Introduction

Image: honeypips.com

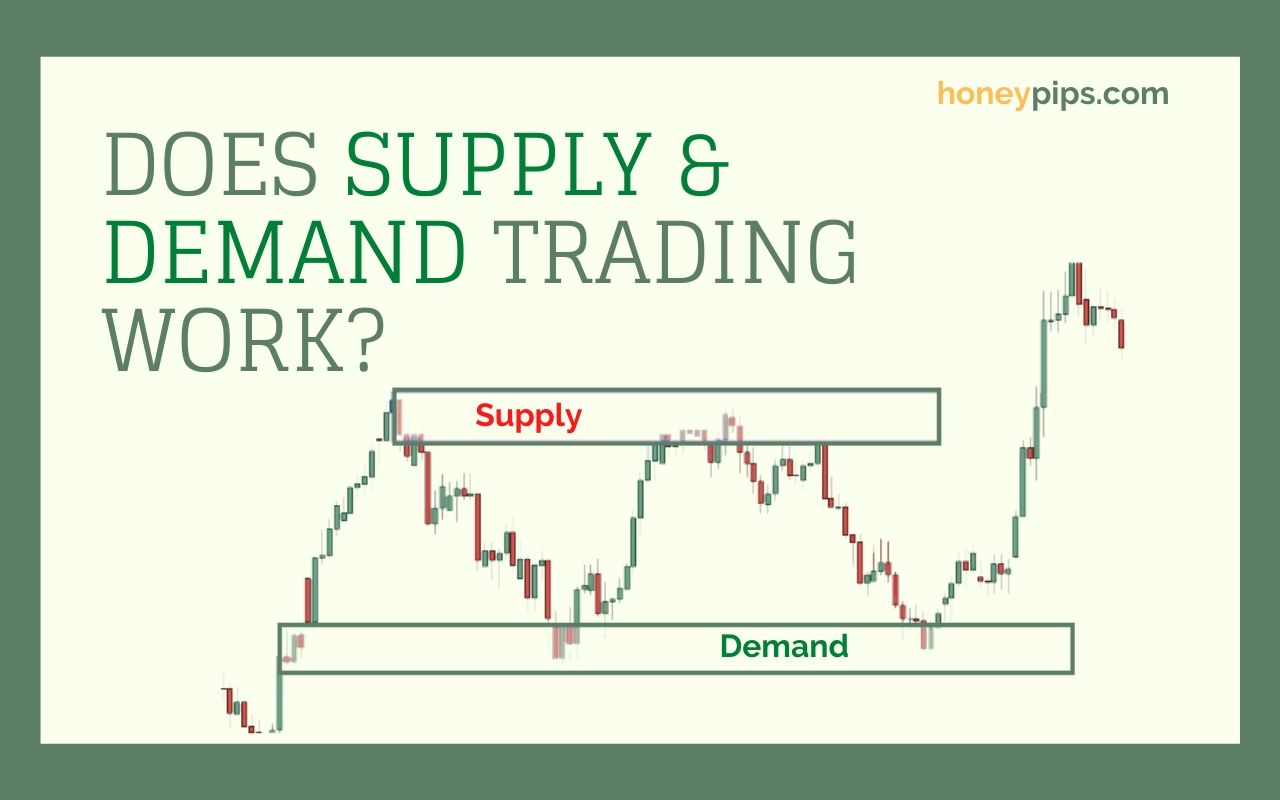

In the world of Forex trading, understanding the intricate interplay between supply and demand is crucial for making informed decisions. The forex supply and demand indicator strategy is a powerful tool that allows traders to identify potential market reversals and capitalize on profitable opportunities. This guide will provide a deep dive into the concept, empowering you with the knowledge and insights necessary to navigate the ever-changing Forex market.

Defining Supply and Demand in Forex

Simply put, supply refers to the amount of a currency that traders are willing to sell at a given price, while demand represents the amount they are willing to buy at that price. When supply exceeds demand, the currency’s value tends to decrease due to a lower number of buyers. Conversely, when demand outstrips supply, prices increase as buyers compete for the limited currency available.

The Forex Supply and Demand Indicator

The forex supply and demand indicator is a technical analysis tool that visually represents the relative strength of supply and demand in a specific currency pair. It measures the volume of buy and sell orders placed in the market, giving traders insights into potential market reversals and price action that could indicate a trend change.

How to Use the Indicator

To use the supply and demand indicator effectively, consider the following steps:

-

Identify areas of significant supply: These are areas where the supply of a currency exceeds demand, causing a drop in price. Look for horizontal or angled lines indicating resistance levels where selling pressure is strong.

