The world of currency trading, also known as forex, presents a dynamic and intriguing financial landscape where savvy traders navigate the ever-shifting values of currencies. With trillions of dollars exchanged daily, Forex offers lucrative opportunities to those who can decipher its complexities. However, the question that perpetually lingers in the minds of traders is whether to buy or sell on any given day. Join us as we delve into the intricacies of Forex trading, equipping you with the knowledge and strategies to navigate this ever-changing market.

Image: www.tradingview.com

Understanding Forex: The Global Currency Exchange

Forex trading involves the buying and selling of currencies from different countries against each other. Unlike stocks or bonds, Forex is not an exchange-based market but rather an over-the-counter (OTC) system where transactions occur directly between participants. The ability to trade 24 hours a day, five days a week allows traders to capitalize on market fluctuations around the globe.

Deciding Buy vs. Sell: A Balancing Act

The decision to buy or sell a currency pair depends on a myriad of factors that influence its value. Here are the key indicators to consider:

-

Economic Conditions: Countries with strong economies, stable political environments, and predictable interest rates tend to have stronger currencies.

-

Interest Rate Differentials: Currencies with higher interest rates typically attract investors seeking higher returns, which can lead to appreciation.

-

Inflation and Currency Strength: High inflation can erode the value of a currency as it reduces its purchasing power within the country.

-

Geopolitical Events: Political instability, natural disasters, and trade conflicts can significantly impact currency values.

-

Supply and Demand: As with any market, the value of currencies is influenced by supply and demand. Factors such as economic data releases and central bank announcements can affect the demand for a particular currency.

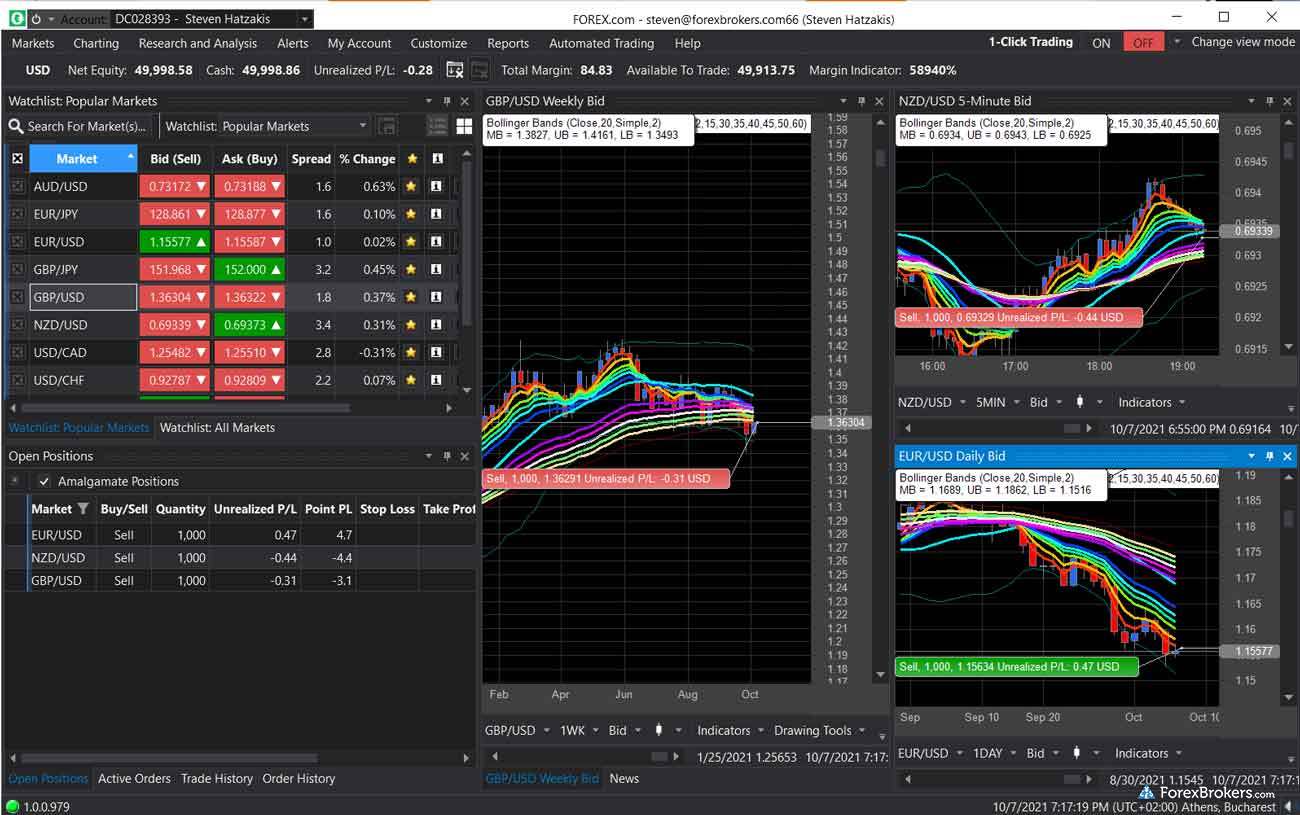

Technical Analysis: Charting the Market’s Whispers

While fundamental factors provide a strong foundation for analysis, many traders rely heavily on technical analysis to predict price movements. Technical analysis involves studying historical price charts and patterns to identify potential opportunities. By analyzing support and resistance levels, trendlines, and candlestick formations, traders aim to gain insights into the market’s direction.

Image: investscope.net

The Role of Leverage: High Rewards, High Risks

Forex traders have access to leverage, which allows them to trade positions larger than their account balance. While leverage can amplify profits, it also magnifies losses. Traders must exercise caution when using leverage and ensure their risk management strategies are in place.

Forex Trade Today Buy Or Sell

Conclusion: Navigating the Forex Labyrinth

Forex trading offers both opportunities and risks, and understanding the factors that influence currency values is crucial. By carefully considering economic conditions, interest rate differentials, and geopolitical events, traders can make informed decisions on whether to buy or sell currencies. Technical analysis provides additional insights into price patterns, helping traders identify potential entry and exit points. However, it’s essential to manage risk effectively through appropriate leverage and stop-loss orders. Armed with knowledge, strategy, and discipline, traders can navigate the complexities of the Forex market and unlock its potential.