Unveiling the Interplay of Economic Forces that Shape Their Dance

In the labyrinthine world of global finance, currencies play a pivotal role, dictating the flow of trade, investments, and economic growth. Among these financial titans, the Indian Rupee and the Euro stand out as prominent players, their interplay shaping the landscape of international transactions. Today, their exchange rates reverberate with implications for businesses, travelers, and investors alike. Join us as we embark on an illuminating journey, delving into the captivating dance of forex rupee vs euro today.

Image: irudivupic.web.fc2.com

Understanding the Ebb and Flow of Currency Exchange

To unravel the complexities of currency exchange, we must first delve into the concept of forex. Forex, short for foreign exchange, refers to the global marketplace where currencies are traded. This interconnected realm facilitates seamless transactions across borders, allowing businesses to import and export goods, travelers to explore the world, and investors to seek opportunities abroad.

Within this dynamic market, exchange rates fluctuate continuously, influenced by a myriad of economic forces. These forces, akin to invisible puppeteers, tug at the strings of currency values, causing them to rise or fall in tandem with supply and demand. As the demand for a currency increases, its value tends to appreciate, while a decrease in demand typically leads to depreciation.

The Rupee’s Resilience Amidst Global Turmoil

The Indian Rupee, a symbol of India’s economic prowess, has weathered myriad challenges over the years. Its stability, in the face of global economic upheavals, has been a testament to the resilience of India’s financial system. Today, the Rupee stands as a respected player in the forex market, its value closely tied to the nation’s economic fundamentals.

India’s robust economic growth, driven by a burgeoning middle class and increasing foreign direct investment, has acted as a bulwark against external shocks. Furthermore, the Reserve Bank of India (RBI), the country’s central bank, has played a crucial role in managing the Rupee’s volatility through prudent monetary policies and timely interventions.

The Euro: A Tower of Strength Amidst Changing Tides

The Euro, a formidable force in the global currency arena, reigns supreme as the official currency of the Eurozone, a collective of 19 European nations. Its inception in 1999 marked a significant milestone in European economic integration, fostering seamless trade and bolstering cross-border investments within the region.

Anchored by the economic might of its member nations, the Euro has withstood numerous storms over the years, emerging stronger from each encounter. Its stability and global acceptance have made it a safe haven for investors seeking refuge from market volatility.

Image: www.financebrokerage.com

Forex Rupee vs Euro: A Tale of Interdependence

The forex rupee vs euro exchange rate serves as a barometer of the economic interplay between India and the Eurozone. Strong economic conditions in either region tend to boost demand for their respective currencies, leading to appreciation. Weaker economic performance, on the other hand, can diminish demand and result in depreciation. Political developments, interest rate decisions, and global economic events also play a role in shaping their exchange rate dynamics.

Implication for Businesses, Travelers, and Investors

Fluctuations in the forex rupee vs euro exchange rate have tangible implications for businesses, travelers, and investors engaged in cross-border transactions. A favorable exchange rate can provide a competitive advantage to businesses importing from or exporting to the Eurozone. Travelers may find their purchasing power enhanced or diminished depending on the exchange rate dynamics. Similarly, investors seeking opportunities in either region must carefully consider the potential currency fluctuations.

Making the Most of Currency Movements

Navigating the complexities of forex rupee vs euro exchange rates requires a keen understanding of economic fundamentals and market trends. Businesses involved in cross-border trade can employ hedging strategies to mitigate currency risks. Travelers should stay informed about exchange rate movements to plan their expenses accordingly. Investors can diversify their portfolios across multiple currencies to reduce exposure to exchange rate volatility.

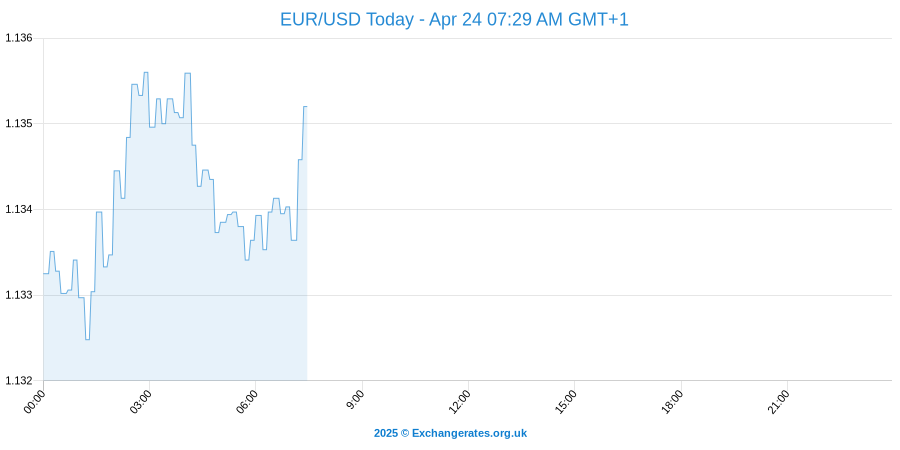

Forex Rupee Vs Euro Today

Empowerment through Information

Knowledge is power, especially when navigating the ever-evolving landscape of currency exchange. By equipping ourselves with a comprehensive understanding of the forex rupee vs euro dynamics, we empower ourselves to make informed decisions, harness market opportunities, and mitigate potential risks.