Introduction

The world is currently witnessing an unprecedented surge in oil prices, with Brent crude oil reaching its highest levels in over a decade. This has sent shockwaves through global economies, particularly those heavily reliant on oil imports like India. In this context, India’s foreign exchange reserves have become a topic of increasing concern, as they have been steadily declining in recent months. This article aims to shed light on the complex relationship between India’s forex reserves and oil prices, unraveling the underlying causes and potential consequences.

Image: www.livemint.com

Understanding Forex Reserves

Foreign exchange reserves, commonly known as forex reserves, are assets held by a country’s central bank that can be used to settle international transactions. These reserves typically include gold, foreign currencies, and Special Drawing Rights (SDRs), an international reserve asset issued by the International Monetary Fund (IMF). Forex reserves play a crucial role in maintaining a stable exchange rate and ensuring confidence in a country’s economy.

India’s Forex Reserves: A Historic Decline

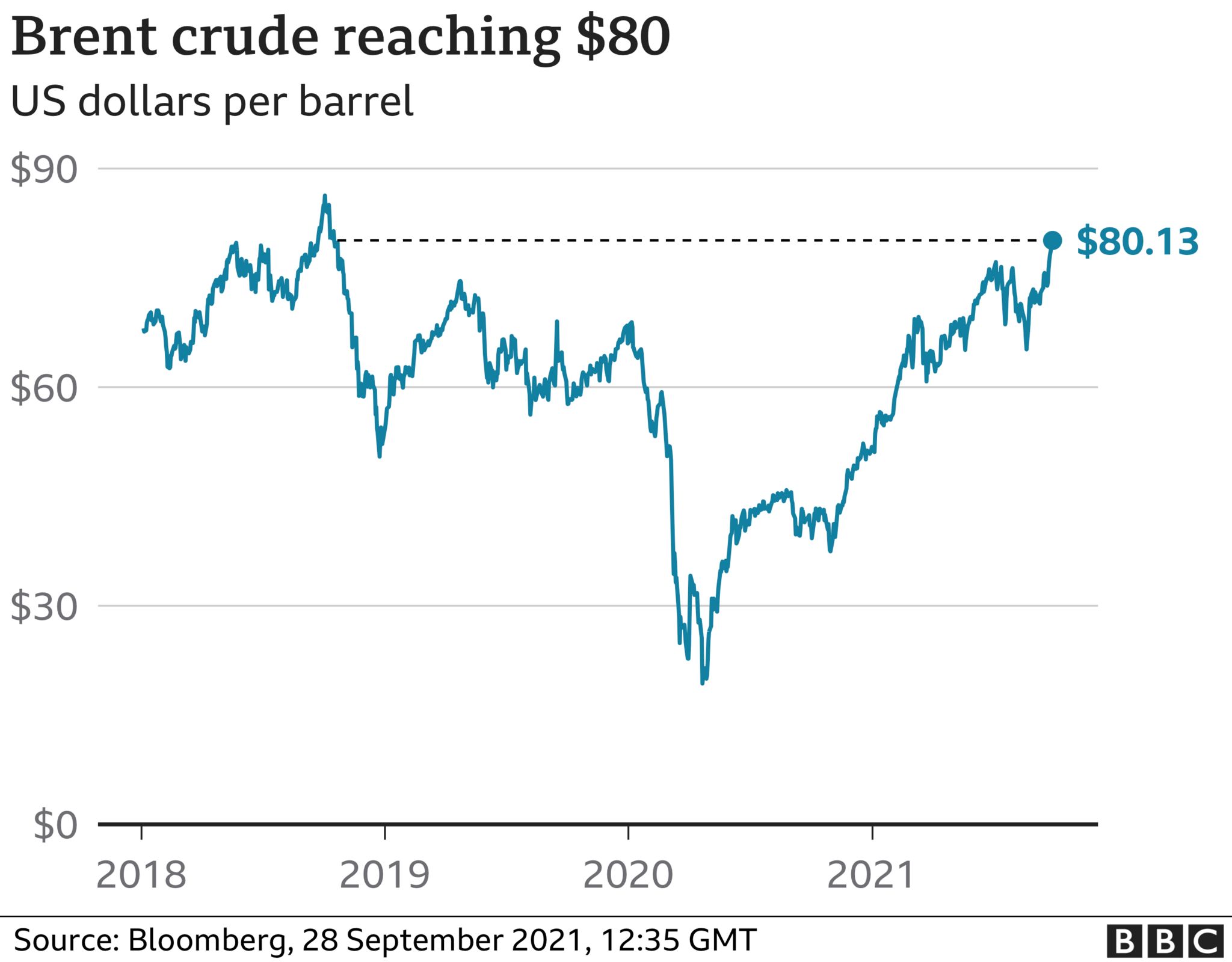

India’s forex reserves have witnessed a sharp decline in recent months. As of August 2023, they stood at $524.5 billion, down from a peak of $642 billion in September 2021. This significant erosion has raised concerns among economists and policymakers about India’s ability to meet its external obligations effectively.

The Correlation between Forex Reserves and Oil Prices

India is the world’s third-largest importer of crude oil, and its import bill has surged drastically due to rising global oil prices. To pay for these imports, India must use its forex reserves to purchase foreign exchange, leading to a depletion in its reserves. This inverse correlation between forex reserves and oil prices has become a significant concern for the Indian economy.

Image: www.victoriana.com

Underlying Causes of the Forex Reserve Decline

- Rising Oil Prices: The primary reason for the decline in India’s forex reserves is the persistent increase in global oil prices. Geopolitical tensions, supply chain disruptions, and high demand have all contributed to this surge, putting pressure on India’s import bill.

- Inflationary Pressures: The rising cost of oil imports has pushed up India’s inflation rate, eroding the purchasing power of consumers and businesses. This has led to a decrease in domestic demand, which, in turn, has reduced India’s export earnings and further depleted its forex reserves.

