Introduction:

Image: gepahotalefi.web.fc2.com

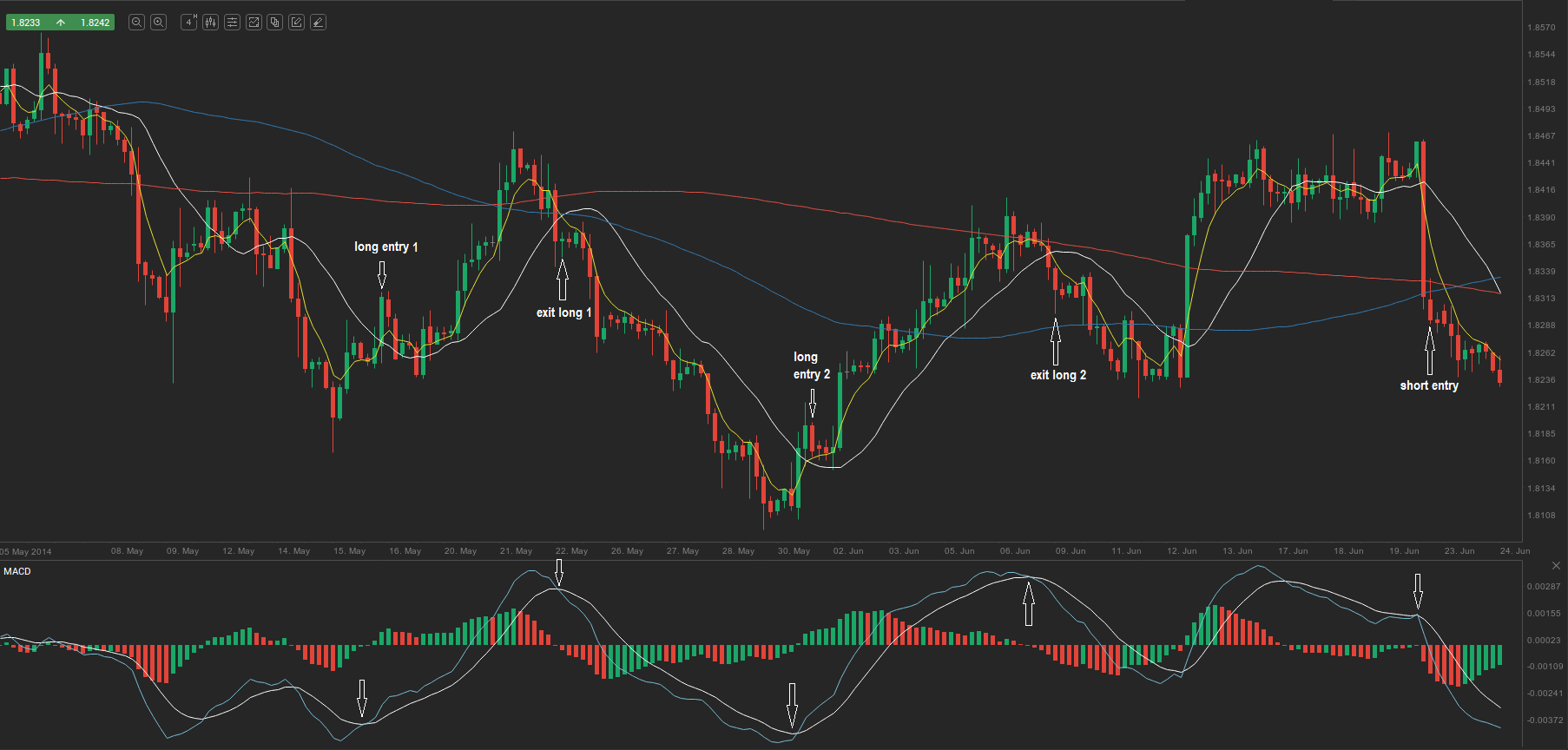

Imagine stepping onto the bustling forex market without a compass, lost amidst a sea of fluctuating currency values. The ever-changing nature of this dynamic arena demands traders navigate its complexities with precision. And that’s where the ingenious 3 Moving Averages (40, 15, 10) strategy emerges as your guiding star.

In the realm of forex trading, moving averages smooth out price fluctuations, revealing the underlying trend. By meticulously aligning three distinct moving averages, the 40, 15, and 10, you gain an unparalleled edge in identifying market direction and executing profitable trades. This article will delve into the secrets of this remarkable strategy, empowering you to conquer the forex market.

Understanding the 3 Moving Averages Strategy

The 3 Moving Averages strategy derives its prowess by combining three distinct timeframes:

-

40-period Moving Average: This long-term average captures the overall trend, filtering out short-term market noise.

-

15-period Moving Average: Offering a medium-term perspective, this average helps identify potential trend reversals.

-

10-period Moving Average: This short-term average provides lightning-fast reactions to price movements.

By analyzing the interactions and crossovers of these three moving averages, traders gain a comprehensive view of market behavior, enabling them to make informed trading decisions.

Identifying Trade Opportunities

The 3 Moving Averages strategy offers multiple trade setups, each with its unique characteristics:

-

Trending Market: When all three moving averages align in the same direction (upward or downward), a pronounced trend is underway. Enter trades aligned with the trend direction for maximum profitability.

-

Trend Reversal: When the 10-period moving average crosses the 15-period and 40-period moving averages, a potential trend reversal is brewing. Anticipate the trend change and capitalize on the shifting momentum.

-

Overbought or Oversold: When the 10-period moving average deviates significantly from the 15- and 40-period moving averages, the market may be reaching extreme levels. Short the currency pair if overbought or buy if oversold to exploit mean reversion.

Harnessing Expert Insights

Renowned forex strategist, Benjamin Graham, advocates for thorough trend analysis using moving averages: “The most reliable way to determine the actual trend is to study the trend of earnings per share over a period of years.” By incorporating this method into your trading arsenal, you’ll enhance your understanding of long-term market behavior and make smarter decisions.

Mark Douglas, another trading virtuoso, stresses the significance of emotional control in forex trading: “The game of trading can be won only by the individual who can control his feelings and keep them under tight rein at all times.” Practicing disciplined trading strategies, like the 3 Moving Averages, will help you overcome emotional biases and trade with clarity.

Image: www.daytradetheworld.com

Forex Strategy 3 Moving Average 40 15 10

Conclusion

Mastering the 3 Moving Averages (40, 15, 10) strategy is a game-changer in the forex market. By harmonizing three distinct timeframes, you gain unparalleled insights into market direction and trading opportunities. Whether you’re a seasoned professional or a novice explorer, this strategy offers a roadmap to navigate the often-unpredictable currency landscape.

Embrace the power of the 3 Moving Averages, unlock your trading potential, and conquer the forex market. Remember, knowledge, discipline, and emotional fortitude are the keys to unlocking financial freedom.