In the fast-paced world of foreign exchange trading, navigating the complexities of international money transfers can be a daunting task. However, the SWIFT code, a unique identifier assigned to financial institutions worldwide, provides a secure and efficient gateway for executing forex transactions. This comprehensive guide will delve into the intricacies of SWIFT codes, unraveling their significance in facilitating seamless cross-border payments.

Image: www.ofx.com

Unveiling the SWIFT Code: A Gateway to Global Finance

SWIFT, an acronym for Society for Worldwide Interbank Financial Telecommunication, is a global messaging system that facilitates secure and standardized communication between financial institutions. Each bank or financial institution is assigned a unique SWIFT code, consisting of eight to eleven characters, which serves as its exclusive identifier in the global financial network.

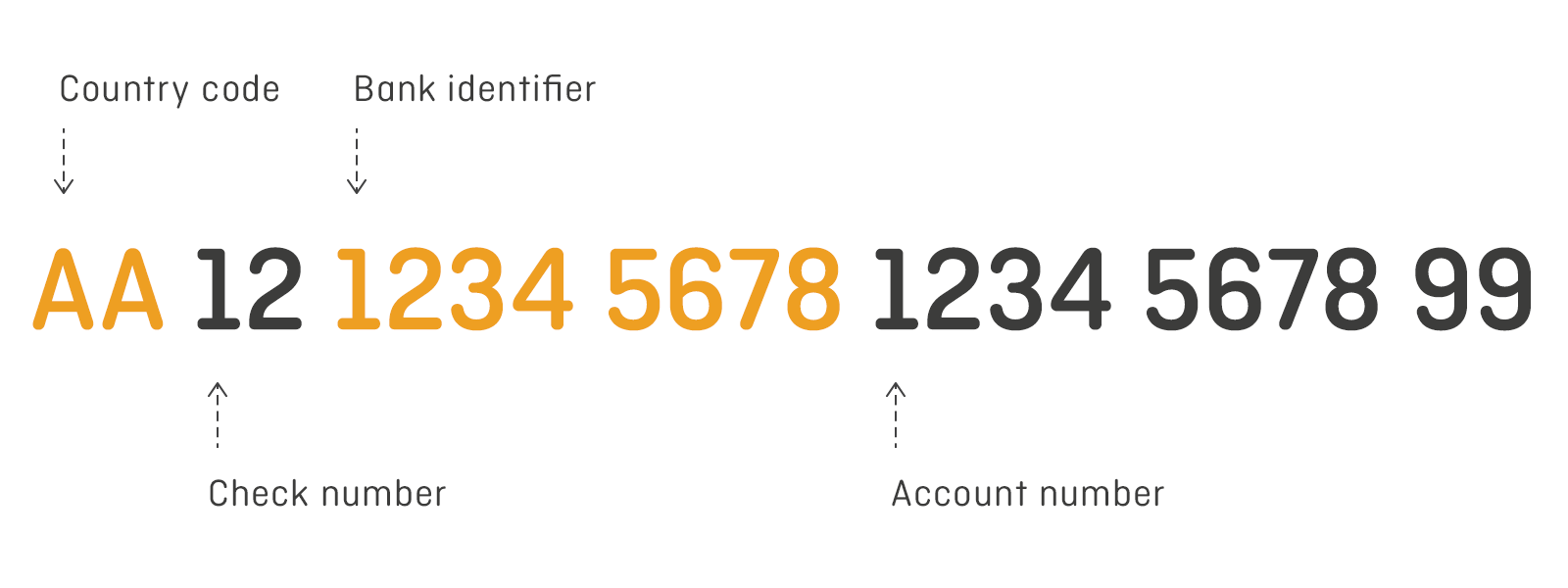

The SWIFT code comprises four distinct sections:

- Bank Code: A four-character code representing the specific bank or financial institution.

- Country Code: A two-character code denoting the country in which the bank is located.

- Location Code: A two-character code indicating the city or region where the bank’s head office or branch is situated.

- Branch Code (Optional): A three-character code that identifies a specific branch of the bank, used when multiple branches exist within the same city.

