Headline: Navigating the Currency Convergence: India’s and China’s Forex Reserves on the Frontlines

Image: www.chinadaily.com.cn

Engaging Introduction:

In the dynamic tapestry of global economics, forex reserves play a pivotal role in shaping the destiny of nations. As two of the world’s leading economies, India and China have long been at the forefront of this financial chess game. With their bulging forex reserves, they wield formidable power in the currency markets, and their actions can have far-reaching consequences on the global stage.

This in-depth analysis will delve into the fascinating world of forex reserves, examining the strategies and motivations that guide India and China in accumulating these colossal sums. We’ll explore the impact of their forex reserves on their economies, the complexities of international currency dynamics, and the potential for intensified competition between these two Asian giants in the years to come.

Deep Dive into India’s and China’s Forex Reserves:

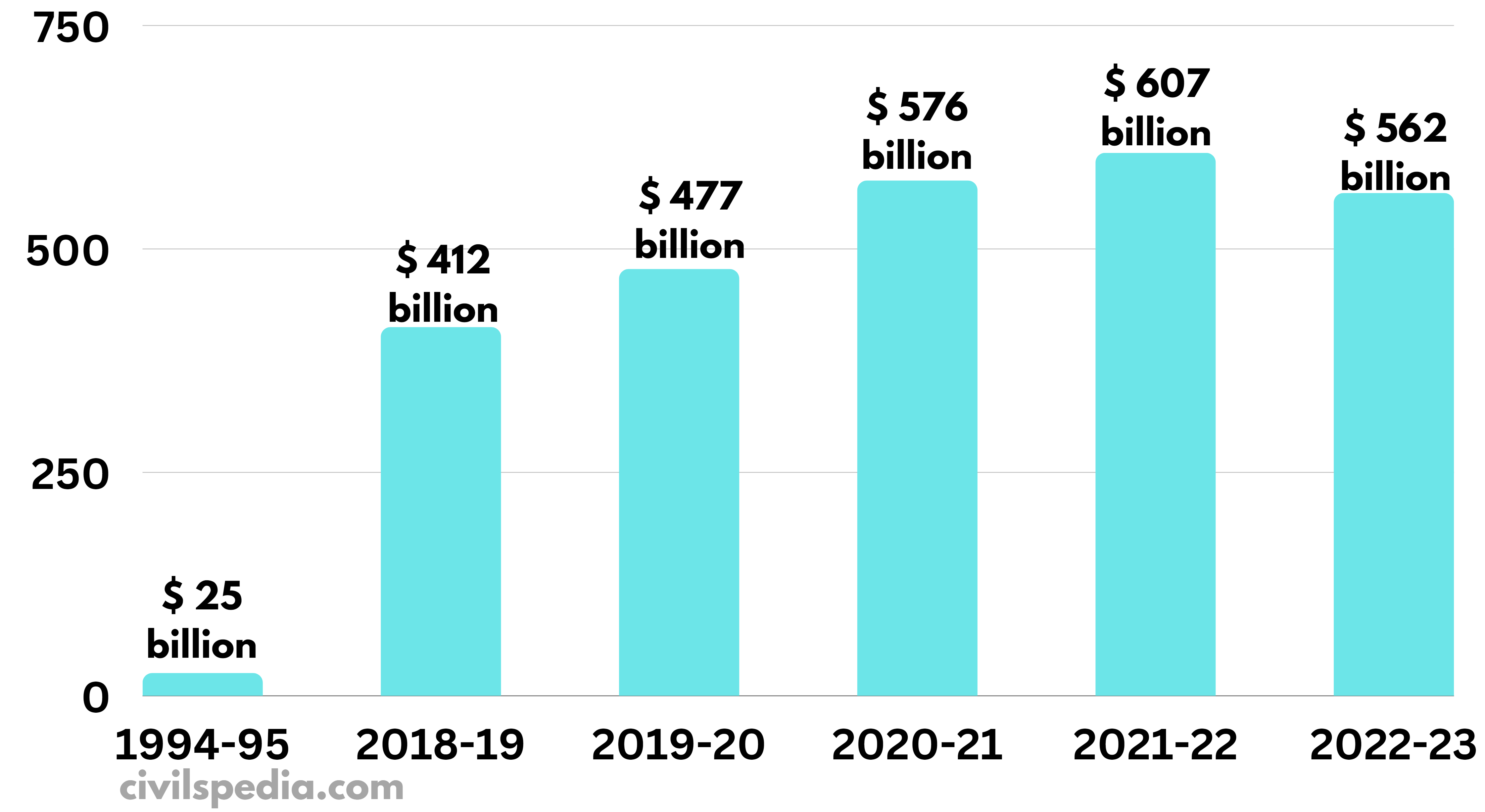

India’s forex reserves have soared to a record high of over USD 600 billion, making it the fifth-largest forex reserve holder globally. This massive stockpile represents a significant achievement for an economy that was grappling with a balance of payments crisis just a few decades ago. The reasons behind India’s forex accumulation are multifaceted.

Firstly, India has pursued a cautious approach to international trade. By keeping imports under control and encouraging exports, it has generated a trade surplus, which has been a major contributor to its forex reserves. Secondly, India has attracted significant inflows of foreign direct investment (FDI) and remittances from overseas workers, boosting its foreign exchange earnings.

China, on the other hand, holds the world’s largest forex reserves, exceeding USD 3 trillion. This staggering sum reflects China’s export-oriented economic strategy, which has generated substantial surpluses in its trade accounts. Moreover, China has implemented strict capital controls, limiting the outflow of foreign funds from the country.

While both India and China have benefited from their large forex reserves, there are inherent challenges as well. Managing such vast sums requires prudent investment strategies, and the risk of exchange rate fluctuations can be a double-edged sword.

Expert Insights and Actionable Tips:

According to Dr. Raghuram Rajan, former Governor of the Reserve Bank of India, “Forex reserves provide a cushion against external shocks and help maintain macroeconomic stability.” He advises countries to diversify their forex reserves across different currencies and currencies to mitigate risks.

Professor Shang-Jin Wei of Tsinghua University cautions that “Excessive accumulation of forex reserves can lead to complacency and distort domestic economic policies.” He urges policymakers to use forex reserves judiciously to support sustainable economic growth and reduce external vulnerabilities.

Compelling Conclusion:

India and China’s forex reserves are a testament to their economic prowess and strategic planning. However, the size of their reserves is not a panacea for economic challenges. Effective management, prudent investment, and a balanced approach to international trade are crucial to reap the full benefits of these financial assets.

As the global economy continues to evolve, the dynamics between India and China’s forex reserves will continue to captivate financial analysts and policymakers alike. The path they forge will undoubtedly shape the contours of currency markets in the years to come.

Image: civilspedia.com

Forex Reseve India Vs China