What are Forex Reserves?

Forex reserves, also known as foreign exchange reserves, are a stockpile of foreign currencies and gold held by a country’s central bank. These reserves serve as a buffer against economic shocks and play a pivotal role in maintaining the stability and liquidity of a nation’s economy.

Image: www.financialexpress.com

Importance of Forex Reserves

Forex reserves are essential for several reasons:

- Maintaining Currency Stability: Reserves allow central banks to intervene in foreign exchange markets and stabilize the value of their domestic currency, especially during periods of volatility.

- Protecting Against External Shocks: In times of economic crisis or geopolitical events that may adversely affect foreign currency inflows, forex reserves provide a cushion and allow countries to meet their external obligations.

- Preserving Purchasing Power: Reserves can be used to import essential goods and services from abroad, maintaining purchasing power and preventing sharp price hikes in the domestic market.

- International Confidence: Adequate forex reserves signal a country’s financial strength and stability, boosting investor confidence and attracting foreign direct investment.

Composition of Forex Reserves

Forex reserves are typically composed of the following assets:

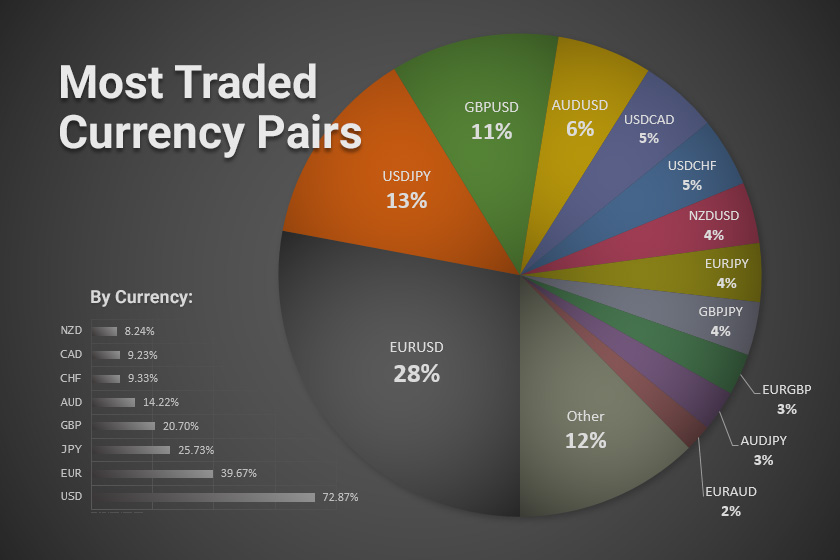

- Foreign Currencies: These include major currencies such as the US dollar, euro, and Japanese yen, as well as currencies of major trading partners.

- Gold: Gold is a traditional store of value and plays a significant role in diversifying reserves and enhancing their overall stability.

- Special Drawing Rights (SDRs): SDRs are an international reserve asset created by the International Monetary Fund (IMF).

- Other Assets: Some central banks also hold other assets such as bonds and equities, although these are typically a smaller portion of reserves.

Factors Influencing Forex Reserves

The level of forex reserves a country holds depends on various factors, including:

- External Dependence: Countries that rely heavily on imports or have a large external debt require higher forex reserves.

- Export Revenue: Countries with strong export revenue tend to have larger reserves due to the accumulation of foreign currencies through trade.

- Capital Controls: Capital controls limit the outflow of foreign currency and can contribute to higher forex reserves.

- Foreign Direct Investment: Inflows of foreign direct investment boost a country’s forex reserves.

- Central Bank Policy: Central banks use various tools, such as foreign exchange intervention and reserve management strategies, to influence the level of reserves.

Image: howtotradeonforex.github.io

Challenges of Managing Forex Reserves

Managing forex reserves presents several challenges:

- Currency Fluctuations: Changes in the value of foreign currencies can impact the real value of reserves.

- Investment Risk: Central banks must carefully manage the investment of forex reserves to minimize losses while maximizing returns.

- Ethical Considerations: Some countries may face ethical concerns about the composition of their reserves, such as investing in countries or companies involved in human rights violations.

- Optimal Level: Determining the optimal level of forex reserves can be challenging, as it involves balancing the need for stability with the opportunity cost of holding large reserves.

Forex Reserve Multiple Quetion Economy

Conclusion

Forex reserves are a vital component of a nation’s economic resilience and financial stability. By providing a buffer against external shocks, maintaining currency stability, and preserving purchasing power, reserves play a crucial role in ensuring economic growth and prosperity. Understanding the importance of forex reserves and the challenges they pose is essential for informed economic decision-making and the long-term financial health of nations.