Introduction

In the realm of financial markets, foreign exchange trading holds prominence, paving the way to lucrative opportunities. To navigate the complexities of forex trading, selecting the right account type is pivotal. This guide delves into the diverse array of forex trading accounts available, empowering you to make an informed decision and maximize your trading potential.

Image: a-defense.blogspot.com

Forex trading accounts are typically offered by brokers, financial institutions that facilitate the buying and selling of currencies. These accounts provide the platform through which traders can access the global forex market and enact their trading strategies. Choosing the most suitable account type is contingent upon factors such as your trading style, risk tolerance, and capital availability.

Types of Forex Trading Accounts

Standard Account

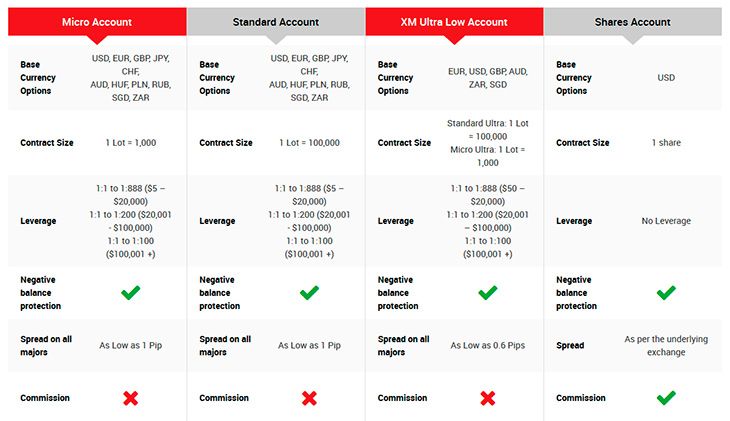

The standard account is the most ubiquitous account type among retail forex traders. It offers a straightforward approach, providing access to the most common currency pairs with floating spreads. Floating spreads fluctuate in response to market conditions, reflecting the real-time supply and demand dynamics. Standard accounts are well-suited for beginners due to their ease of use and accessibility.

Micro Account

Micro accounts are designed for traders with limited capital or those seeking a low-risk entry point into the forex market. These accounts enable traders to trade with micro-lots, which represent a fractional amount of a standard lot. The reduced lot size allows for smaller trade volumes, minimizing potential losses. Micro accounts are particularly beneficial for practicing trading strategies or testing new markets.

Image: skatrader.blogspot.com

Mini Account

Mini accounts bridge the gap between micro and standard accounts. They offer a compromise between the low-risk environment of micro accounts and the larger trade sizes of standard accounts. Mini accounts utilize mini-lots, which represent a fraction of standard lots, providing greater flexibility and risk management options than micro accounts.

ECN Account

ECN (Electronic Communication Network) accounts provide traders with direct access to the interbank market, where large financial institutions and banks execute their forex trades. ECN accounts offer tighter spreads and higher liquidity compared to standard accounts. However, they also come with higher commissions and require a deeper understanding of the forex market. ECN accounts are suited for experienced traders who seek optimal execution and control over their trades.

STP Account

STP (Straight-Through Processing) accounts streamline trade execution by eliminating intermediaries such as dealing desks. STP accounts provide faster order execution and greater transparency. Spreads in STP accounts are typically higher than ECN accounts but lower than standard accounts. STP accounts are suitable for traders seeking a balance between execution speed and competitive spreads.

Managed Account

Managed accounts are entrusted to professional money managers who handle all trading decisions on behalf of the account holder. This option is ideal for traders with limited time or expertise who prefer a hands-off approach. Managed accounts typically charge a fee based on the account’s performance or a percentage of profits.

Choosing the Right Account Type

Selecting the optimal forex trading account type requires careful consideration of your unique circumstances and trading goals. Here are some key factors to guide your decision:

Risk Tolerance

Assess your risk tolerance and tailor your account type accordingly. Micro and mini accounts limit risk exposure, while standard and ECN accounts provide greater flexibility but also carry higher risks.

Capital Availability

Determine the amount of capital you are comfortable trading with. Micro accounts are suitable for smaller capital amounts, while standard and ECN accounts cater to larger capitalizations.

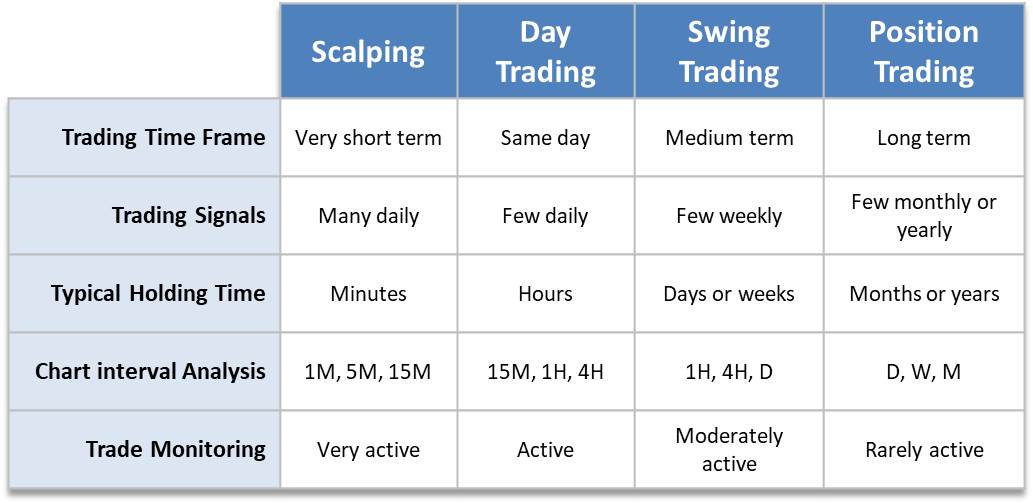

Trading Style

Consider your trading style and choose an account that aligns with your approach. ECN and STP accounts provide advanced features for scalping and high-frequency trading, while standard accounts may be sufficient for longer-term strategies.

Experience Level

Your experience level plays a crucial role. Micro and standard accounts are beginner-friendly, while ECN and managed accounts necessitate a deeper understanding of forex trading.

Forex Trading Account Types Slideshare

Conclusion

Choosing the right forex trading account type is a pivotal step towards successful trading. By understanding the various account types and aligning them with your trading goals and circumstances, you can create a solid foundation for your forex trading journey. Take the time to research and compare different brokers and account types to find the one that best suits your needs. Remember, the key is to match your account with your trading style, risk tolerance, and capital availability