In the intricate world of international finance, forex and currency swaps are two closely intertwined concepts that play a pivotal role in facilitating global commerce and financial stability. While they share certain similarities, these instruments exhibit distinct characteristics that cater to different needs. This article aims to demystify the complexities of forex and currency swaps, providing a comprehensive guide that empowers readers to navigate these indispensable financial tools.

Image: www.forex.academy

Forex Swap: A Bridge Between Currency Pairs

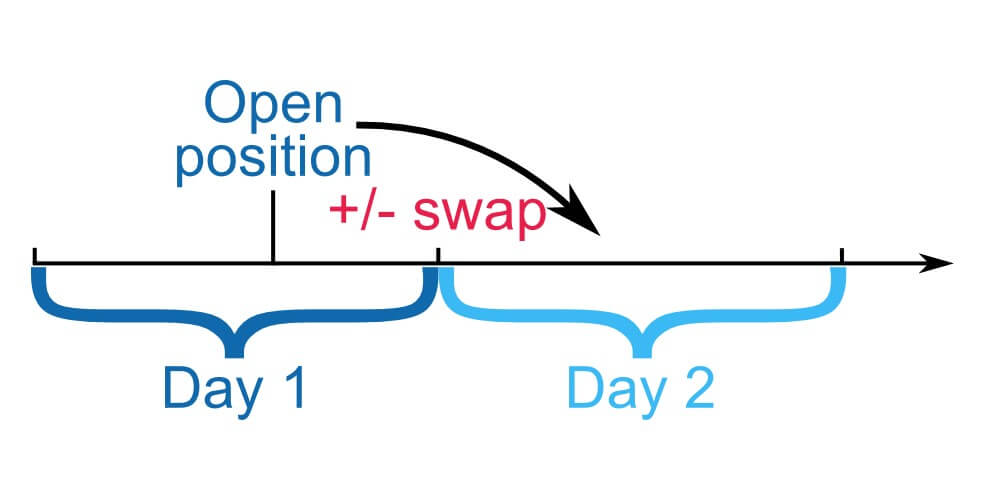

At the heart of a forex swap lies the simultaneous buying and selling of two different currencies at a predetermined rate and for a specified period. Unlike spot transactions, which are settled on the same day, forex swaps are completed at a future date known as the settlement date or value date. This mechanism allows traders to lock in a favorable currency exchange rate and protect themselves against future currency fluctuations. Forex swaps are commonly employed by businesses and investors to manage foreign exchange risk associated with international trade or investments, as well as for speculative purposes.

Currency Swap: A Tool for Long-Term Currency Management

A currency swap, in contrast, involves the exchange of principal and interest payments denominated in different currencies over a predetermined period. Typically structured through a bilateral agreement between two parties, currency swaps entail a contractual commitment to exchange a fixed amount of one currency for another on a periodic basis. Unlike forex swaps, which primarily serve to mitigate short-term foreign exchange risk, currency swaps are designed to facilitate long-term currency hedging and exposure management. They provide investors with a flexible and cost-effective way to access foreign markets without the need for physical currency settlement.

Unveiling the Key Distinctions

To distinguish between forex and currency swaps, it is imperative to delve into their fundamental differences. While both instruments involve the exchange of currencies, forex swaps focus on managing short-term foreign exchange risk through a simple transaction, while currency swaps provide a long-term solution for currency hedging and exposure management. Forex swaps are executed through spot and forward transactions, whereas currency swaps involve periodic exchanges of principal and interest payments. Additionally, forex swaps are primarily utilized by businesses and investors, while currency swaps cater to both financial institutions and non-financial corporations.

Image: www.phillipcfd.com

The Role of Central Banks in Swap Arrangements

Central banks play a significant role in the realm of currency swaps, particularly in stabilizing the foreign exchange markets and managing imbalances in international payments. Currency swaps between central banks are often employed as a monetary policy tool to influence exchange rates, smooth currency flows, and provide liquidity to markets. Central banks may also engage in forex swaps for intervention purposes, aiming to influence the value of their currency against other major currencies.

Unlocking the Advantages of Forex and Currency Swaps

Both forex and currency swaps offer a plethora of advantages, providing financial institutions and businesses with invaluable tools for managing currency risk and enhancing their financial stability. Forex swaps enable traders to lock in favorable exchange rates and protect against adverse currency movements, while currency swaps facilitate long-term currency management, reduce financing costs, and provide access to foreign markets.

Understanding the Risks

As with any financial instrument, forex and currency swaps carry inherent risks that need to be carefully considered. Currency fluctuations, changes in interest rates, and counterparty risk are among the key risks associated with these instruments. It is essential for traders and investors to possess a thorough understanding of the risks involved and to implement appropriate risk management strategies.

Forex Swap And Currency Swap

The Future of Forex and Currency Swaps

The future of forex and currency swaps looks promising, as the demand for these instruments continues to grow in the face of global economic integration and heightened financial market volatility. Technological advancements are expected to enhance the efficiency and accessibility of these instruments, while regulatory frameworks aim to ensure transparency and mitigate risks. As the world becomes increasingly interconnected, forex and currency swaps will undoubtedly remain indispensable tools for managing currency risk and fostering financial stability.