In the high-stakes world of foreign exchange trading, mastering a profitable strategy is akin to possessing the philosopher’s stone. Traders yearn for a system that promises consistent gains while mitigating risks. One such strategy that has graced the trading scene is the 50-pip-per-day approach.

Image: investgrail.com

Whether you’re a seasoned veteran or a novice navigating the turbulent waters of forex, this article will equip you with the knowledge and tools necessary to harness the power of this strategy, enabling you to secure daily profits with confidence and finesse.

The Essence of the 50-Pip Strategy

At its core, the 50-pip-per-day strategy is a disciplined approach to forex trading designed to generate modest but consistent daily returns. The concept is simple yet profound: aim to capture a daily gain of 50 pips by identifying high-probability trading opportunities. By accumulating small profits each day, traders can build their trading accounts steadily over time.

The Pillars of Profitability

The success of the 50-pip strategy relies on the following pillars:

-

Technical Analysis Mastery: Traders must develop a keen eye for identifying chart patterns, price action signals, and technical indicators that can provide valuable insights into market direction.

-

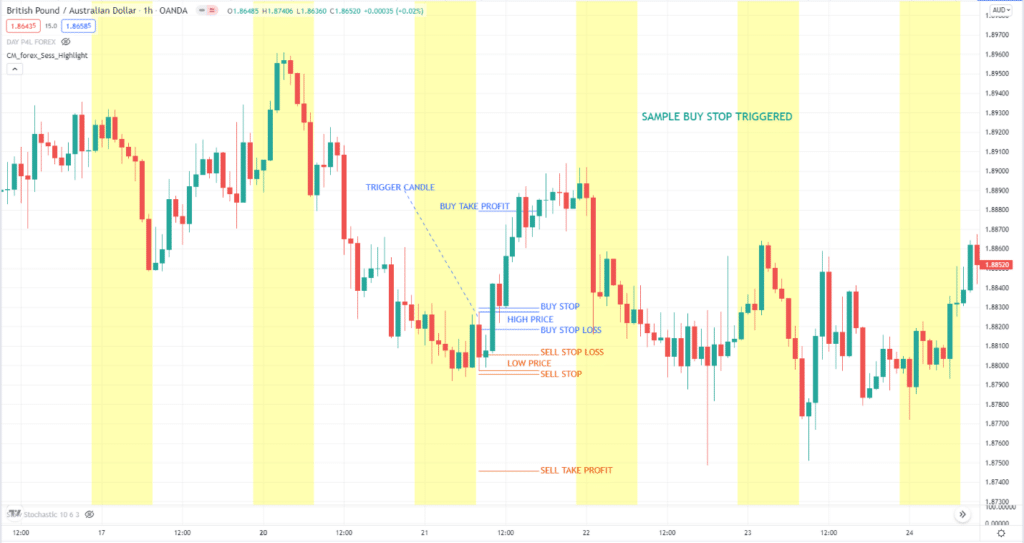

Risk Management Discipline: Adhering to strict risk parameters is paramount. Traders must define clear entry and exit points, use stop-loss orders judiciously, and manage their positions prudently.

-

Emotional Control: Forex trading can be an emotional roller coaster. Traders must remain composed, avoid impulsive decisions, and stick to their trading plan even when faced with market fluctuations.

The Building Blocks of a 50-Pip Strategy

-

Currency Pair Selection: Choose highly liquid currency pairs with predictable trends, such as EUR/USD, GBP/USD, or USD/JPY.

-

Time Frame Selection: The 4-hour and 1-hour time frames provide optimal opportunities for identifying 50-pip price movements.

-

Technical Indicators: Moving averages, Bollinger Bands, and relative strength index (RSI) are commonly used indicators for identifying potential trends and entry points.

-

Target Profit: Aim for a realistic and achievable target of 50 pips per trading day. Avoid the temptation of overtrading or chasing unrealistic profits.

Image: tokenist.com

Expert Insight: The Art of Identifying High-Probability Trades

“The key to consistent profitability in forex trading is to focus on high-probability trades,” advises renowned forex trader Andrew Aziz. “Look for clearly defined chart patterns, such as double tops or bottoms, with a confluence of technical indicators supporting your entry.”

Actionable Tips for Success

-

Practice on a Demo Account: Hone your skills on a virtual trading platform before risking real capital.

-

Backtest Your Strategy: Validate your strategy by testing it on historical data to ensure consistency and profitability.

-

Seek Guidance from Experts: Learn from experienced traders, webinars, and forex educational resources.

Forex Strategy For 50 Pips Per Day

Conclusion

The 50-pip-per-day strategy is a proven approach for those seeking consistent profitability in forex trading. By mastering technical analysis, embracing risk management, and controlling emotions, traders can unlock the potential to build their wealth steadily and confidently. Remember, trading success lies not in chasing extraordinary gains but in maintaining a disciplined and patient approach.