Prepare to be outraged as we delve into the depths of the forex scandal that rocked the financial world. A web of deception and manipulation was orchestrated by unscrupulous individuals, seeking to profit at the expense of unsuspecting traders. Brace yourself for the unsettling details of this financial travesty.

Image: www.bbc.com

A Corrupted System: The Mechanics of Fraud

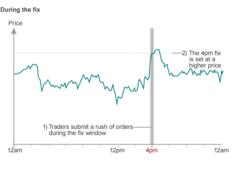

The forex market, where currencies are traded globally, became a breeding ground for illicit activities. Shady brokers and rogue traders employed sophisticated techniques to manipulate exchange rates and rig the system in their favor. They traded in “packs,” placing orders that artificially inflated or deflated the value of certain currencies.

The manipulation reached unprecedented levels as rogue participants forged alliances, manipulating supply and demand to drive prices to predetermined levels. Altering order patterns, flooding the market with false trades, and even accessing confidential bank information were among the tactics used to exploit the system.

Caught in the Crosshairs: Victims of Manipulation

The victims of this scandal extended beyond the traders who lost their hard-earned money. Financial institutions, pension funds, and ordinary investors were also caught in the crossfire of this financial storm. Trust in the forex market plummeted as it became evident that the system was rigged against legitimate participants.

In one particularly egregious case, a group of traders artificially inflated the value of a particular currency, leading to a rise in its price. Unsuspecting investors, lured by the seemingly strong currency, poured their funds into it, only to watch as the value plummeted when the manipulation was uncovered. Millions of dollars were lost in an instant.

Shadowy Figures: Behind the Scenes of Deception

At the heart of this scandal were a network of shady brokers and traders who operated in the shadows. Some had connections to offshore banks or shell companies, enabling them to launder ill-gotten gains. Greed and a reckless disregard for ethical conduct fueled their actions.

They exploited loopholes in the regulatory framework and brazenly engaged in insider trading, using advanced algorithms and software to gain an unfair advantage over their unsuspecting counterparts.

Image: www.bbc.com

Exposed: The Damning Evidence

The extent of the manipulation was finally exposed through painstaking investigations by financial regulators around the world. Emails, trading records, and other incriminating evidence revealed the shocking scope of the fraud.

Legal authorities cracked down on the perpetrators, leading to criminal charges and hefty fines. The scandal had a profound impact on the forex industry, prompting a re-examination of regulatory practices and a renewed focus on protecting investors from such malfeasance.

Lessons Learned: Regulating the Untamed

The forex scandal served as a stark reminder of the importance of robust regulation in the financial sector. Governments and regulatory bodies around the globe implemented stricter measures to prevent future manipulations and safeguard the integrity of the markets.

Transparency emerged as a key factor in restoring trust. Regulators demanded more stringent reporting and disclosure from forex brokers, giving traders a clearer view of market activities and reducing the opportunities for manipulation.

Call to Arms: Protecting the Innocent

The fight against forex fraud is an ongoing battle that requires vigilance and collaboration. Traders must educate themselves and be wary of suspicious activities. Regulatory bodies must continue to strengthen oversight and swiftly prosecute those who break the law.

Together, we can create a fair and transparent forex market where the hard-earned money of ordinary individuals and institutions is protected from the greed and dishonesty of unscrupulous actors.

Forex Scandal How To Rig The Market

Conclusion

The forex scandal remains a disturbing chapter in the history of financial markets. It exposed the dark underbelly of fraud and manipulation, leaving countless victims in its wake. However, it also served as a catalyst for change, leading to stricter regulations and a renewed commitment to protecting investors.

As we move forward, it is crucial to remember the lessons learned from this scandal and remain vigilant against those who seek to rig the system for their own gain. By working together, we can ensure that the forex market operates with integrity and justice, benefiting all participants in a fair and equitable manner.