Embark on a transformative journey in the realm of foreign exchange trading with the revolutionary Renko Silverlight strategy, a methodology designed to empower traders with enhanced market insights and exceptional profit-generating opportunities. In this comprehensive guide, we delve into the intricacies of this remarkable strategy, unveiling its historical context, underlying principles, and practical applications. Geared towards beginners and experienced traders alike, this exploration will equip you with the knowledge and tools necessary to navigate the ever-changing currency markets with confidence and precision.

Image: www.x-trader.net

What is the Renko Silverlight Strategy?

The Renko Silverlight strategy is a unique technical analysis method that employs Renko charts, a specialized type of price chart, and Silverlight, a user-friendly programming platform. Renko charts visually represent price movements by plotting bricks, where each brick represents a specific amount of price change rather than a fixed time interval. This innovative approach eliminates noise from market data, allowing traders to focus on significant price trends and identify potential trading opportunities more effectively.

The Importance of Renko Charts

Renko charts offer several advantages over traditional time-based charts. Firstly, they filter out insignificant price fluctuations, providing a clearer representation of underlying market trends. This streamlined view enables traders to identify potential reversals or breakouts earlier than with standard charts, offering a competitive edge in capturing profitable trades. Furthermore, Renko charts can be customized to suit the trader’s preferences, adjusting the brick size to align with different market conditions and trading styles.

The Role of Silverlight

Silverlight plays a crucial role in this strategy by providing a powerful platform for charting, analysis, and trade execution. Its user-friendly interface allows traders to create and modify Renko charts with ease, apply technical indicators and charting tools, and execute trades directly within the platform. Additionally, Silverlight’s advanced scripting capabilities enable traders to automate trading strategies, saving time and reducing the risk of emotional decision-making.

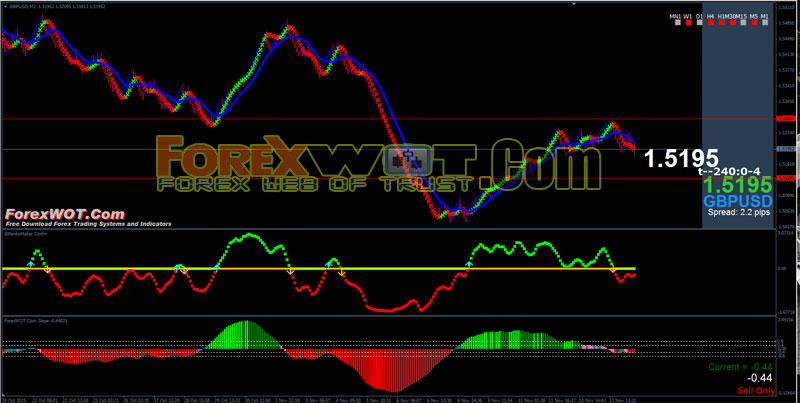

Image: forexwot.com

Historical Roots and Evolution

The Renko charting technique has a rich history dating back to the 17th century when Japanese rice traders utilized it to visually represent price fluctuations. Over time, the methodology has evolved to incorporate modern technical analysis techniques, with Silverlight serving as a contemporary tool for its seamless implementation. Today, the Renko Silverlight strategy is widely recognized as an effective tool for identifying trading opportunities and enhancing profitability in the forex markets.

Practical Applications and Trading Techniques

The Renko Silverlight strategy can be applied to a wide range of trading styles, including scalping, day trading, and swing trading. Traders can employ various charting patterns, such as support and resistance levels, trendlines, and chart formations, to identify high-probability trades. Additionally, technical indicators, such as moving averages, oscillators, and Bollinger Bands, can be integrated into the strategy to provide additional confirmation and risk management.

The Benefits of Using the Renko Silverlight Strategy

The Renko Silverlight strategy offers numerous benefits to traders of all levels. Its ability to filter out noise and clarify market trends enhances trading accuracy and reduces the risk of false signals. Moreover, the strategy’s flexibility allows for customization to suit individual trading preferences, maximizing its potential in different market conditions. The addition of Silverlight’s advanced scripting capabilities further streamlines the trading process, saving time and improving trade execution.

Forex Renko Silverlight Strategy Free Download

Conclusion

The Renko Silverlight strategy is a powerful and versatile tool that provides traders with a unique perspective on the forex markets. By embracing its historical roots and leveraging the latest technological advancements, this strategy empowers traders with the ability to identify promising trading opportunities, navigate market volatility more effectively, and ultimately achieve consistent profitability.