Unveiling the exhilarating realm of forex trading, where opportunities abound for those seeking financial liberation. With its vast liquidity and round-the-clock accessibility, forex offers a unique arena for seasoned traders and neophytes alike to harness the potential for significant returns. Within this realm, the allure of a 50% monthly return holds immense appeal, beckoning ambitious traders on a tantalizing journey of financial conquest.

Image: www.pinterest.co.uk

Embracing the Forex Trading Arena

Forex, an abbreviation for foreign exchange, represents the dynamic marketplace where currencies from different nations are traded. As the largest and most liquid financial market globally, forex offers traders unparalleled access to myriad currency pairs, from the familiar to the exotic. This global trading hub facilitates the exchange of trillions of dollars daily, creating a vibrant environment where profit potential thrives.

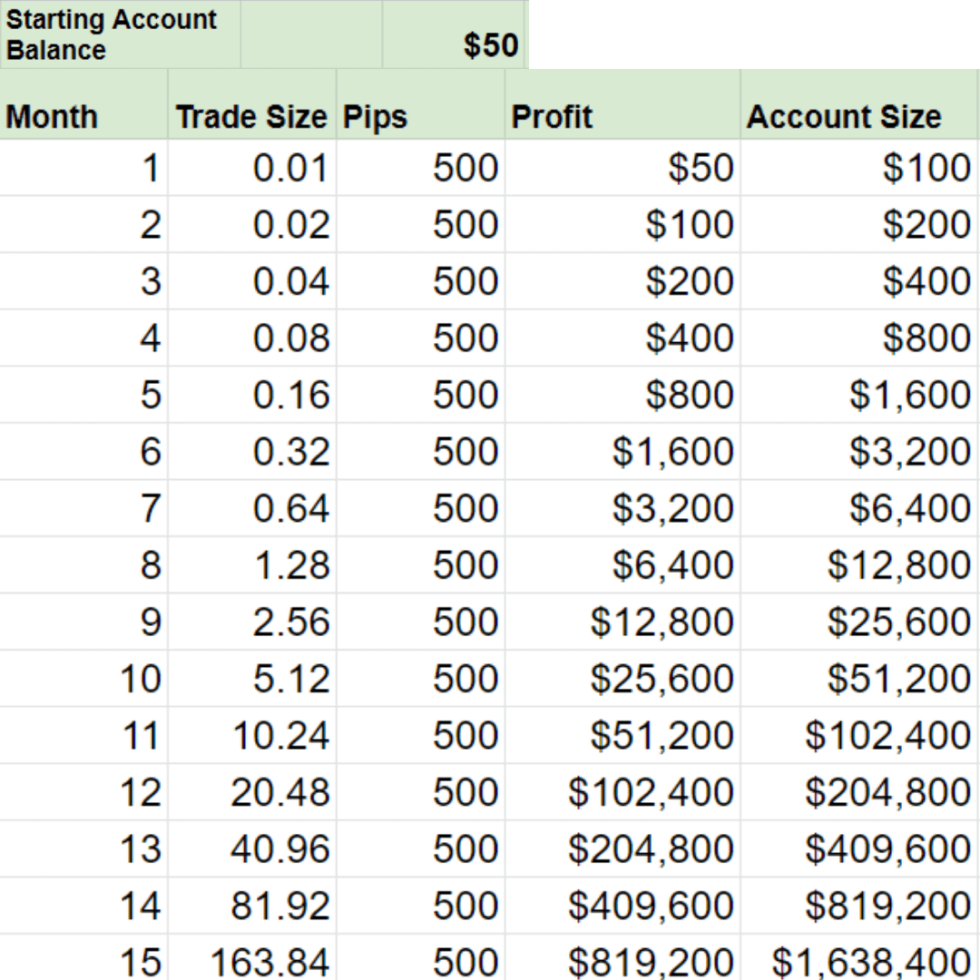

Decoding the 50% Monthly Return

A 50% monthly return in forex trading implies a consistent surge in trading account value by half its initial amount within a 30-day period. While this objective may initially appear audacious, it is certainly achievable through a combination of astute strategy, rigorous risk management, and unwavering discipline. Seasoned traders who have mastered the intricacies of technical and fundamental analysis, coupled with a deep understanding of market psychology, have consistently demonstrated the ability to generate such impressive returns.

Navigating the Path to Success

Attaining a 50% monthly return in forex trading is not a result of haphazard actions or wishful thinking; rather, it is the product of meticulous planning, diligent execution, and unwavering persistence. Novice traders are strongly encouraged to embark upon a comprehensive learning journey, delving into the intricacies of the forex market. This educational pursuit should encompass technical analysis techniques, risk management principles, and a thorough understanding of economic fundamentals.

Image: tradingstrategyguides.com

Strategies for Maximizing Returns

Traders seeking to amplify their earnings in the forex market may consider employing a combination of trading strategies. Scalping, a high-frequency trading technique, involves profiting from minute price movements over a short time frame, akin to shaving off “pips” (the smallest price increments in forex trading). Day trading, on the other hand, entails opening and closing positions within a single trading day, capitalizing on intraday price fluctuations. Swing trading, with its focus on profiting from broader market trends, offers the allure of holding positions for several days or weeks.

Risk Management: A Cornerstone of Success

Risk management lies at the heart of successful forex trading, serving as a crucial pillar in the pursuit of consistent profitability. Prudent traders meticulously calculate their risk-to-reward ratio, ensuring that potential profits significantly outweigh potential losses. Employing stop-loss orders, which automatically close losing positions at a predetermined level, plays a pivotal role in safeguarding capital and mitigating risk.

Emotional Control: The Path to Mastery

Forex trading, with its inherent potential for substantial gains and losses, can evoke a rollercoaster of emotions. The ability to maintain composure, particularly during periods of market volatility, is paramount to long-term success. Emotional trading, fueled by fear and greed, can lead to impulsive decisions that jeopardize hard-earned profits. Cultivating emotional fortitude and adhering to a disciplined trading plan are essential for navigating the tumultuous waters of the forex market.

Forex Trading 50 Monthly Return

Conclusion: Embarking on the Path to Financial Freedom