In the dynamic world of foreign exchange (forex) trading, mastering the art of identifying and utilizing support and resistance levels is paramount for achieving consistent profitability. This comprehensive guide will delve into the intricacies of forex support and resistance, exploring their historical significance, conceptual nuances, and practical applications. By equipping yourself with this fundamental knowledge, you can elevate your trading strategy and unlock the gateway to enhanced forex trading outcomes.

Image: www.forex.academy

Understanding the Stakes: Why Support and Resistance Matter

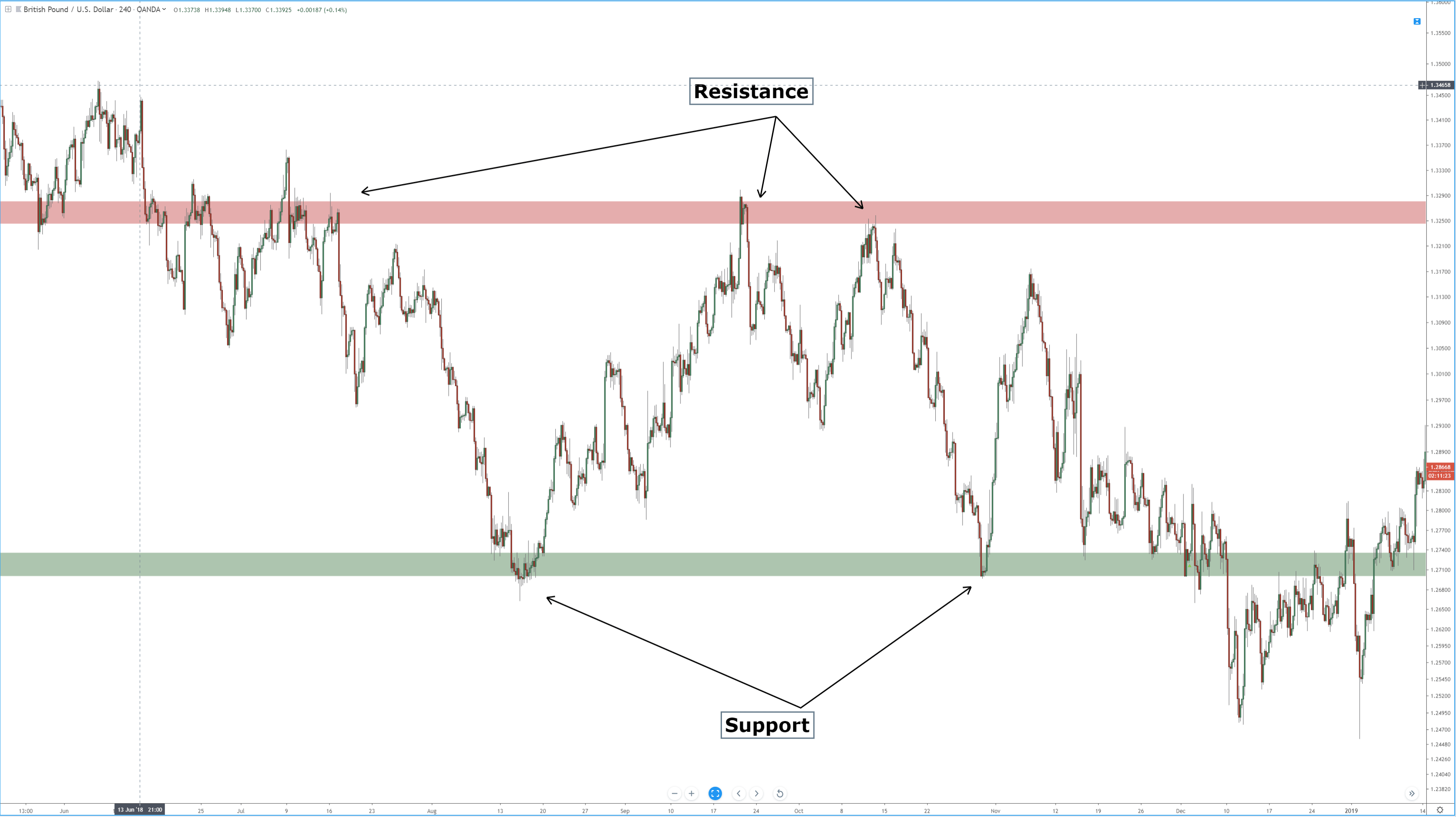

The forex market is an intricate tapestry woven from the fluctuations of currency values. Amidst the ebb and flow of these valuations, certain price points emerge that act as invisible barriers, influencing the market’s trajectory. These price points, known as support and resistance levels, represent the equilibrium between buyers and sellers, providing traders with invaluable insights into potential market movements.

Support levels, akin to trading floors, materialize when a currency pair encounters buying pressure that halts its downward trend. Conversely, resistance levels, analogous to trading ceilings, arise when the selling pressure curtails a currency pair’s upward trajectory. By comprehending the dynamics of these support and resistance levels, traders can anticipate price reversals, identify profitable entry and exit points, and navigate market volatility with greater precision.

A Historical Lens: Tracing the Roots of Support and Resistance

The concept of support and resistance levels has its genesis in the realm of technical analysis, a trading discipline that deciphers market patterns and trends by scrutinizing historical price data. Early traders astutely observed that specific price points consistently played a pivotal role in shaping market direction. These observations laid the foundation for the widespread acceptance of support and resistance levels as indispensable tools in the trader’s arsenal.

Over the years, support and resistance levels have stood the test of time, proving their enduring relevance in a perpetually evolving financial landscape. By leveraging historical price data and employing various technical analysis techniques, modern traders continue to harness the power of these levels to decipher market sentiment and optimize their trading strategies.

Identifying Support and Resistance: A Systematic Approach

