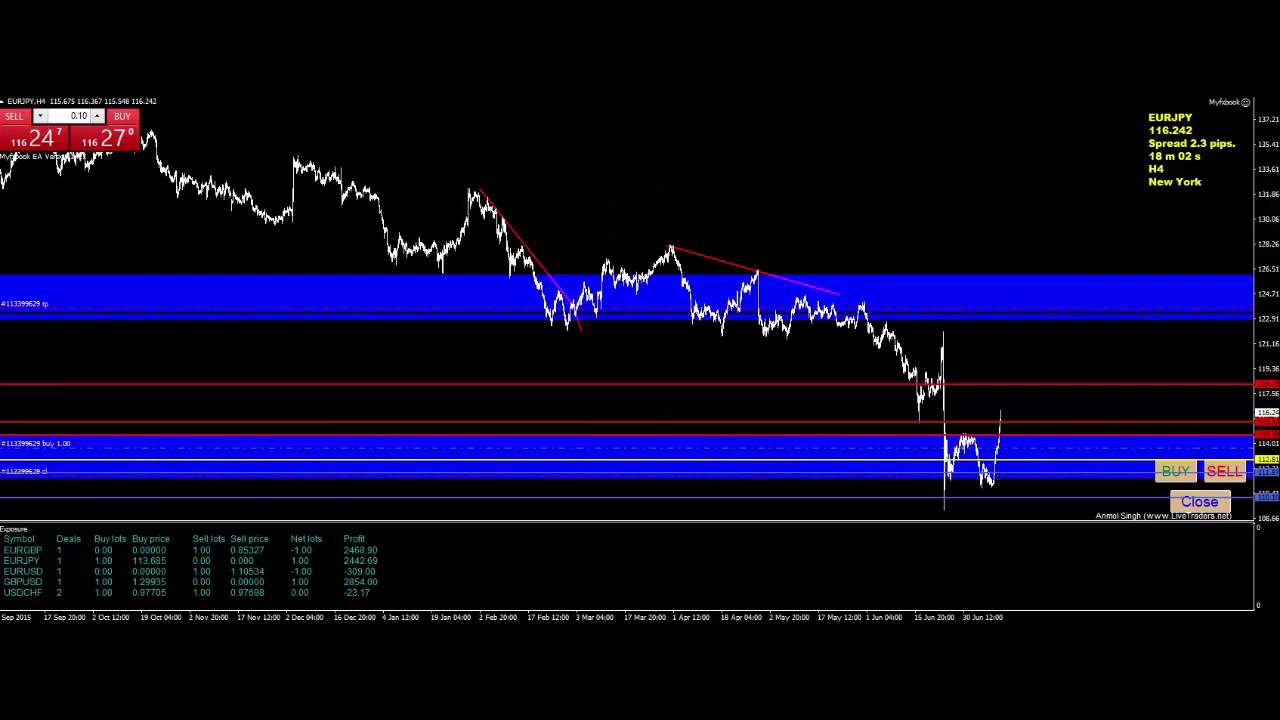

Image: www.youtube.com

Benefits of Forex Trading

In addition to its high return potential, forex trading offers several other benefits for investors.

Flexibility: Forex trading is accessible 24 hours a day, five days a week, allowing traders to engage in the market at their convenience.

Global Reach: As the forex market operates globally, traders can access opportunities from anywhere on earth with an internet connection.

Low Transaction Costs: Compared to other investment options, forex trading generally involves lower transaction costs, making it more accessible to a wider range of investors.

Forex Trading Is High Return

https://youtube.com/watch?v=-in493eRozY

Conclusion

Forex trading presents a compelling investment opportunity with substantial potential for high returns. However, it is crucial to approach forex trading with a thorough understanding of its risks and complexities. By employing sound trading strategies, implementing prudent risk management, and continuously honing one’s skills, investors can harness the power of forex trading to achieve financial success and secure their financial future.