Introduction:

In the labyrinthine world of finance, currency trading stands out as an enigmatic yet lucrative endeavor. It enchants aspiring investors with its allure of limitless wealth and the intoxicating thrill of playing at the global monetary stage. Nigeria, the economic behemoth of Africa, has recently opened its doors to the exhilarating realm of forex trading, offering its citizens an unprecedented opportunity to tap into the vast ocean of financial liquidity.

Forex trading in Nigeria presents multifaceted advantages, ranging from the potential for substantial financial gains to flexible accessibility and a low barrier to entry. This comprehensive guide will navigate you through the uncharted waters of forex trading in Nigeria, revealing its intricacies, potential pitfalls, and the unparalleled wealth that awaits the astute investor. Join us on this transformative journey as we delve into the dynamic world of forex trading.

Image: www.forexbeginner.com

Section I: Unveiling Forex Trading in Nigeria

Forex trading, a ubiquitous term in high-stakes financial circles, denotes the buying and selling of foreign currencies. It operates as the bedrock of international commerce, facilitating global trade and powering the global financial system. In Nigeria, forex trading is overseen and regulated by the Central Bank of Nigeria (CBN), ensuring the integrity and stability of this rapidly expanding market.

Section II: Understanding Foreign Exchange Market (Forex)

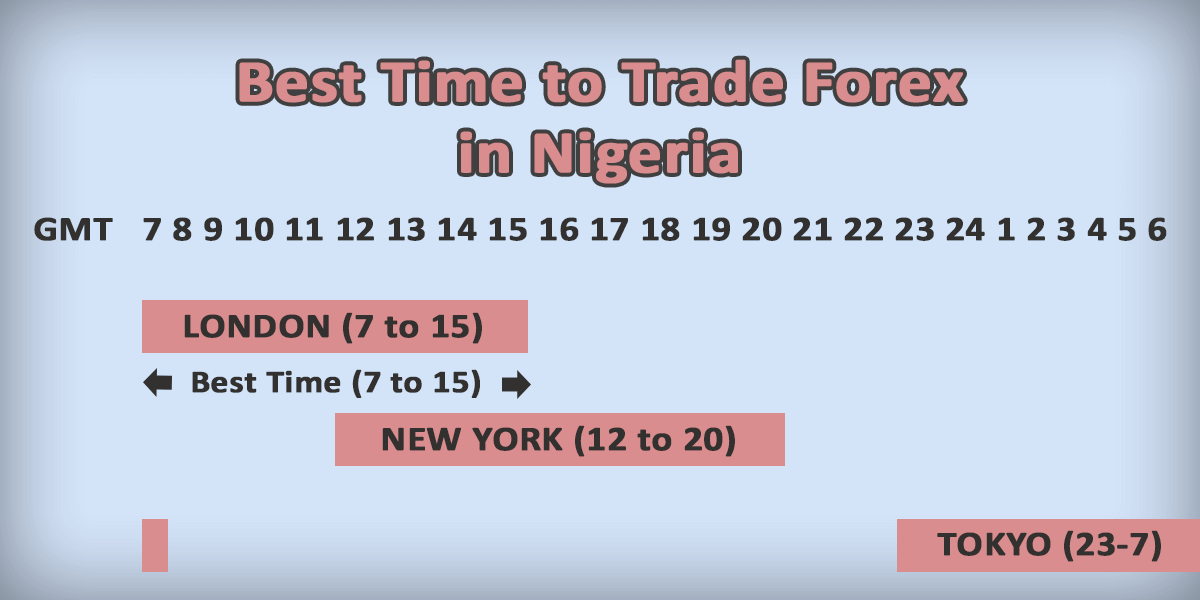

The foreign exchange market, a breeding ground for currency traders worldwide, stands as the most liquid market in the financial ecosystem. Its sheer size and unmatched liquidity allow traders to effortlessly enter and exit positions, empowering them to seize fleeting market opportunities. The Forex market operates 24 hours a day, five days a week, spanning different time zones and continents, providing traders with unrivaled access to global trading opportunities.