Mastering the art of identifying support and resistance levels is a cornerstone of successful forex trading. This process hinges on meticulous analysis of historical price data, coupled with a discerning eye for patterns and trends. One of the most effective methods involves identifying areas where the market has repeatedly bounced off specific price points. These areas typically coincide with significant highs (resistance levels) and lows (support levels) on the price chart.

Another valuable technique entails drawing trend lines along with the peaks and troughs of a currency pair’s price movement. The intersection of these trend lines with the price chart can often reveal potential support and resistance levels. However, it’s crucial to remember that support and resistance levels are not static but rather dynamic, subject to change as market conditions evolve. Traders must exercise constant vigilance, adapting their strategies accordingly.

Image: forexearnings2.blogspot.com

Practical Applications: Unveiling Trading Opportunities

The true power of support and resistance lies in their practical applications within the forex market. By discerning these levels, traders can seize lucrative trading opportunities and mitigate potential risks. When a currency pair approaches a support level, astute traders anticipate a potential price reversal, presenting a prime opportunity to enter a long position (buying). Conversely, if the pair nears a resistance level, a short position (selling) might be warranted in anticipation of a downward reversal.

Moreover, support and resistance levels serve as potent risk management tools. By placing stop-loss orders below support levels (for long positions) or above resistance levels (for short positions), traders can effectively limit potential losses. Additionally, these levels can guide traders in determining optimal entry and exit points, maximizing profit potential while minimizing risk exposure.

Forex Support And Resistance Mp4

Conclusion: Embracing Support and Resistance for Trading Success

In the competitive arena of forex trading, mastering the art of identifying and utilizing support and resistance levels is an invaluable skill that can pave the way to consistent profitability. By grasping the historical significance, conceptual underpinnings, and practical applications of these levels, traders can elevate their trading strategies and navigate market volatility with greater precision. Whether a seasoned veteran or a novice seeking to establish a solid foundation, understanding support and resistance is a cornerstone of successful forex trading. Embrace the power of these levels, and embark on a journey toward enhanced trading outcomes.