In the ever-evolving world of financial markets, the foreign exchange market, commonly known as Forex or FX, has emerged as a colossal and dynamic arena. For individuals seeking lucrative investment opportunities or businesses looking to manage their global operations, understanding the Forex market is paramount.

Image: pl.brokersofforex.com

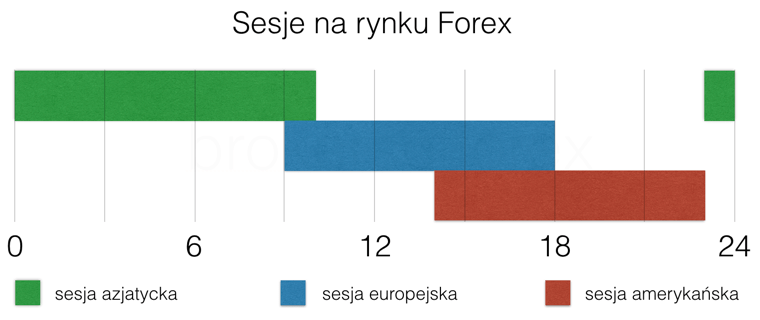

The allure of the Forex market lies in its unparalleled liquidity, making it the largest and most accessible financial marketplace in the world. Traders from all corners of the globe converge on this virtual exchange to buy, sell, and trade currencies in real-time. This continuous accessibility grants traders around-the-clock opportunities to capitalize on market fluctuations.

Delving into Forex: Concepts and Mechanisms

The Forex market operates through a decentralized network of banks, brokers, and other financial institutions connected by electronic trading platforms. Currency pairs, such as EUR/USD (Euro against the US dollar), serve as the primary trading instruments. Traders speculate on the price movements of these currency pairs, seeking to profit from differences in their relative values.

Unlike traditional stock exchanges, the Forex market lacks a central location. Instead, trades are executed over-the-counter (OTC), directly between buyers and sellers. This decentralized structure fosters a highly competitive environment, leading to tighter spreads and increased transparency.

Unveiling the Driving Forces of Forex

The Forex market is influenced by a myriad of factors, both macroeconomic and microeconomic. Interest rate decisions by central banks, economic data releases, political events, and geopolitical tensions can significantly impact currency values. Additionally, supply and demand dynamics, driven by market participants’ speculative behavior, play a crucial role in determining currency prices.

Furthermore, currency pairs exhibit varying correlations. For instance, the EUR/USD tends to move in tandem with the broader Eurozone economy, while the USD/JPY pair is often influenced by Japanese monetary policy. Understanding these correlations and interrelationships is essential for successful Forex trading.

Embracing the Advantages of Forex

Investors and businesses flock to the Forex market for its numerous advantages. High liquidity ensures that orders are executed swiftly and efficiently, minimizing slippage and maximizing trading opportunities. Moreover, the 24-hour trading cycle allows traders to capitalize on market movements around the globe.

Forex also provides unparalleled leverage, enabling traders to control a position many times larger than their initial capital. This magnification of potential returns comes with increased risk, emphasizing the importance of responsible trading practices.

Image: www.contador.pl

Navigating Risk and Achieving Success

While the Forex market presents immense opportunities, it also harbors inherent risks that traders must prudently manage. Volatile market conditions and unpredictable events can lead to significant losses if not adequately addressed.

To mitigate risk, traders employ various strategies such as setting stop-loss orders to limit potential losses, implementing risk management techniques, and practicing sound money management principles. Additionally, thorough research, technical analysis, and a deep understanding of market dynamics are crucial for maximizing returns while minimizing risk.

Forex Stał Się Popularnym Rynkiem

Conclusion: Forex – A Gateway to Financial Empowerment

The Forex market has cemented its position as a global financial powerhouse, offering unparalleled liquidity, flexibility, and profit potential. By embracing its advantages and navigating its risks responsibly, traders and businesses can harness the power of Forex to enhance their financial well-being. Whether seeking short-term speculative opportunities or long-term investment strategies, the Forex market beckons as a gateway to financial empowerment.