Introduction

Image: www.zeebiz.com

In a remarkable testament to India’s economic resilience, the country’s foreign exchange reserves (forex reserves) have reached an unprecedented peak of $230 billion. This extraordinary milestone represents a significant increase of $6 billion since last week and is a resounding affirmation of the nation’s vibrant economy and prudent financial management.

Understanding Forex Reserves

Forex reserves refer to the assets held by a nation’s central bank in foreign exchange markets. These assets include currencies, bonds, and other liquid investments denominated in foreign currencies. Forex reserves play a crucial role in maintaining a stable exchange rate, cushioning external shocks, and facilitating international trade.

Historical Context

India’s forex reserves have grown steadily in recent years, mirroring the nation’s strong economic growth and robust exports. This steady accumulation has provided India with significant financial buffers to withstand external economic challenges and has bolstered the Rupee’s resilience against global fluctuations.

Factors Contributing to the Forex Reserve Rise

Several factors have contributed to this historic surge in India’s forex reserves:

-

Foreign Direct Investment (FDI): India has witnessed a surge in FDI inflows, particularly in sectors like technology, manufacturing, and infrastructure. These investments have boosted the supply of foreign exchange in the country.

-

Export Growth: India’s exports have performed exceptionally well, driven by rising global demand and the government’s export promotion initiatives.

-

Reserve Bank of India (RBI) Interventions: The RBI has implemented measures to manage the fluctuations in foreign exchange markets and enhance the stability of the Rupee. These interventions have added to India’s forex reserves.

Benefits for the Indian Economy

The strong forex reserves offer a range of benefits to the Indian economy:

-

Reduced Risk of Economic Downturns: Ample forex reserves provide a cushion against external economic shocks, such as oil price volatility or global financial crises.

-

Exchange Rate Stability: Forex reserves help the RBI stabilize the Rupee’s value against foreign currencies, preventing sharp fluctuations that could harm businesses and consumers.

-

Access to International Credit: High forex reserves enhance India’s creditworthiness in the global financial markets, allowing the nation to access funds at favorable rates.

-

Economic Growth: Forex reserves indirectly support economic growth by facilitating international trade and attracting foreign investment.

Recognition and Appreciation

India’s economic policymakers, including the Finance Minister and the RBI Governor, have commended the significant achievement of $230 billion forex reserves. They have recognized the role of sound economic policies, prudent financial management, and the resilience of the Indian economy in contributing to this milestone.

Expert Insights

Economists and financial experts laud this surge in forex reserves as a testament to India’s strong economic fundamentals and its potential for sustained growth. They emphasize the importance of prudent financial management and policies that foster economic stability.

Conclusion

The record-breaking $230 billion forex reserve is a testament to India’s unwavering economic resilience and its unwavering commitment to financial prudence. This milestone enhances India’s global economic standing, provides stability to the Rupee, and creates a solid foundation for continued economic growth. It is a resounding affirmation of the government’s vision of an “Atmanirbhar Bharat” (Self-Reliant India), capable of navigating global economic challenges with resilience and confidence.

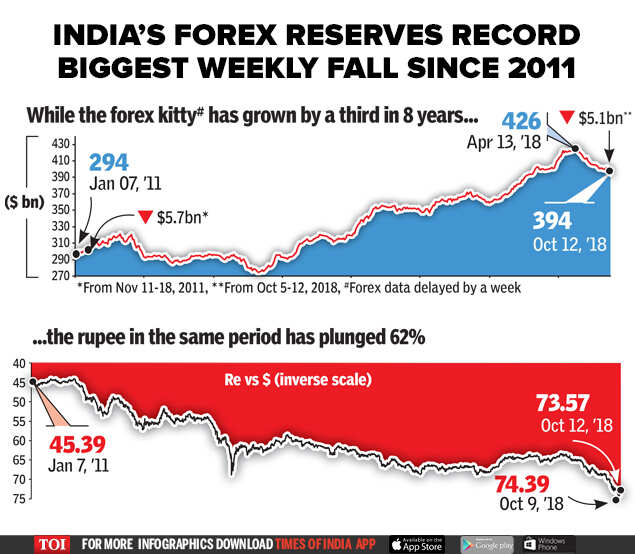

Image: timesofindia.indiatimes.com

Forex Reserve Of India Reaces To 230 Billiondollar