Introduction

As a seasoned forex trader, I’ve come to rely heavily on technical indicators to analyze market trends and make informed trading decisions. Among the many indicators at my disposal, the Relative Strength Index (RSI) has proven to be particularly valuable, especially when paired with Dynamic Zones. In this comprehensive guide, I’ll delve into the intricacies of the RSI 809 indicator, providing a detailed overview of its definition, calculation, and how it can empower traders to navigate the complexities of the forex market.

Image: www.pinterest.com

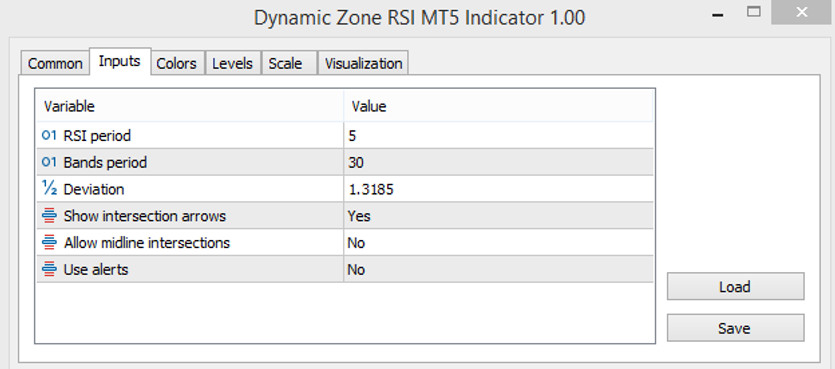

Understanding the Dynamic Zones RSI 809

The Dynamic Zones RSI 809 is a technical indicator that combines the traditional RSI with dynamic support and resistance levels, creating a powerful tool for identifying potential trading opportunities. The RSI, a momentum oscillator, measures the magnitude of recent price changes to assess whether an asset is overbought or oversold. Dynamic Zones, on the other hand, are horizontal lines that adapt to changing market conditions, providing visual cues for potential support and resistance areas.

Calculating the RSI 809

The RSI 809 is calculated using a two-step process:

- Calculate the RSI: The RSI is calculated by comparing the average gain of closing prices over a specific period (typically 14 periods, denoted as RSI 14) with the average loss of closing prices over the same period. The formula is:

RSI = 100 - [100 / (1 + (Average Gain / Average Loss))]- Add Dynamic Zones: The RSI 809 indicator overlays dynamic support and resistance levels on the RSI chart. These levels are calculated using a proprietary algorithm that considers the volatility and price action of the underlying asset.

Using the RSI 809 for Trading

The RSI 809 can provide valuable insights for both short-term and long-term traders. Here are some of its key uses:

- Identify Overbought and Oversold Conditions: The RSI 809 can help traders identify when an asset is overbought (above 70) or oversold (below 30), providing potential trading opportunities.

- Determine Support and Resistance Levels: The dynamic support and resistance levels on the RSI 809 chart can serve as valuable reference points for placing trades or setting stop-loss orders.

- Confirm Trend Direction: When the RSI 809 is moving in the same direction as the price trend, it can strengthen the confirmation of the trend. Conversely, a divergence between the RSI 809 and the price action can indicate a potential reversal.

Image: investworld.net

Expert Insights and Trading Tips

To enhance your understanding and application of the RSI 809, here are some expert insights and trading tips:

- Use RSI 809 alongside other indicators: Combining the RSI 809 with other technical indicators, such as moving averages or candlestick patterns, can provide a more comprehensive view of market conditions.

- Consider market context: Keep in mind that no indicator is foolproof, and the RSI 809 should be used in conjunction with other factors, such as news and economic data.

- Use multiple time frames: Analyzing the RSI 809 on different time frames, such as daily, weekly, and monthly charts, can provide a broader perspective on market trends.

Frequently Asked Questions

Q: What is the difference between RSI and RSI 809?

A: The RSI 809 adds dynamic support and resistance levels to the traditional RSI, providing traders with more visual cues for potential trading opportunities.

Q: Is the RSI 809 a lagging or leading indicator?

A: The RSI 809 is a lagging indicator, as it uses historical price data to calculate its values.

Q: Can the RSI 809 be used on any financial instrument?

A: Yes, the RSI 809 can be applied to any financial instrument that has a price history, including forex, stocks, and commodities.

Forex Station The Dynamic Zones Rsi 809

Conclusion

The Dynamic Zones RSI 809 is a powerful technical indicator that provides invaluable insights into the overbought and oversold conditions of an asset while also identifying potential support and resistance levels. By understanding the intricacies of this indicator and following the expert advice provided in this guide, traders can enhance their ability to make informed trading decisions and potentially achieve greater success in the forex market.

Are you ready to learn more about the Dynamic Zones RSI 809 and start implementing it in your own trading strategy? Don’t hesitate to explore additional resources or connect with experienced forex traders to further your knowledge and skills.