Section III: Key Players in Forex Trading

The forex market thrives on the active participation of various players, each fulfilling distinct roles within this dynamic ecosystem. Retail traders, armed with personal capital and a thirst for financial freedom, form the bedrock of this market. They operate independently, utilizing analytical skills and trading strategies to navigate the turbulent waters of currency fluctuations. Institutional traders, representing investment banks, hedge funds, and other financial institutions, possess immense financial clout and contribute significantly to market liquidity.

Image: guardian.ng

Section IV: Forex Trading Strategies: A Guiding Compass

Successfully navigating the treacherous waters of forex trading demands a well-crafted strategy, akin to a compass guiding a ship through stormy seas. There exists a myriad of forex trading strategies, each with unique strengths and intricacies, catering to diverse trading styles and risk appetites. Scalping, Day Trading, Range Trading, Trend Following, and Carry Trade are but a few examples of these time-tested strategies. Prudent traders meticulously research and select a strategy that aligns with their financial objectives and trading preferences.

Section V: Forex Trading Platforms: Embracing Technology

The advent of innovative trading platforms has democratized access to forex trading in Nigeria. These platforms provide traders with a seamless interface, real-time market data, and advanced charting tools, empowering them to make informed trading decisions with greater efficiency. MetaTrader 4 (MT4) and MetaTrader 5 (MT5), industry-leading platforms, dominate the forex trading landscape, offering powerful functionalities and a user-friendly experience.

Section VI: Forex Trading Techniques: Mastering the Art

The path to forex trading mastery lies not only in strategic acumen but also in the skillful execution of trading techniques. Understanding market orders, limit orders, and stop-loss orders provides traders with the tools to effectively manage risk and maximize gains. Leveraging technical indicators, such as moving averages and Bollinger Bands, helps traders decipher market trends and make informed decisions.

Section VII: Forex Trading Psychology: Unveiling the Mindset of Success

The psychological aspect of forex trading holds immense sway over the ultimate success of aspiring traders. Cultivating patience, discipline, and emotional control separates the masters from the masses. Resisting the siren call of FOMO (Fear Of Missing Out) and effectively managing risk through position sizing and stop-loss orders are essential elements of maintaining mental fortitude in the face of market volatility.

Section VIII: Forex Trading Risk Management: Navigating the Perils

Forex trading, like any other financial endeavor, carries inherent risks, which must be carefully assessed and managed. Understanding the concept of leverage, the double-edged sword that can amplify both profits and losses, is paramount. Implementing sensible risk management strategies, such as setting clear trading goals, identifying risk tolerance, and employing stop-loss orders, safeguards traders from the vagaries of the market.

Section IX: Forex Trading and Nigerian Economy: A Symbiotic Relationship

The rise of forex trading in Nigeria has far-reaching implications for the nation’s economy. It provides citizens with an avenue for wealth creation, boosting financial independence and reducing reliance on traditional employment models. By facilitating international trade and foreign direct investment, forex trading contributes to economic growth and the stability of the financial sector.

Section X: Forex Trading in Nigeria: The Elephant in the Room

Despite its transformative potential, forex trading in Nigeria has attracted scrutiny and debate. Critics argue that it can be a breeding ground for speculative activities, potentially destabilizing the economy. Additionally, concerns over the lack of comprehensive regulatory oversight and the proliferation of unregulated platforms have sparked discussions about the need for stricter measures to safeguard the interests of retail traders.

Forex Trading Allowed In Nigeria

Conclusion:

Embarking on the uncharted waters of forex trading in Nigeria presents a blend of opportunities and challenges for the discerning investor. By embracing a thirst for knowledge, developing sound trading strategies, practicing rigorous risk management, and maintaining unwavering discipline, traders can harness the boundless potential of this dynamic financial frontier. Remember, the path to forex trading mastery is paved with constant learning, meticulous execution, and an unyielding determination to navigate the tumultuous seas of currency fluctuations.