A Comprehensive Guide to Understanding FOREX Reserves and Their Impact on Global Commerce

In today’s interconnected world, international trade forms the backbone of global economies. The smooth flow of goods and services across borders enables nations to access specialized products, expand markets, and foster economic growth. However, this intricate network relies heavily on a critical element: foreign exchange (forex) reserves.

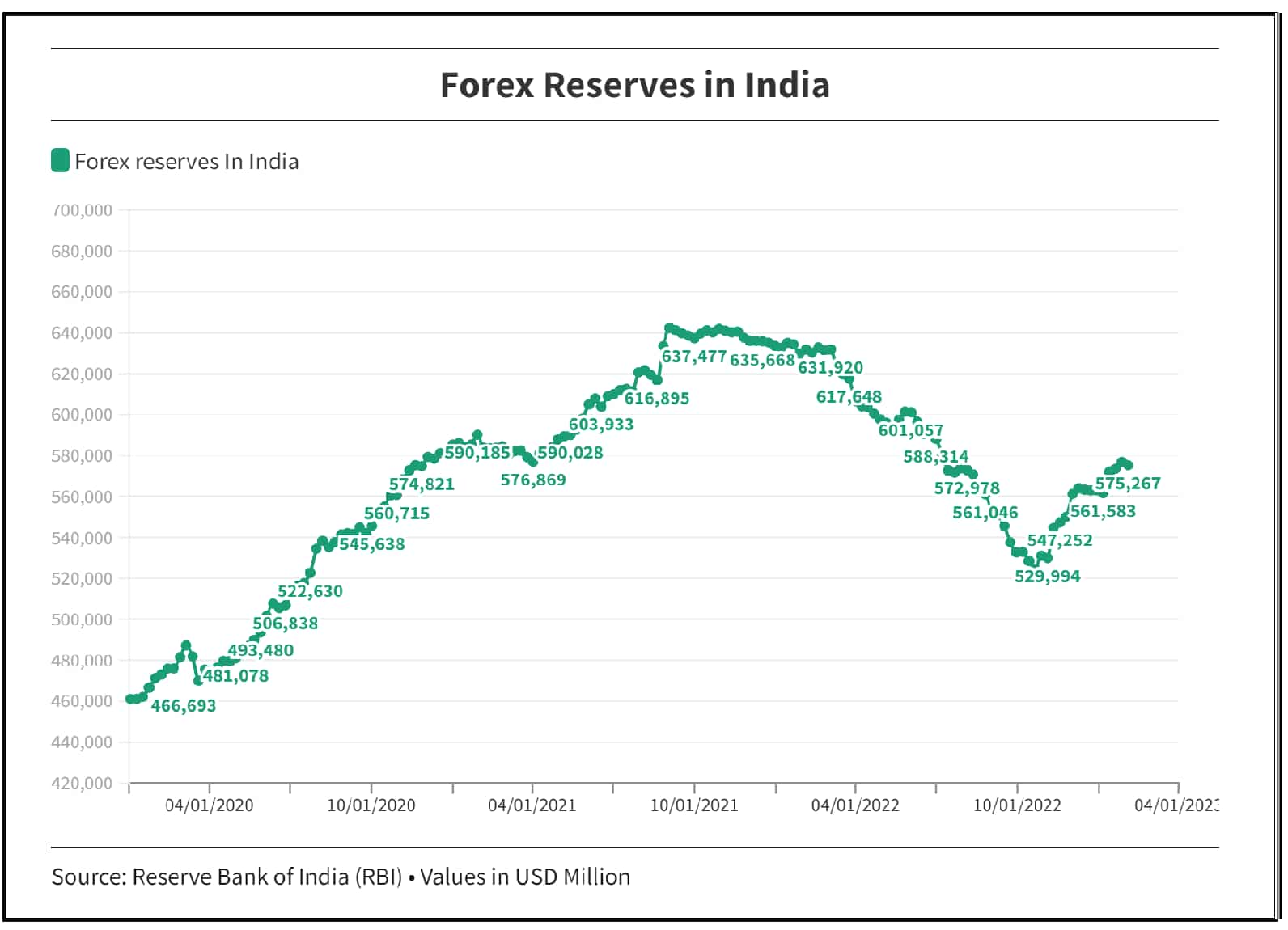

Image: economynext.com

Forex reserves are the store of various foreign currencies and other assets held by central banks and monetary authorities of a country. These reserves are primarily used to facilitate international payments, support the stability of domestic currencies, and finance imports. In this comprehensive guide, we delve into the complexities of forex reserves, examining their significance in foreign trade and highlighting their role in promoting global economic stability.

Understanding Forex Reserves: A Cornerstone of International Finance

Foreign exchange reserves are the cornerstone of a country’s international financial system. They consist of currencies of other countries, special drawing rights (SDRs), gold, and other assets readily convertible into widely accepted currencies. Central banks and monetary authorities meticulously manage these reserves, striving to maintain a diversified portfolio that balances risk and liquidity.

The primary function of forex reserves is to facilitate international payments. When a country imports more than it exports, it needs to use its forex reserves to settle the resulting trade deficit. Conversely, countries with trade surpluses can accumulate forex reserves as payment for their exported goods and services.

Forex Reserves and Currency Stability: A Delicate Balance

Forex reserves also play a pivotal role in maintaining the stability of a country’s domestic currency. Central banks can intervene in the foreign exchange market, buying or selling their own currency, to influence its value. By increasing or decreasing the supply of domestic currency, central banks can control fluctuations and prevent sharp depreciations or appreciations. Stable currencies promote a favorable investment climate, encourage economic growth, and protect the value of domestic savings.

Financing Imports: The Lifeline of Global Trade

Imports are indispensable for countries to access goods and services that are either not produced domestically or are available at more competitive prices elsewhere. Forex reserves act as the financial backbone for financing these imports. When a country imports goods, the importer must pay the supplier in a foreign currency. The necessary foreign currency is drawn from the country’s forex reserves, ensuring the smooth flow of imports and preventing disruptions to critical supply chains.

Image: www.zeebiz.com

Ensuring Financial Resilience: A Buffer against Economic Shocks

In times of economic turmoil or financial crises, having substantial forex reserves provides a vital buffer. Countries with strong forex reserves can defend their currency from speculative attacks and maintain market confidence. These reserves enable countries to meet their financial obligations, repay foreign debts, and implement policies to mitigate economic downturns. Strong forex reserves bolster a country’s overall financial resilience and help it weather economic storms.

Integration and Growth: The Interconnectedness of Global Trade

Forex reserves play a crucial role in promoting global trade integration and fostering economic growth. They facilitate the exchange of goods and services between countries, enabling businesses to expand their markets and consumers to access a wider range of products. By reducing currency risks and ensuring payment settlement, forex reserves pave the way for increased international trade and economic interconnectedness.

Forex Reserves And Foreign Trade

Conclusion: The Cornerstone of Global Economic Stability and Progress

Foreign exchange reserves are not merely financial statistics but rather the lifeblood of international trade and global economic stability. They enable countries to engage in trade, ensure currency stability, and weather economic shocks. By maintaining adequate forex reserves, central banks and monetary authorities foster a favorable investment climate, promote economic growth, and protect the value of domestic savings. As the world becomes increasingly interconnected, the significance of forex reserves in supporting global trade and economic prosperity will only continue to grow.