Introduction

Managing foreign exchange reserves is a crucial aspect of any nation’s economic stability and financial resilience. India, with its burgeoning economy, has witnessed a remarkable trajectory in its forex reserves over the past decade. This article aims to unravel the nuances of India’s forex reserves from 2014 to 2018, exploring its evolution, composition, and implications for the Indian economy.

Image: www.reuters.com

Understanding Forex Reserves

Foreign exchange reserves refer to the stockpile of foreign currencies, gold, and other reserve assets held by a country’s central bank. These assets play a multifaceted role in international finance, including:

- Maintaining exchange rate stability

- Facilitating international trade and payments

- Providing a buffer against economic shocks

India’s Forex Reserves: An Overview from 2014 to 2018

India’s forex reserves have grown steadily over the years, reaching remarkable heights from 2014 to 2018. A key factor contributing to this growth was the country’s robust economic performance during this period, characterized by high foreign direct investment inflows and a stable current account balance.

As of March 2014, India’s forex reserves stood at $292.3 billion. By March 2017, they had surged to a record high of $426.0 billion, representing an increase of over 45%. This robust growth continued until June 2018, when the reserves touched an all-time high of $430.9 billion.

Composition of Forex Reserves

The Reserve Bank of India (RBI), the apex monetary authority in India, manages the country’s forex reserves. The composition of these reserves has remained relatively stable over the years, with the majority comprising foreign currency assets. As of June 2018, foreign currency assets accounted for approximately 90% of India’s forex reserves.

Gold and special drawing rights (SDRs) constitute the other major components of India’s forex reserves. Gold reserves provide a hedge against currency fluctuations and serve as a traditional store of value. India’s gold reserves gradually rose from 557.7 tonnes in March 2014 to 569.1 tonnes in June 2018.

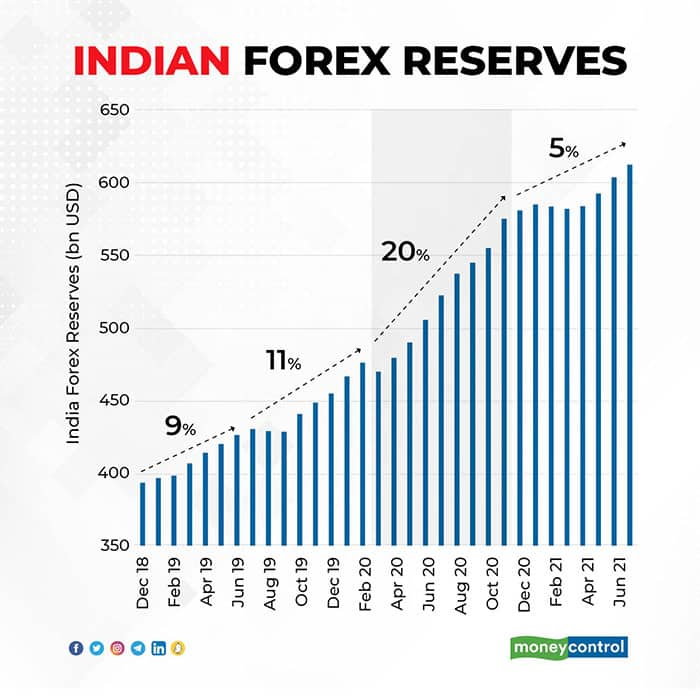

Image: www.moneycontrol.com

Determinants of Forex Reserves in India

Numerous factors influence the level of forex reserves in India. Some of the key determinants include:

- Foreign Direct Investment: Inflows of foreign capital through foreign direct investment (FDI) contribute significantly to India’s forex reserves.

- Foreign Exchange Earnings: Income earned through exports of goods and services adds to foreign currency reserves.

- Remittances: Inflows of foreign exchange from Indian citizens working abroad also bolster India’s forex reserves.

- Intervention: The Reserve Bank of India may intervene in the foreign exchange market to manage the exchange rate, which can affect the size of forex reserves.

Significance of Forex Reserves

Forex reserves serve as an important cushion for the Indian economy, providing numerous benefits:

- Exchange Rate Stability: Ample forex reserves allow the RBI to intervene in the foreign exchange market, thereby influencing the value of the Indian rupee and maintaining its stability.

- Import Cover: Forex reserves provide a safeguard against fluctuations in import prices, assuring the availability of essential goods for the economy.

- Mitigating External Shocks: Adequate forex reserves enhance India’s ability to withstand external shocks, such as global financial crises or disruptions in international trade.

- Confidence Builder: Ample forex reserves boost investor confidence in India’s financial strength and resilience.

Forex Reserves Of India 2014 To 2018

Conclusion

India’s forex reserves witnessed a remarkable growth trajectory from 2014 to 2018, mirroring the country’s strong economic fundamentals. This growth has provided India with a robust buffer against external shocks, contributing to its overall economic growth and global competitiveness. As India continues to navigate the complexities of the international economic landscape, the management of forex reserves will remain paramount for maintaining financial stability and fostering sustainable growth.