Introduction

In today’s globalized economy, businesses are increasingly engaging in foreign exchange (forex) transactions. Managing these transactions effectively is crucial for businesses to maximize returns and mitigate risks. Tally ERP 9, a leading business management software, has integrated forex trade capabilities that seamlessly align with India’s Goods and Services Tax (GST) regulations. This article explores the advantages and intricacies of forex trade with Tally ERP 9 in GST, empowering businesses to navigate this complex landscape with confidence.

Image: kygimafezes.web.fc2.com

Tally ERP 9: A GST-Compliant Solution for Forex Management

Tally ERP 9 is a GST-compliant accounting software that allows businesses to automate their forex transactions, ensuring seamless integration with their financial processes. This integration eliminates manual errors, enhances efficiency, and empowers businesses to make data-driven decisions based on real-time forex data.

Benefits of Forex Trade with Tally ERP 9 in GST

- Automated Forex Accounting: Tally ERP 9 automates forex accounting processes, including transaction recording, currency conversions, and journal entries, ensuring accurate and compliant accounting practices.

- GST Compliance: The software adheres to GST regulations, automatically calculating and adjusting GST liability based on forex transactions, minimizing compliance risks and penalties.

- Real-Time Reporting: Tally ERP 9 provides real-time reporting on forex transactions, enabling businesses to monitor their forex exposure and make timely decisions.

- Integrated Currency Management: The software supports multiple currencies, allowing businesses to manage foreign currency transactions seamlessly, eliminating the need for separate currency platforms.

- Comprehensive Forex Management: Tally ERP 9 offers comprehensive forex management features, including dealing with forward contracts, reconciliation of open positions, and analysis of forex positions.

How to Configure Forex Trade in Tally ERP 9 in GST

Configuring forex trade in Tally ERP 9 in GST involves the following steps:

- Create Currency Masters: Add all relevant currencies used in forex transactions.

- Configure Exchange Rate: Import the latest foreign currency exchange rates from authorized sources.

- Create Foreign Book: Create a separate foreign book for recording forex transactions.

- Set GST Settings: Enable GST on forex transactions and configure GST rates as per applicable GST regulations.

- Record Forex Transactions: Enter forex transactions accurately, providing details such as transaction date, amount, currency, and exchange rate.

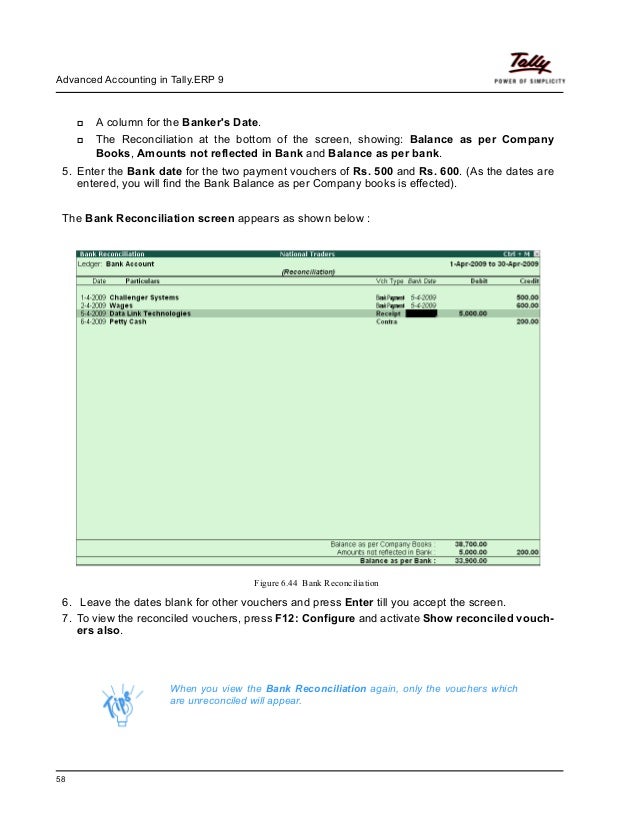

- Reconcile Open Positions: Periodically reconcile open forex positions to ensure accounting accuracy and mitigate risks.

Image: www.youtube.com

Advanced Forex Management Techniques with Tally ERP 9

- Dealing with Forward Contracts: Tally ERP 9 allows businesses to manage forward contracts, including forward purchases, forward sales, and cross-currency swaps.

- Forex Gain/Loss Analysis: The software generates detailed reports to analyze forex gains or losses, aiding in risk assessment and financial planning.

- Multi-Currency Reporting: Tally ERP 9 enables businesses to generate financial reports in multiple currencies, fostering transparency and facilitating global operations.

Forex Trade With Tally Erp 9 In Gst

Conclusion

Forex trade with Tally ERP 9 in GST is a powerful solution for businesses navigating the complexities of international trade. By leveraging this integrated platform, businesses can automate their forex transactions, ensure GST compliance, and gain real-time insights into their forex exposure. With Tally ERP 9, businesses can optimize their forex operations, mitigate risks, and maximize returns in the dynamic global business environment.