As an avid traveler, I’ve often encountered the dilemma of exchanging currencies at unfavorable rates that eat into my spending budget. One time, when I was purchasing souvenirs in a charming European market, I realized that the currency conversion spread was surprisingly high, reducing my purchasing power significantly.

Image: bernstein-bank.com

Unveiling the Forex Spread in Payments

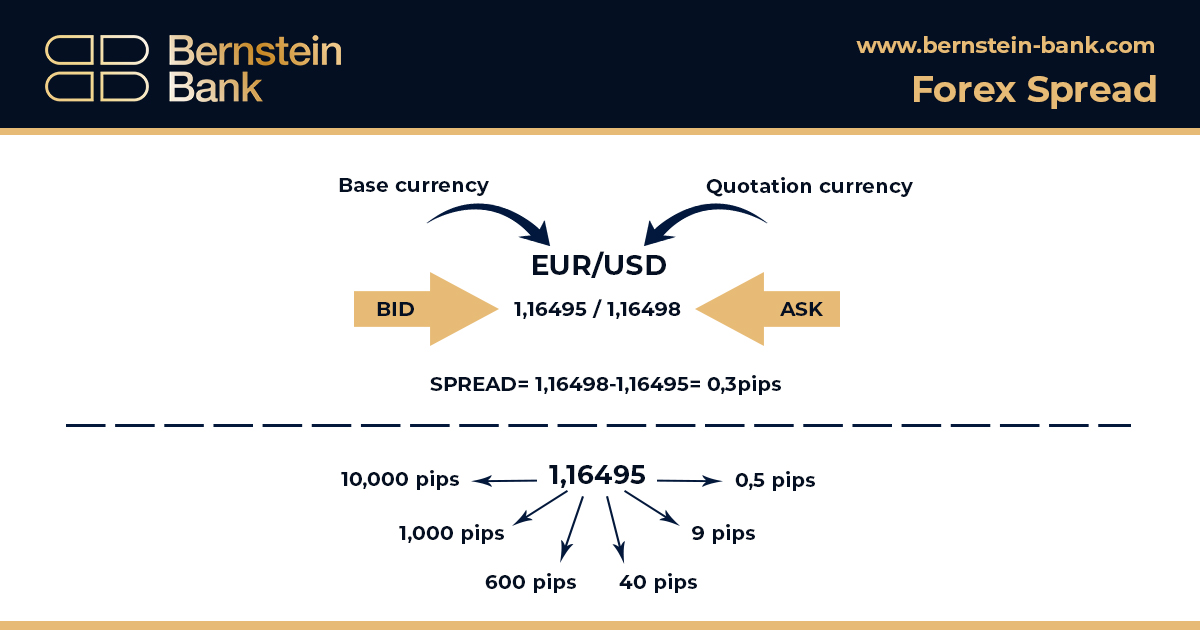

Forex spread is the difference between the buy and sell price of a currency pair, essentially a fee charged by banks or currency exchange services for converting one currency to another. This spread can vary based on market conditions, the currency pair being traded, and the payment provider involved.

Impact on Payments Switch

When making international payments or switching between currencies, forex spread can have a noticeable impact on your overall expenses. It can increase the cost of your transactions, especially if you’re dealing with large amounts of money.

Forex spread can also affect businesses that operate internationally. When receiving payments from clients abroad or making overseas purchases, businesses need to be aware of the spread to avoid unnecessary costs that can impact their profit margins.

Minimizing Forex Spread for Optimal Returns

To mitigate the impact of forex spread, it’s crucial to explore various strategies and leverage the latest trends in the industry:

- Negotiate with Providers: Engage with multiple currency exchange providers and negotiate for competitive rates and lower spreads.

- Choose Wisely: Opt for providers that offer transparent pricing, disclose their spread fees clearly, and have a proven track record of reliability.

- Use Online Tools: Utilize online currency converters and comparison tools to compare the spread charged by different providers and identify the most cost-effective option.

In addition to these tips, staying informed about the latest market trends and developments can help you make informed decisions. Forex spread can fluctuate based on economic events, political instability, or market sentiment. By monitoring these fluctuations, you can identify favorable conditions for currency exchange and lock in optimal rates.

Image: www.thaifrx.com

FAQs on Forex Spread

- Q: How can I calculate the cost of forex spread?

A: Multiply the value of your transaction by the spread, expressed as a percentage or pips (points in percentage).

- Q: Are there any hidden fees associated with forex spread?

A: Some providers may charge additional fees, such as commissions or service charges, beyond the advertised spread.

- Q: How can I minimize the impact of forex spread on my business?

A: Negotiate favorable rates with payment providers, explore currency hedging strategies, and consider using alternative payment solutions that minimize spread costs.

Forex Spread In Payments Switch

Conclusion

Forex spread is an inherent cost associated with payments switch that can impact your expenses. By understanding the dynamics of forex spread, choosing reliable providers, and employing strategies to minimize its impact, you can optimize your currency conversions, maximize your profits, and empower yourself with a competitive edge in the global marketplace.

Are you ready to take control of forex spread and unlock the full potential of your international payments?