The currency market, also known as the forex market, is the world’s largest, most liquid financial market where currencies are traded in pairs. Amidst the constant fluctuations, navigating the forex market requires a keen eye and a deep understanding of the underlying factors that drive currency prices. This is where forex research and analysis come to the forefront, providing invaluable insights for traders and investors.

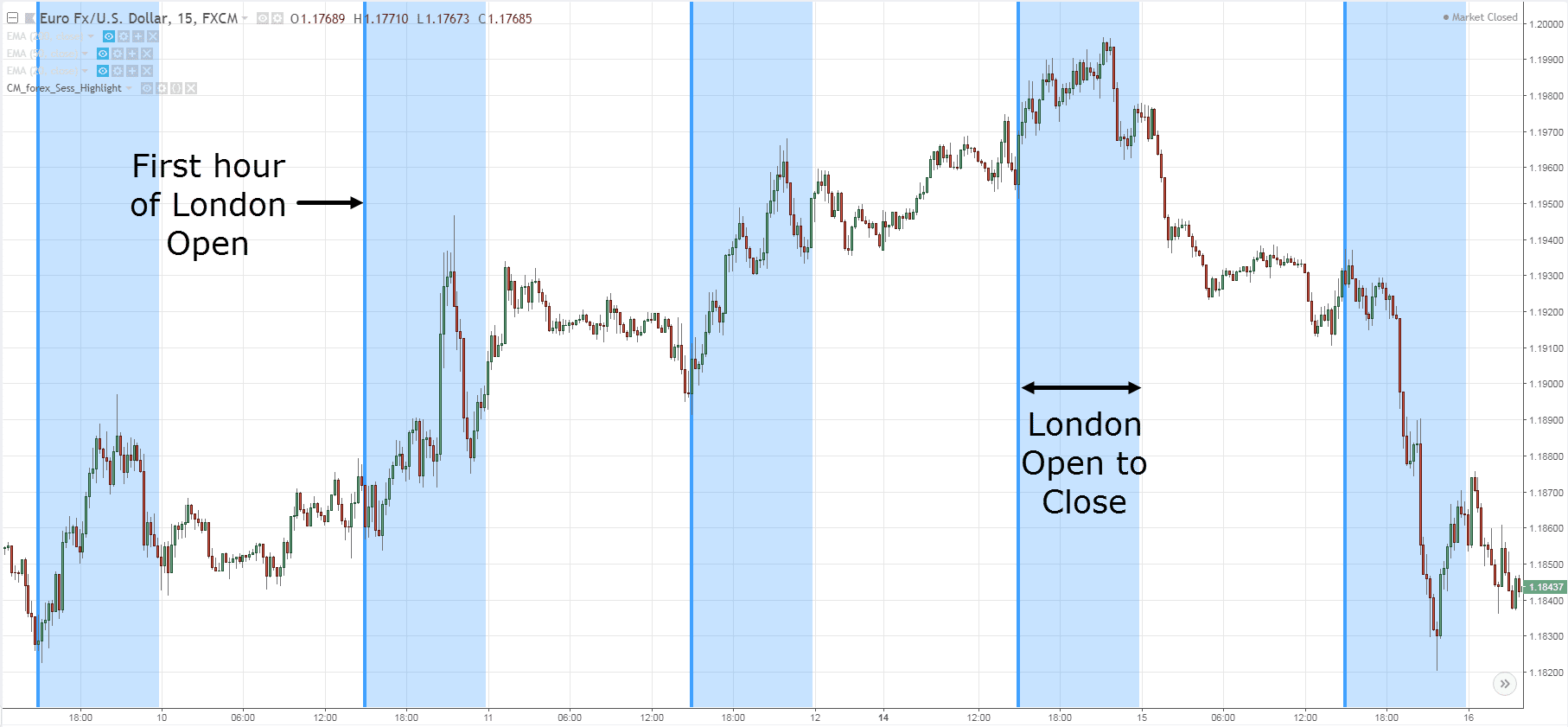

Image: www.tradingwithrayner.com

Defining Forex Research and Analysis

Forex research involves the systematic study and interpretation of economic, political, and market data to identify trends, patterns, and opportunities within the currency market. Analysis of this data forms the basis for strategic decision-making in forex trading, enabling traders to make informed predictions and position themselves accordingly.