- Global Economic Uncertainty: The ongoing Russia-Ukraine conflict and the lingering effects of the Covid-19 pandemic have created global economic uncertainty. This has led to capital outflows from India as investors seek safer havens for their investments.

- Increased Imports: In addition to rising oil prices, India has also witnessed an increase in imports of non-oil commodities, such as gold and semiconductors. This has further exacerbated the pressure on its forex reserves.

Potential Consequences of Forex Reserve Depletion

The decline in India’s forex reserves poses several potential risks to the country’s economy:

- Dependence on External Debt: As forex reserves dwindle, India may need to resort to borrowing from external sources to meet its foreign currency requirements. This could lead to an increase in external debt and potentially threaten India’s financial independence.

- Exchange Rate Volatility: A sharp decline in forex reserves can make India’s currency vulnerable to speculative attacks, leading to currency depreciation and inflation. This could destabilize the economy and make it more difficult for businesses to import essential goods.

- Weakened International Standing: A country with low forex reserves is perceived as less creditworthy by international investors and lenders. This can affect India’s ability to secure favorable terms on trade and investments.

Measures to Address the Forex Reserve Depletion

To address the depletion of forex reserves, the Indian government has taken several measures, including:

- Tightening Import Restrictions: The government has placed restrictions on the import of certain non-essential items to reduce the demand for foreign exchange.

- Promoting Exports: Efforts are being made to boost India’s exports to generate more foreign currency earnings and replenish forex reserves.

- Attracting Foreign Investments: The government has introduced policy changes to attract foreign investments into India, which can help stabilize forex reserves.

- Managing Capital Outflows: The Reserve Bank of India (RBI), India’s central bank, has implemented measures to curb capital outflows by regulating investments in overseas markets.

Forex Reserve India Oil Price

Conclusion

The decline in India’s forex reserves due to rising oil prices is a serious concern that requires urgent attention. A sustained decline in reserves could lead to economic instability and weaken India’s international standing. The government and the RBI have taken steps to address this issue, but much more needs to be done to ensure the long-term stability of India’s economy. It remains crucial for India to focus on reducing its dependency on oil imports, diversifying its energy sources, and implementing sustainable economic policies to safeguard its financial future.