The foreign exchange (forex) market, a global financial ecosystem, constantly oscillates between dynamic market trends. These trends, broadly classified as strong and flat, dictate the direction and volatility of currency values, presenting both opportunities and challenges for traders. This article delves into the intricacies of strong and flat trends in the forex market, empowering traders with the knowledge to navigate these unique market conditions effectively.

Image: in.pinterest.com

Strong Trends: Riding the Currency Wave

Strong trends in the forex market are characterized by sustained, unidirectional price movements. These trends can endure for extended periods, offering substantial profit potential for traders who correctly anticipate their direction. Identifying strong trends requires keen market observation and the ability to interpret technical indicators such as moving averages, trend lines, and momentum oscillators.

The benefits of trading in strong trends are multifaceted. First, traders can capitalize on prolonged market momentum, potentially magnifying their profits. Second, strong trends often exhibit predictable price movements, making it easier for traders to determine entry and exit points. Third, strong trends tend to generate ample trading opportunities, allowing traders to optimize their risk-reward ratios.

Flat Trends: Navigating the Market Lulls

Flat trends, also known as range-bound markets, depict periods of minimal price fluctuations. In these trends, currency values oscillate within a defined range, without any clear directional bias. Flat trends can be challenging for traders accustomed to trending markets, as profit opportunities are often limited.

However, savvy traders can navigate flat trends successfully by employing specific strategies. One approach involves identifying and trading breakout points, where the currency pair breaks through the defined range and triggers a potential trend reversal. Another strategy is to trade the range itself, capitalizing on the occasional price swings within the established boundaries.

Distinguishing Strong from Flat Trends: A Trader’s Guide

Differentiating between strong and flat trends is crucial for successful forex trading. While there is no foolproof method, several key indicators can assist traders in making informed decisions:

-

Trend Lines: Strong trends exhibit well-defined trend lines connecting a series of higher highs and higher lows (uptrend) or lower lows and lower highs (downtrend).

-

Moving Averages: Moving averages, such as the 50-day or 200-day moving average, can help identify the overall market trend. A rising moving average indicates a potential uptrend, while a falling moving average suggests a downtrend.

-

Momentum Indicators: Momentum indicators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, measure the strength and direction of a trend. High momentum readings, coupled with a clearly defined trend, indicate a strong trend.

-

Price Action: Price action itself provides valuable clues about the underlying trend. Strong trends exhibit consistent price movements in one direction, with minimal reversals or consolidation periods.

-

Volume: Volume is an indicator of market participation. High volume during a trend suggests increased conviction among traders, further validating the trend’s strength.

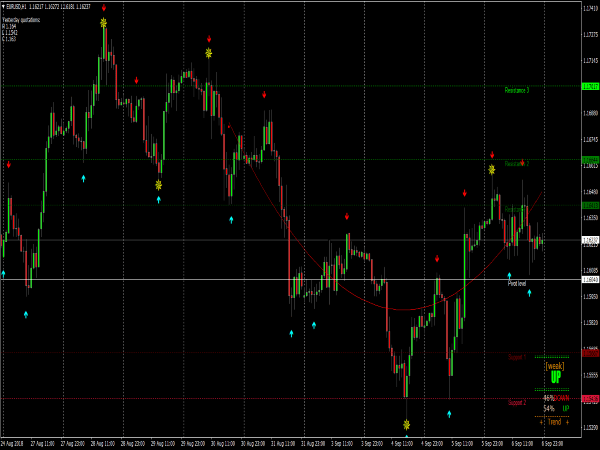

Image: www.best-metatrader-indicators.com

Forex System With Strong Trend And Flat Trend

Conclusion: Capitalizing on Currency Dynamics

Understanding the nature of strong and flat trends is essential for successful forex trading. By recognizing these trends and employing appropriate trading strategies, traders can maximize their profit potential while mitigating risks. Strong trends provide opportunities for substantial gains, but flat trends require patience and a different approach to profitability. By mastering the art of navigating these market dynamics, traders can harness the power of the forex market and achieve consistent success.