Introduction

In the bustling world of forex trading, diving into the realm of cross currency pairs presents an ocean of opportunities. Unlike currency pairs pegged against the US dollar, cross currency pairs empower you to tap into the interplay of two non-USD currencies, broadening your trading horizons and potentially unlocking greater rewards. But navigating these cross currency currents requires knowledge, strategy, and an insatiable thirst for knowledge. This comprehensive guide will serve as your compass, guiding you through the intricate tapestry of cross currency pair trading.

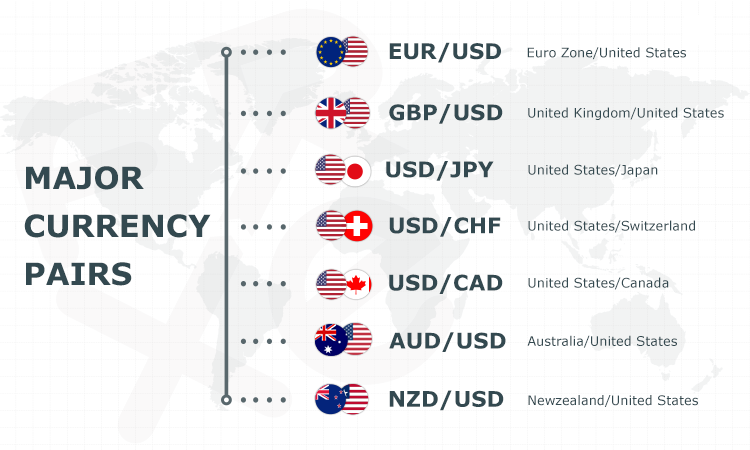

Image: doughvest.com

Understanding Cross Currency Pairs

Currency pairs are the lifeblood of forex trading, representing the exchange rate between two different currencies. These pairs are typically denoted with a three-letter currency code, such as EUR/USD (Euro versus US dollar). Cross currency pairs, on the other hand, break away from the USD anchor, connecting two non-USD currencies. For instance, EUR/GBP (Euro versus British pound) exemplifies a cross currency pair.

The value of a cross currency pair is determined by the supply and demand dynamics between the two component currencies. When demand for one currency surpasses the other, its value rises, while the value of its counterpart falls. This delicate dance between currencies creates both opportunities and risks, demanding traders to possess a profundo understanding of the economic factors influencing each currency.

Benefits of Cross Currency Pair Trading

Venturing into the world of cross currency pairs can bestow upon traders a treasure chest of benefits, including:

-

Reduced Dependency on USD: Unlike traditional currency pairs, cross currency pairs liberate traders from the constant influence of the US dollar, opening doors to a wider range of trading strategies.

-

Portfolio Diversification: By incorporating cross currency pairs into your trading portfolio, you spread your risk across multiple currencies, reducing overall exposure to any single currency’s fluctuations.

-

Potential for Higher Returns: While cross currency pairs exhibit higher volatility, they also present the tantalizing prospect of enhanced returns. The absence of the USD’s dominance can lead to more pronounced currency price movements, creating opportunities for shrewd traders.

-

Hedging Opportunities: Cross currency pairs provide a sanctuary for hedging against potential losses in other trades. By correlating your currency exposure across different pairs, you mitigate the risks associated with unfavorable currency fluctuations.

Challenges of Cross Currency Pair Trading

Conquering the world of cross currency pair trading is not without its fair share of challenges:

-

Higher Volatility: As mentioned earlier, cross currency pairs are more susceptible to price swings. The absence of USD’s stabilizing influence can result in more erratic currency movements, demanding nimble decision-making and risk management.

-

Wider Spreads: Cross currency pairs often exhibit wider bid-ask spreads compared to major currency pairs involving the US dollar. This spread difference can potentially impact profitability, necessitating careful consideration before entering a trade.

-

Complexities of Cross-Cultural Influences: The economic and political dynamics of multiple currencies intertwine in cross currency pairs, adding a layer of complexity to analysis and trading strategies. Traders must stay abreast of events and news affecting both currencies involved to make informed decisions.

Image: www.forextraders.com

Strategies for Trading Cross Currency Pairs

Seasoned traders have honed a repertoire of effective strategies to navigate the cross currency pair universe:

-

Carry Trading: This strategy entails borrowing a currency with low interest rates and investing in a currency with higher interest rates, seeking to capitalize on the interest rate differential. Cross currency pairs can offer attractive carry trade opportunities for discerning traders.

-

Momentum Trading: By identifying trends in cross currency pairs, traders can ride the wave of currency price movements. Momentum trading involves entering trades in the direction of the prevailing trend, aiming to capture the maximum momentum and potential profits.

-

Cross Currency Arbitrage: Exploiting inefficiencies in currency markets, cross currency arbitrage involves simultaneously buying and selling the same currency pair in different markets. This strategy leverages the slight price discrepancies between markets to generate profits.

Forex Trading Cross Currency Pairs

Conclusion

The enticing realm of cross currency pair trading beckons traders seeking to expand their forex horizons. By understanding the dynamics of these pairs, embracing the potential benefits, and mitigating the challenges, you can embark on a currency trading odyssey that could lead to bountiful rewards. Remember, knowledge is your compass, strategy your guiding light, and a resilient mindset your unfailing companion. As you delve into the intricacies of cross currency pairs, may you navigate the market currents with grace and emerge as a seasoned forex navigator.