Introduction

In the ever-evolving world of forex trading, navigating the complexities of the market can be daunting. Forex signal indicators, such as MetaTrader 4 (MT4), empower traders with valuable insights into potential market movements, enhancing their trading strategies and maximizing profitability. In this comprehensive guide, we delve into the realm of forex signal indicator MT4 settings, deciphering their intricacies to unlock the full potential of this powerful tool.

Image: www.sealtrader.com

Understanding Forex Signal Indicators

Forex signal indicators are technical analysis tools that process price data, applying mathematical formulas to generate trading signals. MT4, a renowned trading platform, offers an extensive suite of signal indicators, each serving a specific purpose. These indicators analyze price patterns, identify trends, measure volatility, and provide guidance on entry and exit points. By understanding the settings of these indicators, traders can customize them to suit their unique trading styles and market conditions.

Customized Trading with MT4 Settings

MT4 provides a customizable interface, allowing traders to tailor their indicator settings according to their preferences. These settings encompass a wide range of parameters, including:

- Period: The number of price data points used for calculations.

- Deviation: The threshold for significant price movements.

- Time: The time frame over which data is analyzed.

- Indicators: The specific indicators used for signal generation.

- Alerts: Set audio or visual alerts for specific trading signals.

Optimal settings vary based on trading strategy, time frame, and market dynamics. Experimentation and historical data analysis can help traders fine-tune their settings to maximize indicator accuracy and generate profitable trading opportunities.

Key Settings for Common Forex Indicators

-

Moving Average Convergence Divergence (MACD): Adjust the “Period” settings to match the desired trading timeframe and the volatility of the market. Fast and slow exponential moving averages should be set to complement the trader’s strategy.

-

Relative Strength Index (RSI): Calibrated using the “Period” parameter, the RSI can be adjusted to identify overbought or oversold conditions in different timeframes. Traders can experiment with different values to find the optimal sensitivity for their setups.

-

Stochastic Oscillator: By customizing the “Slow” parameter, traders can refine the oscillator’s period of calculation and suitability to the market conditions. Higher values result in smoother and less sensitive signals.

-

Bollinger Bands: Adjusting the “Period” parameter determines the width of the Bollinger Bands around the moving average. Higher values create wider bands, encompassing greater price volatility.

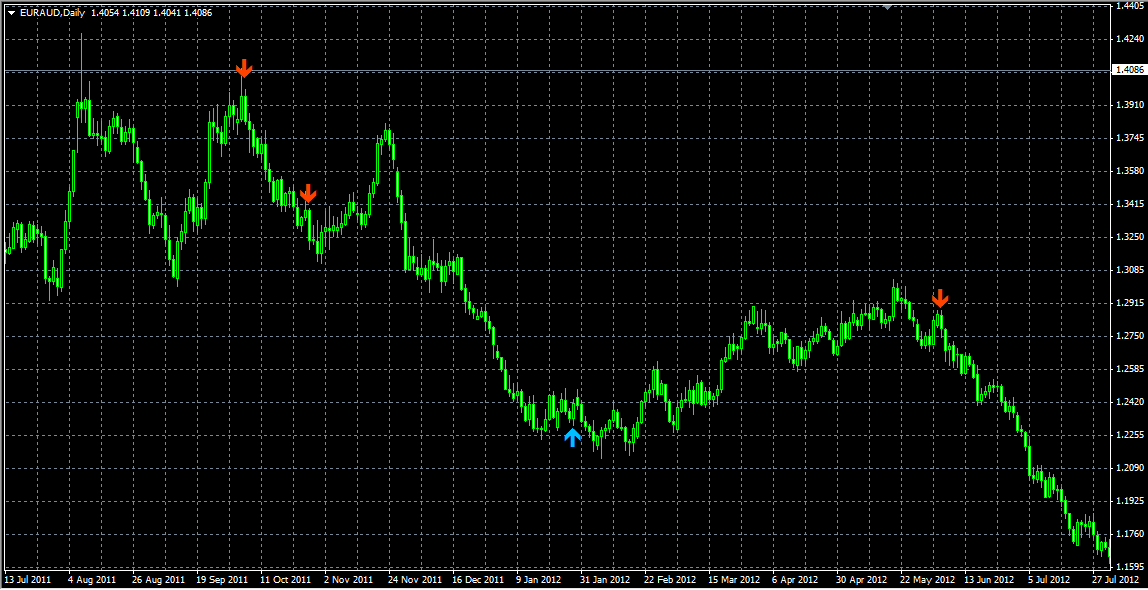

Image: forexprofitway.com

Forex Signal Indicator Mt4 Settings

Conclusion

Navigating the forex market with confidence requires traders to master the intricacies of forex signal indicator MT4 settings. Understanding the purpose of each parameter and customizing them to their unique trading styles is crucial for maximizing indicator accuracy and profitability. Through experimentation and analysis, traders can unlock the full potential of these valuable tools, empowering their decision-making and optimizing their trading strategies. By harnessing the power of forex signal indicators, traders can gain a competitive edge, increase their trading efficiency, and achieve greater financial success in the dynamic environment of forex trading.