Welcome to the World of Forex: Unlocking Currency Markets’ Secrets

Step into the captivating realm of forex trading, where currencies dance in a dynamic symphony. As a gateway to global markets, forex allows you to profit from fluctuations in exchange rates, making it a lucrative and thrilling endeavor. Whether you’re a seasoned trader or a curious novice, this comprehensive guide will equip you with the essential knowledge to navigate the ever-evolving forex landscape.

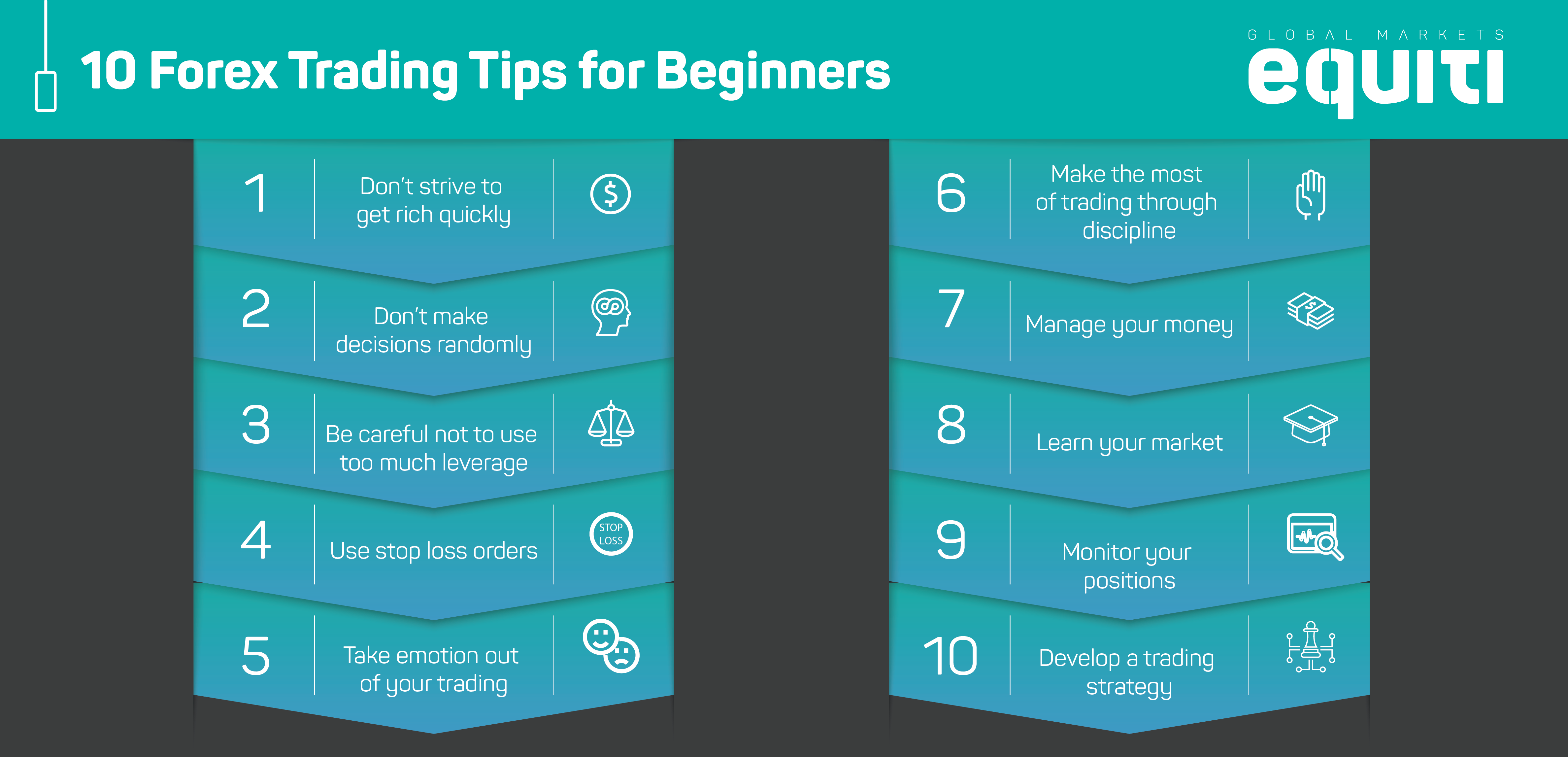

Image: www1.equiti.com

Understanding the Forex Basics: A Currency Crash Course

Forex, short for foreign exchange, is the trading of one currency against another. Unlike stock or bond markets, forex involves no physical exchange of currencies but rather the exchange of contracts that represent the value of one currency in relation to another. With over 170 currencies actively traded worldwide, the forex market boasts unparalleled liquidity and an average daily trading volume exceeding $6.6 trillion.

Deciphering Currency Pairs: The Language of Forex

The forex market operates in pairs, with one currency always quoted in relation to another. The first currency listed in a pair is the base currency, while the second is the quote currency. For instance, the EUR/USD pair represents the exchange rate of one Euro (base currency) to U.S. Dollars (quote currency).

Market Participants: Who’s Who in Forex?

The forex market is a vast ecosystem teeming with diverse participants, each influencing exchange rates in their unique way. Major banks and financial institutions dominate the market, while hedge funds and retail traders also play significant roles. Central banks, with their mandate to manage inflation and monetary policy, wield considerable influence on currency markets.

Image: www.youtube.com

Types of Forex Orders: Mastering Execution Strategies

Traders employ various order types to enter and exit the forex market, adapting to different market conditions. Market orders execute trades at the current prevailing market price, while limit orders specify the desired price at which an order should be filled. Stop-loss orders protect against potential losses by automatically closing trades when a certain price level is reached.

Technical Analysis: Unraveling Market Patterns

Technical analysts scrutinize historical price data to identify patterns and trends that may guide future price movements. They use a range of indicators, including moving averages, support and resistance levels, and candlestick patterns, to make informed trading decisions and anticipate potential reversals.

Fundamental Analysis: Delving into Economic Factors

Fundamental analysts delve into economic data and global events to assess their potential impact on currency values. Economic indicators like GDP growth, inflation rates, and interest rate decisions play a crucial role in shaping exchange rates. By understanding the underlying economic fundamentals, traders can gain a deeper insight into currency market dynamics.

Risk Management: The Cornerstone of Successful Trading

In the dynamic world of forex, risk management is paramount to preserve capital and safeguard against potential losses. Traders employ risk-to-reward ratios and stop-loss orders to limit potential losses while maximizing profit opportunities. Money management techniques ensure that traders allocate capital judiciously, preventing emotional decision-making and promoting long-term success.

Overcoming Common Trading Mistakes: Lessons from the Trenches

Navigating the forex market can be fraught with challenges, but learning from common trading mistakes can pave the way to consistent profitability. Overtrading, disregarding risk management, and succumbing to emotional bias are pitfalls that can sabotage trading success. Understanding and avoiding these mistakes will equip you with a solid foundation for informed decision-making.

Forex Set By Step Topics To Talk About

Conclusion: Empowering Your Forex Trading Journey

Embark on your forex trading adventure with confidence, armed with the knowledge and strategies outlined in this comprehensive guide. Remember, consistent success in forex requires dedication, patience, and an unwavering commitment to learning and adapting. As you master the nuances of this dynamic market, you’ll not only unlock profit opportunities but also gain a profound understanding of global economics. So, prepare to navigate the ever-evolving forex landscape and reap the rewards of financial empowerment.