The Importance of Forex Research and Analysis

In the fast-paced and unpredictable world of forex trading, comprehensive research and analysis are essential for success. They provide a framework to:

- Uncover fundamental economic and political factors influencing currency values.

- Identify market trends and patterns to make informed trading decisions.

- Assess the risk and reward associated with different trading strategies.

- Stay updated on the latest developments impacting the forex market.

Techniques and Tools for Forex Research and Analysis

Forex research and analysis encompass various techniques and tools, ranging from fundamental analysis to technical analysis.

- Fundamental Analysis explores economic and political factors that affect currency valuations, such as GDP growth, inflation rates, and central bank policy decisions.

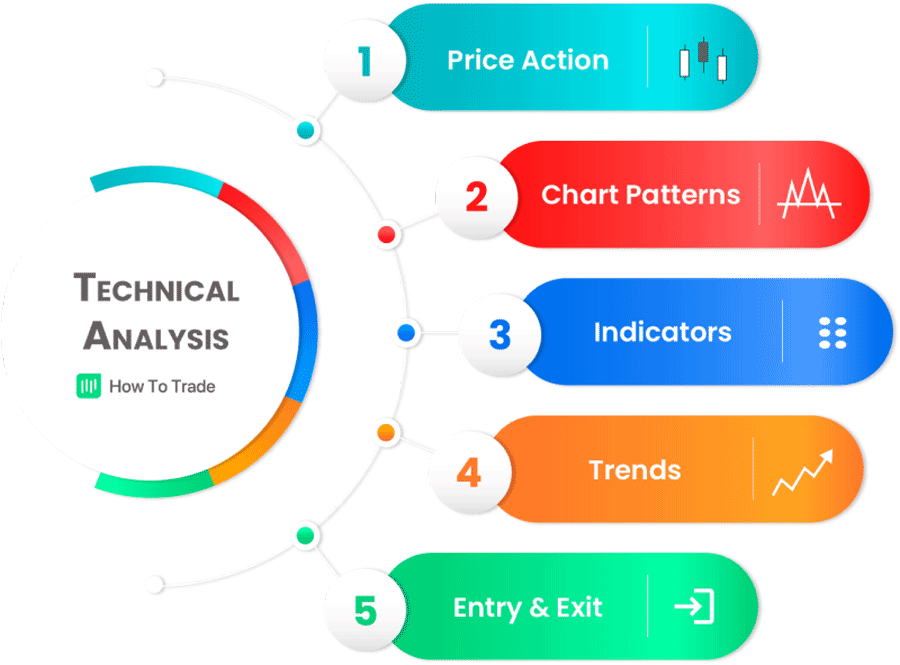

- Technical Analysis utilizes historical price data to identify trends, patterns, and support and resistance levels that guide trading strategies.

Image: howtotrade.com

Real-World Applications of Forex Research and Analysis

Understanding forex research and analysis directly translates to greater success in forex trading. Here’s how:

- Making informed trading decisions based on data-driven insights.

- Capitalizing on market opportunities identified through trend analysis.

- Managing risk by assessing market volatility and identifying potential pitfalls.

- Staying ahead of the curve by anticipating changes in market dynamics.

Forex Research And Analysis Reports

Conclusion

Forex research and analysis are not just abstract concepts; they are indispensable tools for anyone seeking to establish a foothold in the ever-evolving currency market. By embracing thorough research and thoughtful analysis, traders and investors can navigate the complexities, make informed decisions, and ultimately achieve greater success in the forex market.

To further enhance your understanding and maximize your potential in forex trading, we encourage you to explore additional resources and continue to seek knowledge about the factors shaping the global currency landscape.