Introduction:

In the dynamic landscape of global finance, foreign exchange reserves hold paramount importance for nations seeking economic stability and financial resilience. India, a rising economic powerhouse, has diligently amassed a substantial stockpile of foreign exchange reserves, playing a pivotal role in the country’s economic development and safeguarding its financial well-being. This article delves into the multifaceted significance of India’s forex reserves, highlighting its critical functions and exploring the broader implications for the nation’s economic growth.

Image: www.theindianwire.com

Understanding Forex Reserves: A Primer:

Foreign exchange reserves, often referred to as forex reserves, represent a country’s holdings of various foreign currencies, gold, and other monetary assets. These reserves serve as a vital buffer against external financial shocks, enabling a nation to meet its international payment obligations, such as imports, external debt servicing, and repatriation of profits by foreign investors. India’s forex reserves primarily comprise assets denominated in U.S. dollars, followed by other major currencies like the Euro, British Pound, and Japanese Yen.

Key Functions of Forex Reserves:

India’s forex reserves perform several indispensable functions that contribute to the country’s economic stability and growth prospects:

1. Ensuring Import Coverage: Forex reserves provide a crucial cushion for India’s import requirements. The nation relies heavily on imports of essential commodities such as oil, machinery, and raw materials. Ample forex reserves allow India to meet these import payments without disruptions, ensuring the uninterrupted supply of critical goods and services for its population and industries.

2. Currency Stabilization: India’s forex reserves serve as a stabilizing force in the foreign exchange market. By intervening in the currency market, the Reserve Bank of India (RBI) can influence the value of the Indian Rupee against other currencies. This ability enables the RBI to moderate excessive fluctuations in the exchange rate, preventing sharp depreciations that could harm the economy.

3. External Debt Management: India’s forex reserves play a pivotal role in managing the country’s external debt obligations. By maintaining sufficient reserves, India can confidently meet its international debt repayment commitments, bolstering investor confidence and enhancing the nation’s creditworthiness in the global financial markets.

4. Maintaining Financial Confidence: Substantial forex reserves foster confidence among foreign investors, signaling India’s financial strength and ability to withstand economic shocks. This confidence attracts foreign direct investment (FDI) and portfolio investments, providing a vital source of capital for India’s economic growth.

Impact on Economic Development:

India’s ample forex reserves have a profound impact on the nation’s broader economic development:

1. Facilitating Trade and Investment: Forex reserves enable India to engage in global trade and investment activities with ease. They provide a buffer against currency fluctuations, reducing uncertainty and promoting cross-border transactions. Foreign investors are attracted to India’s robust forex reserves, which signifies the country’s financial stability and economic resilience.

2. Supporting Economic Growth: Forex reserves contribute to economic growth by providing a stable macroeconomic environment. By mitigating external financial risks, they bolster investor confidence, attract capital inflows, and foster economic expansion.

3. Inflation Control: Ample forex reserves enable the RBI to absorb excess liquidity from the financial system, helping to control inflation. Forex reserves provide the flexibility to manage monetary policy effectively, maintaining price stability and protecting the purchasing power of Indian citizens.

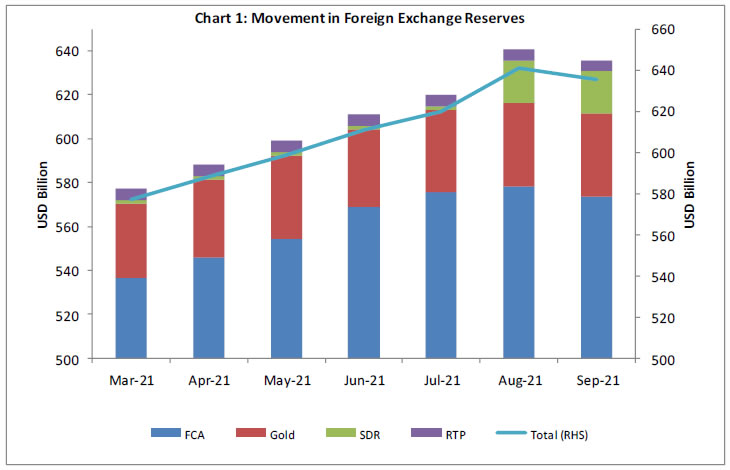

Image: www.rbi.org.in

Forex Reserves Of India Comment

Conclusion:

India’s foreign exchange reserves are a cornerstone of the nation’s economic resilience and financial stability. They play a multifaceted role in ensuring import coverage, stabilizing the currency, managing external debt, maintaining financial confidence, and facilitating economic growth. By diligently accumulating and managing its forex reserves, India has positioned itself as a credible and attractive destination for global trade and investment. As the nation continues to grow economically, its forex reserves will continue to serve as a critical lifeline, safeguarding the country’s financial well-being and fueling its onward march toward prosperity.