Mastering the Forex Maze: Crafting a Risk Management Policy That Protects Your Profits

Image: learnpriceaction.com

In the tumultuous tapestry of the forex market, where fortunes are won and lost in an instant, having a robust risk management policy is not merely an option; it’s an absolute necessity. Like a navigational beacon in a storm-tossed sea, a well-defined risk management framework will guide you through the treacherous currents and turbulent tides, ensuring you emerge victorious from the financial battleground.

Decoding the Codex of Risk Management

A risk management policy is a comprehensive blueprint that outlines a set of predefined parameters, guiding your trading decisions to mitigate potential losses and safeguard your precious capital. It encompasses essential elements such as position sizing, leverage management, and stop-loss placement, providing a structured approach to navigate the inherent risks associated with currency trading.

The Pillars of an Unwavering Strategy

-

Position Sizing: Determining the optimal contract size to trade, based on your account balance, risk appetite, and trading strategy. By aligning position size with your financial capabilities, you minimize the potential for catastrophic losses.

-

Leverage Management: Wisely wielding leverage is akin to handling a double-edged sword. While it can magnify profits, it can also amplify losses. By employing prudent leverage management techniques, you strike a delicate balance between increasing potential returns and limiting risk exposure.

-

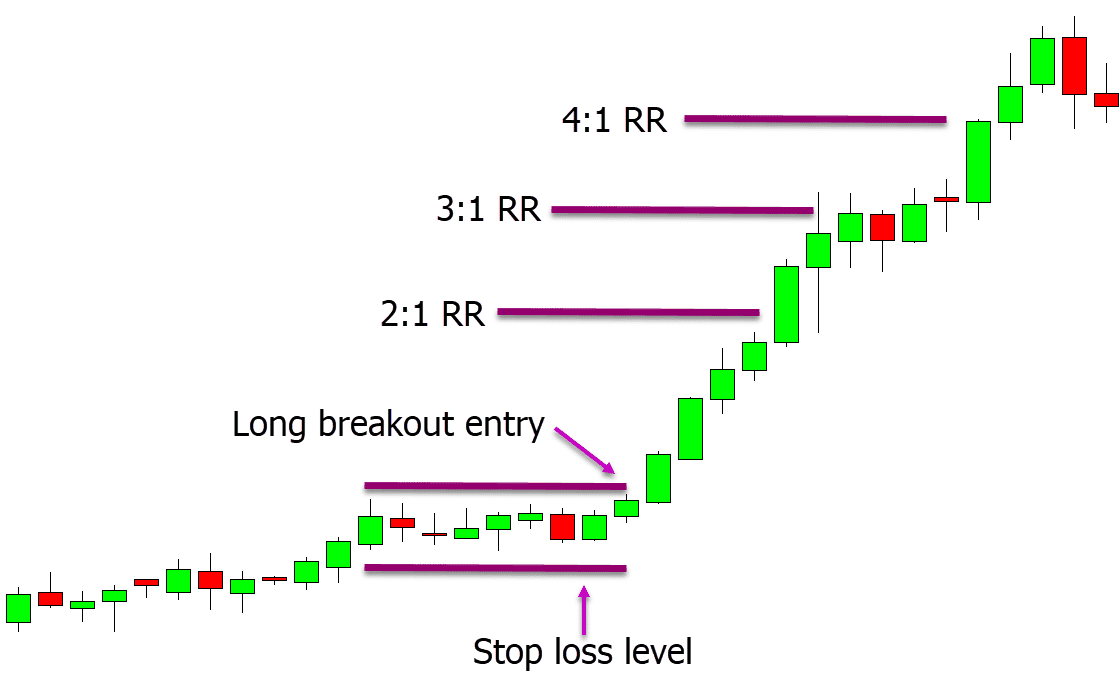

Stop-Loss Placement: They are your trading battlefield’s impenetrable walls. Stop-loss orders automatically close your positions when prices reach predefined levels, safeguarding you from runaway losses. Strategically placing stop-loss levels ensures you exit trades at predetermined points, managing risk and preserving capital.

The Guiding Light of Experts

“Risk management is the cornerstone of successful trading, a guiding compass in the turbulent forex ocean,” says renowned trader Mark Douglas. By incorporating expert insights, you can distill years of wisdom and experience into your own trading approach, enhancing your ability to navigate the market’s unpredictable currents.

A Call to Action

Embrace the power of a comprehensive risk management policy. By implementing these time-honored principles, you transform yourself from a speculative gambler into a disciplined trader. Protect your hard-earned capital, navigate the forex market with confidence, and set sail towards financial freedom. Remember, risk management is not a burden but a liberating shield, allowing you to trade with peace of mind and pursue your financial dreams with unwavering determination.

Image: www.sampletemplates.com

Forex Risk Management Policy Sample