-

Locate areas of substantial demand: Conversely, these areas indicate an excess of buyers relative to sellers, leading to upward price movements. Identify horizontal or angled lines marking support levels where buying activity dominates.

-

Observe the interaction of supply and demand: Monitor how price action interacts with these supply and demand zones. Breakouts above or below these levels can signal potential trend reversals.

Expert Insights on Supply and Demand Strategy

According to renowned Forex trader George Soros, “Supply and demand is not only a useful theory. It is also a basic law of the market, as fundamental as gravity.” Here are additional insights from experts:

-

Bill Lipschutz, founder of the Hedge Fund Association, emphasizes the importance of “Trading against the consensus.” He suggests looking for discrepancies between supply and demand signals and market sentiment to identify potential profitable opportunities.

-

Kathy Lien, Managing Director of BK Asset Management, advises traders to “Be patient and wait for the right setup.” Successful supply and demand trading involves patiently waiting for clear signals and avoiding impulsive decisions.

Actionable Tips for Success

-

Combine supply and demand with other indicators: For more reliable analysis, use the indicator alongside other technical indicators such as moving averages and oscillators.

-

Manage risk effectively: Determine appropriate stop-loss and take-profit levels to protect your capital and secure profits.

-

Practice on a demo account: Fine-tune your supply and demand strategies in a risk-free environment before implementing them with real capital.

Conclusion

Mastering the forex supply and demand indicator strategy gives you a valuable edge in the Forex market. By understanding the dynamics of supply and demand, you can identify potential market reversals, predict price movements, and make informed trading decisions. Embrace the knowledge and insights presented in this guide to unlock the full potential of this powerful tool and achieve greater trading success.

Image: www.youtube.com

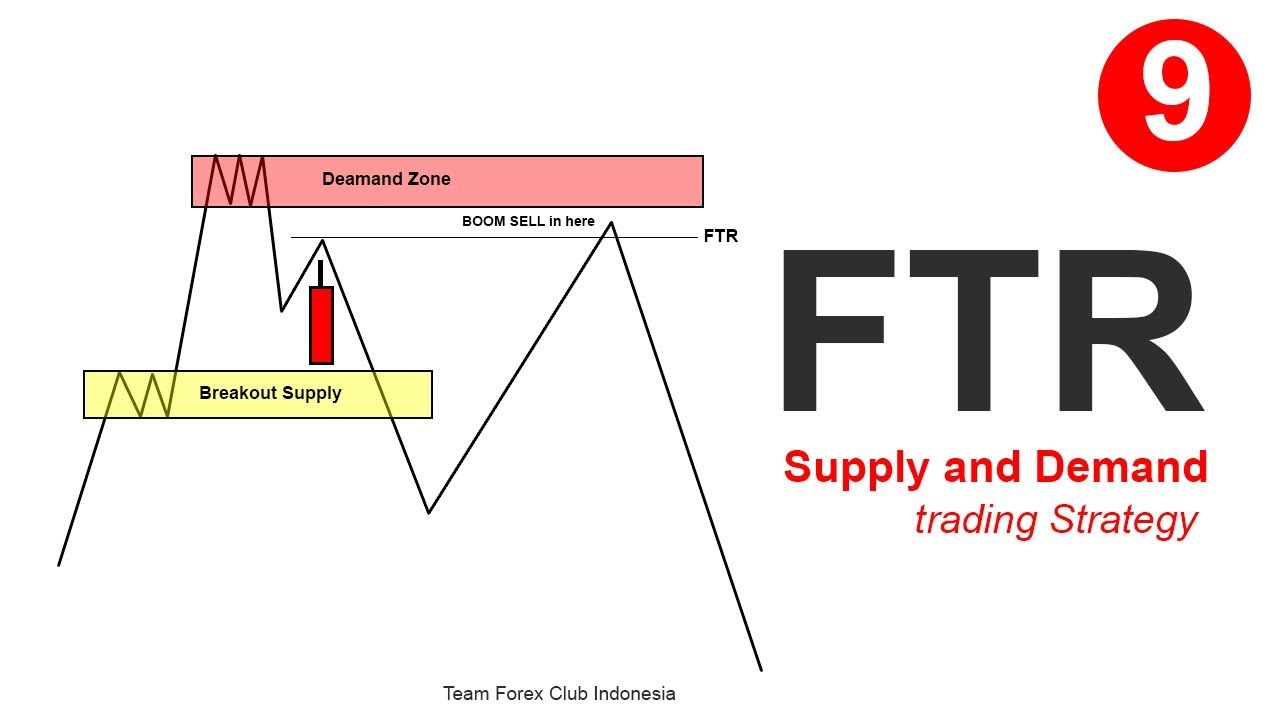

Forex Supply And Demand Indicator Strategy