Seamless Forex Transactions: The Role of SWIFT Codes

SWIFT codes play a pivotal role in facilitating cross-border forex transactions. When initiating a forex transfer, the sender’s bank utilizes the recipient’s SWIFT code to route the funds to the appropriate financial institution. The SWIFT code ensures that the funds are delivered swiftly and securely to the intended recipient.

Through the SWIFT network, banks can transmit standardized payment instructions, including details such as the amount, currency, sender and recipient information, and any necessary references. This streamlined process enhances the accuracy and efficiency of forex transactions, minimizing the risk of errors and delays.

Unveiling the Benefits of SWIFT Codes for Forex Trading

- Speed and Efficiency: SWIFT codes facilitate rapid and efficient cross-border payments, reducing transaction times and minimizing delays.

- Enhanced Security: The SWIFT network employs stringent security measures, including encryption and authentication protocols, to safeguard sensitive financial data during transmission.

- Global Reach: SWIFT connects financial institutions worldwide, empowering traders to execute forex transactions across diverse jurisdictions seamlessly.

- Standardized Messaging: SWIFT’s standardized messaging format ensures clear and accurate communication between banks, eliminating potential errors due to misinterpretation.

Harnessing the Power of SWIFT Codes for Forex Success

To leverage the full potential of SWIFT codes in forex trading, traders should adhere to the following best practices:

- Ensure accuracy when providing the recipient’s SWIFT code to minimize the risk of transaction delays or errors.

- Utilize reliable sources to obtain accurate SWIFT codes, such as official bank websites or trusted financial data providers.

- Understand the potential costs associated with SWIFT transactions, as banks may charge fees for processing these payments.

Conclusion: Embarking on a New Era of Forex Trading with SWIFT Codes

The advent of SWIFT codes has revolutionized the realm of forex trading, enabling traders to execute global transactions swiftly, securely, and efficiently. By embracing the power of SWIFT codes, traders can unlock a world of seamless cross-border payments, empowering them to navigate the complexities of international finance with confidence.

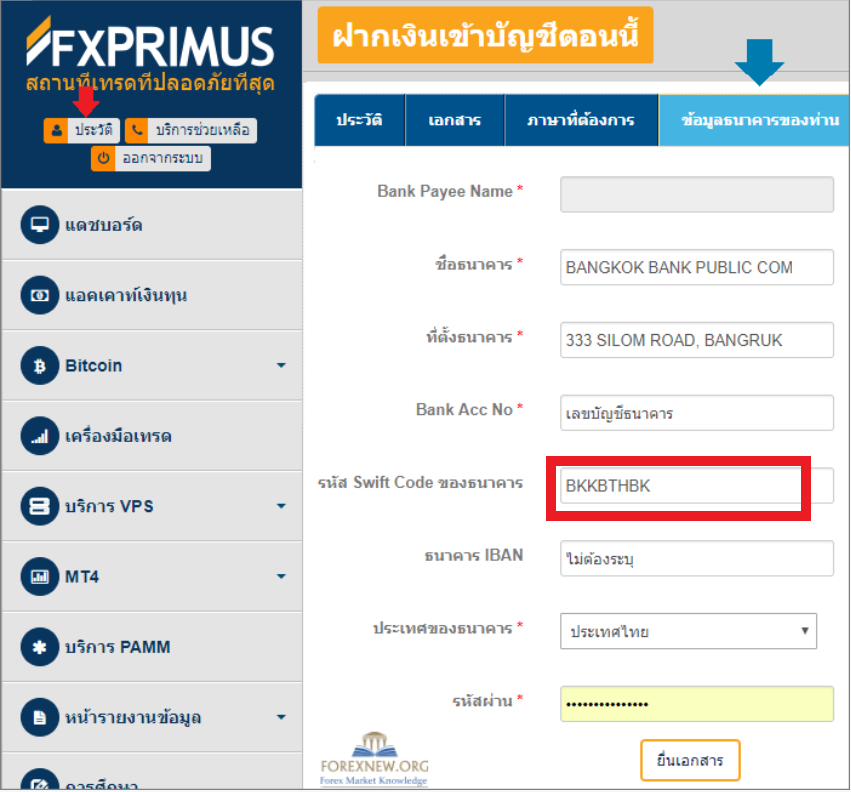

Image: forex-data.net

Forex Swift Code Used For

https://youtube.com/watch?v=S6uXC8iiMOM