In today’s interconnected global economy, financial stability plays a crucial role in fostering economic growth and protecting citizens from financial shocks. Foreign exchange (forex) reserves, held by central banks and governments, serve as a critical line of defense in maintaining financial stability. In this article, we delve into the world of forex reserves, exploring their significance, composition, and the countries with the most robust reserves.

Image: technosports.co.in

Forex reserves are essentially holdings of various foreign currencies, gold, and other financial assets. They function as a safety net, allowing countries to meet their international payment obligations, stabilize their exchange rates, and protect against financial crises. By holding a buffer of foreign currencies, countries can intervene in foreign exchange markets to influence exchange rates and prevent their currencies from becoming too volatile.

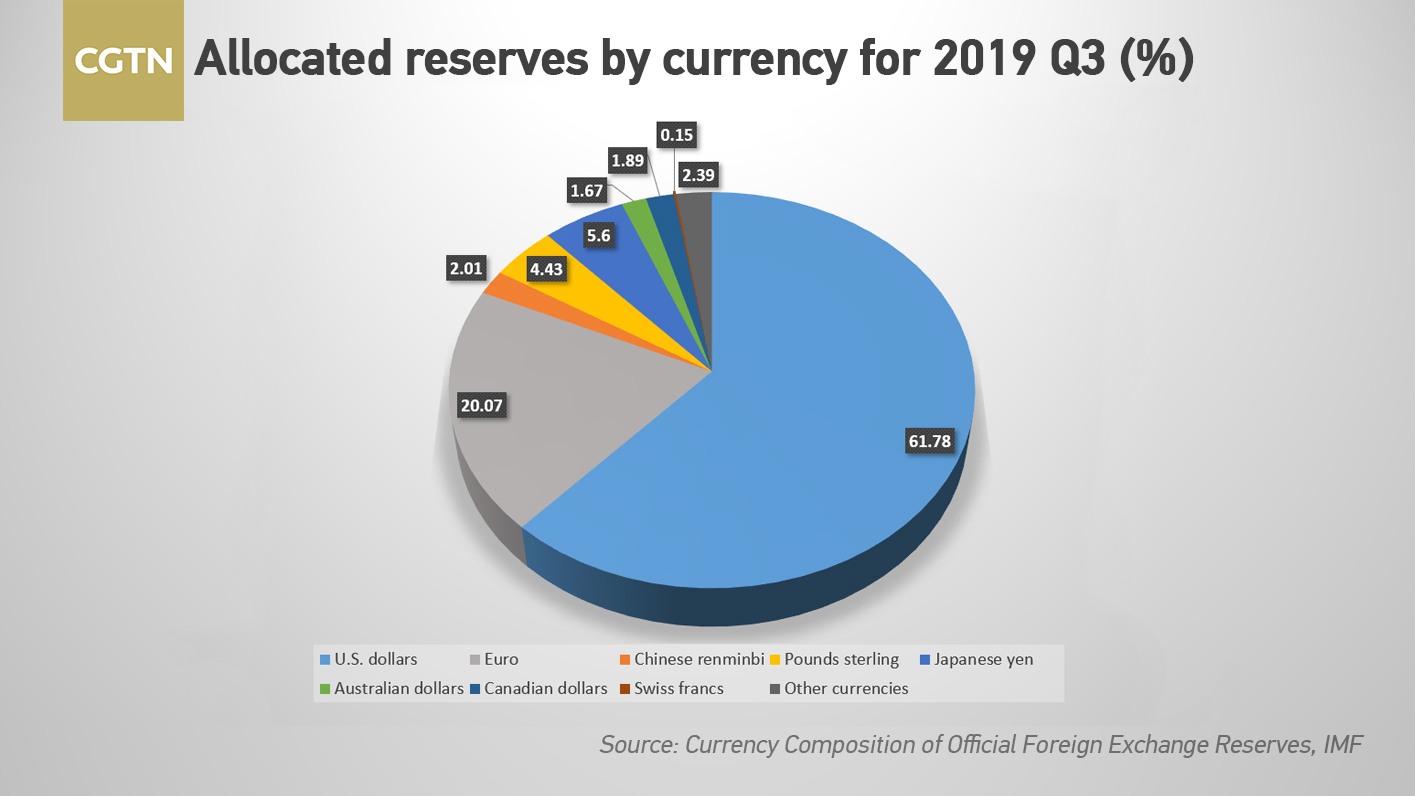

The composition of forex reserves can vary depending on the country’s economic policies and risk appetite. However, common holdings include foreign government bonds, treasury bills, and other highly liquid assets. Central banks also hold gold as a safe haven during periods of financial uncertainty.

A strong level of forex reserves is a sign of a country’s financial health and stability. It indicates the government’s ability to meet its external obligations and provides a cushion against external shocks. High forex reserves can also boost a country’s creditworthiness, making it easier and cheaper to borrow internationally.

Top Countries with Forex Reserves

As of January 2023, China holds the world’s largest forex reserves, valued at $3.3 trillion. China’s vast reserves provide its central bank with significant firepower to manage the yuan’s exchange rate and stabilize its financial system.

Japan ranks second with reserves of $1.3 trillion, followed by Switzerland with $1.1 trillion. Other countries with significant forex reserves include Russia, India, and Saudi Arabia.

The Role of Central Banks

Central banks are the primary holders and managers of forex reserves. They play a pivotal role in maintaining financial stability and implementing monetary policy. By buying and selling foreign currencies, central banks can influence the exchange rates and prevent excessive volatility.

Central banks also use forex reserves to smooth out seasonal fluctuations in foreign exchange rates. During periods of high demand for a particular currency, central banks can intervene by selling foreign currencies to increase its supply in the market, thus stabilizing its value.

Importance of Forex Reserves

Forex reserves play several crucial roles in ensuring financial stability:

-

Meeting Balance of Payments Obligations: Forex reserves allow countries to settle their international payments for goods, services, and investments.

-

Stabilizing Exchange Rates: Central banks can intervene in foreign exchange markets to support their currency’s value and prevent sharp fluctuations.

-

Managing Currency Risk: Forex reserves provide a cushion against currency fluctuations, reducing risks for businesses and investors.

-

Collateral for International Loans: Central banks can use forex reserves as collateral to secure international loans, increasing the country’s access to capital.

-

Protecting against Financial Crises: Forex reserves serve as a buffer against financial shocks, such as sudden outflows of foreign capital or exchange rate volatility.

Image: news.cgtn.com

Forex Reserve Of Different Countries

Conclusion

Forex reserves are an indispensable tool for maintaining financial stability and safeguarding the economic well-being of nations. By holding a sufficient level of foreign currencies and other financial assets, central banks can intervene in foreign exchange markets, stabilize exchange rates, and protect their economies from external shocks. The countries with the strongest forex reserves enjoy a significant advantage in withstanding financial crises and fostering economic growth.

As the global economy becomes increasingly interconnected, the importance of forex reserves continues to grow. Central banks around the world must remain vigilant in managing their forex reserves to safeguard their financial systems and promote economic prosperity.