In the ever-evolving world of forex trading, grasping the intricacies of technical analysis is paramount to achieving consistent profitability. Amidst the myriad of trading strategies and indicators, the support and resistance system stands out as a cornerstone technique that has withstood the test of time. By understanding how to identify and utilize these critical levels, traders can significantly enhance their trading decisions and navigate the forex market with greater confidence.

Image: picclick.com

Defining Support and Resistance – The Pillars of Trading

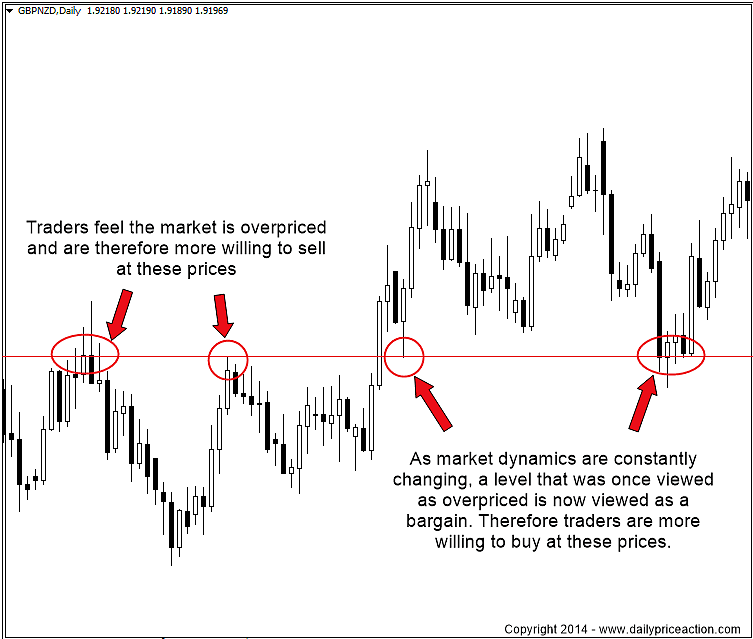

Support and resistance are fundamental concepts in technical analysis that represent price levels at which the market exhibits a tendency to pause, reverse, or bounce. Support acts as a floor, preventing prices from falling further, while resistance acts as a ceiling, limiting upward price movements. These levels are formed by the cumulative buying and selling pressure in the market over time and provide valuable insights into potential price movements.

Historical Insights – Tracing the Roots of Support and Resistance

The concept of support and resistance has been utilized by traders for centuries, dating back to the early days of stock market trading. It was first popularized by Charles Dow, one of the founding fathers of technical analysis, who observed that prices tend to move within defined ranges and experience recurring patterns. Since then, support and resistance levels have become indispensable tools for market analysis across various financial markets, including forex.

Identifying Support and Resistance Levels – A Trader’s Toolkit

There are several methods for identifying support and resistance levels, each with its own advantages and limitations. Common techniques include:

- Horizontal Lines: Drawing horizontal lines at previous price highs and lows can identify potential support and resistance levels.

- Trend Lines: Connecting a series of higher highs or lower lows with a line can create a trend line that serves as a dynamic support or resistance level.

- Fibonacci Levels: Specific Fibonacci ratios, such as 38.2%, 50%, and 61.8%, can be used to identify potential support and resistance areas.

- Moving Averages: Moving averages, such as the 50-period or 200-period moving average, can act as dynamic support and resistance levels.

- Volume Analysis: High trading volume at a specific price level can indicate the presence of strong support or resistance.

Image: dailypriceaction.com

Trading with Support and Resistance – Harnessing the Power

Once support and resistance levels have been identified, traders can utilize them in various ways to enhance their trading strategies:

- Bouncing off Support and Resistance: Prices often bounce off support and resistance levels, providing opportunities for traders to enter or exit trades.

- Breakouts: When prices break through support or resistance levels with significant momentum, it can signal a potential shift in trend, offering opportunities for trend-following trades.

- Retracements and Pullbacks: After a breakout, prices often retrace or pull back towards the previous support or resistance level, offering additional trading opportunities.

- Trend Confirmation: Support and resistance levels can be used to confirm the direction of a prevailing trend, reducing the risk of false signals.

Forex Support And Resistance System

Conclusion – Empowering Traders with the Support and Resistance System

Mastering the support and resistance system is an invaluable skill for forex traders of all levels. By understanding how to identify and interpret these critical price levels, traders can unlock a wealth of trading opportunities, improve their decision-making, and navigate the forex market with greater confidence. Whether you’re a seasoned trader or just starting out, incorporating the support and resistance system into your trading arsenal will empower you to make informed trades and enhance your overall trading performance.