Introduction

With the growing popularity of online forex trading, it is more important than ever to ensure that you are trading with a reputable and regulated broker. In Singapore, the Monetary Authority of Singapore (MAS) is the regulatory body responsible for overseeing the forex industry and issuing forex SGD advisory licenses. This article will provide a comprehensive guide to the forex SGD advisory license and explain the benefits of trading with a licensed broker.

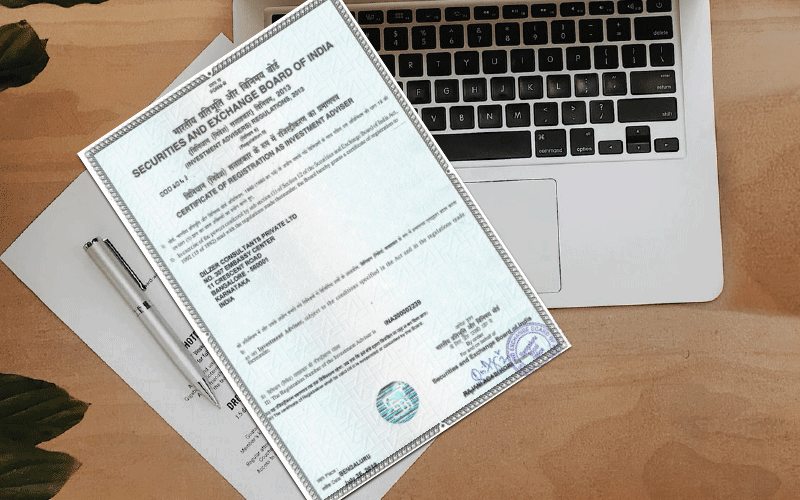

Image: dilzer.net

Forex, short for foreign exchange, refers to the trading of currencies between different countries. The forex market is the largest financial market in the world, with an average daily trading volume of over $5 trillion. Forex trading can be a lucrative way to earn profits, but it is also a risky business. That is why it is important to ensure that you are trading with a licensed and regulated broker.

What is a Forex SGD Advisory License?

A forex SGD advisory license is a license issued by the MAS to forex brokers that authorize them to provide forex advisory services in Singapore. To obtain a forex SGD advisory license, brokers must meet a number of stringent requirements, including:

- Having a physical presence in Singapore

- Maintaining a minimum capital of $2 million

- Having a team of experienced and qualified professionals

- Being subject to regular audits by the MAS

Benefits of Trading with a Licensed Broker

There are a number of benefits to trading with a forex SGD advisory licensed broker. These benefits include:

- Protection against fraud: Licensed brokers are required to follow strict rules and regulations, which helps to protect traders from fraud and scams.

- Access to a wider range of products and services: Licensed brokers typically offer a wider range of products and services than unlicensed brokers, such as access to different currency pairs, trading platforms, and research tools.

- Peace of mind: Knowing that your broker is licensed and regulated by the MAS can give you peace of mind that you are trading with a reputable and trustworthy company.

How to Choose a Licensed Forex Broker

When choosing a licensed forex broker, it is important to do your research and compare different brokers. Some factors to consider include:

- Reputation: Read online reviews and testimonials to see what other traders have to say about the broker.

- Fees and commissions: Be sure to compare the fees and commissions charged by different brokers before signing up with one.

- Trading platform: Make sure that the broker offers a trading platform that is easy to use and meets your trading needs.

- Customer support: Make sure that the broker offers good customer support in case you have any questions or problems.

Image: www.youtube.com

Forex Sgd Advisory License Like Sebi

Conclusion

If you are considering forex trading in Singapore, it is important to choose a licensed and regulated broker. A licensed forex SGD advisory broker can provide you with a number of benefits, including protection against fraud, access to a wider range of products and services, and peace of mind that you are trading with a reputable and trustworthy company.