Introduction

The forex market is the largest and most liquid financial market, with a daily trading volume exceeding $6 trillion. As a global market, forex trading is conducted 24 hours a day, five days a week, making it accessible to traders around the world. However, due to the varying time zones across the globe, forex traders need to be aware of the different market hours to optimize their trading strategies. This article will provide a comprehensive guide to the forex market time zones and their impact on trading.

Image: www.pinterest.com

Major Forex Trading Sessions

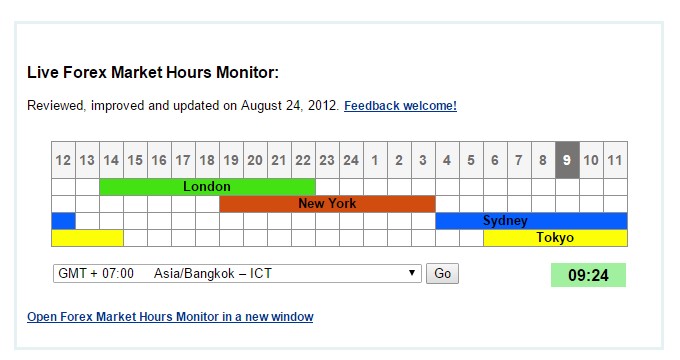

The forex market is divided into four major trading sessions:

-

Sydney Session (00:00-08:00 UTC)

The Sydney session marks the start of the trading day, covering the Asia-Pacific region. This session typically sees moderate trading activity as the Australian and New Zealand markets open for business.

-

Tokyo Session (02:00-10:00 UTC)

The Tokyo session overlaps with the Sydney session and is one of the busiest periods of forex trading. During this time, the Japanese market opens, contributing significant trading volume to the global forex market.

-

Image: forexadvice1.blogspot.comLondon Session (08:00-16:00 UTC)

The London session is the most active period in forex trading, with the opening of the European markets. This session is characterized by the participation of major financial institutions and central banks, resulting in the highest liquidity and volatility.

-

New York Session (13:00-21:00 UTC)

The New York session coincides with the London session and witnesses high trading volume as the American market opens. This session is known for its strong liquidity and influence on global currency trends.

Overlap Between Trading Sessions

The overlap between the major forex trading sessions is crucial for traders. During these periods, the market sees increased liquidity and volatility due to the convergence of multiple market participants. The overlap between the London and New York sessions, sometimes referred to as the “London Fix,” is particularly significant as it often determines the direction of major currency pairs.

Impact on Trading Strategies

Understanding forex time zones is essential for developing effective trading strategies. Traders should consider the market activity during different sessions and adjust their trading schedule accordingly.

-

High-Volume Trading

Traders seeking high-volume trading should focus on the London and New York sessions, which offer maximum liquidity and trading opportunities.

-

Breakout and Trend Following

Breakouts and trend reversals are more likely to occur during the overlap between trading sessions, providing traders with increased profit potential.

-

News and Events

Major economic news and events can significantly impact currency values. Traders should be aware of upcoming news releases and plan their trades accordingly.

-

Carry Trade

The carry trade, which involves borrowing a currency with low interest rates and investing in a currency with higher interest rates, is influenced by the time zones. The best time to execute carry trades is during periods of low market volatility.

Forex Time Zone Which Time

Conclusion

Understanding forex time zones is crucial for maximizing trading success. By aligning trading strategies with the market hours and liquidity cycles, traders can optimize their profits and minimize risks. Whether you are a scalper, day trader, or long-term investor, it is essential to be aware of the different forex time zones and their impact on the market. By embracing this knowledge, traders can navigate the global forex market with confidence and achieve their trading goals.