Remittances, the transfer of funds across borders, have become increasingly commonplace in today’s globalized economy. Whether you’re supporting loved ones overseas, making business transactions, or investing internationally, understanding how to complete a forex remittance form is essential.

Image: www.youtube.com

For customers of Andhra Bank, navigating the intricacies of foreign exchange remittances can be simplified by understanding the process and utilizing the dedicated forex remittance form.

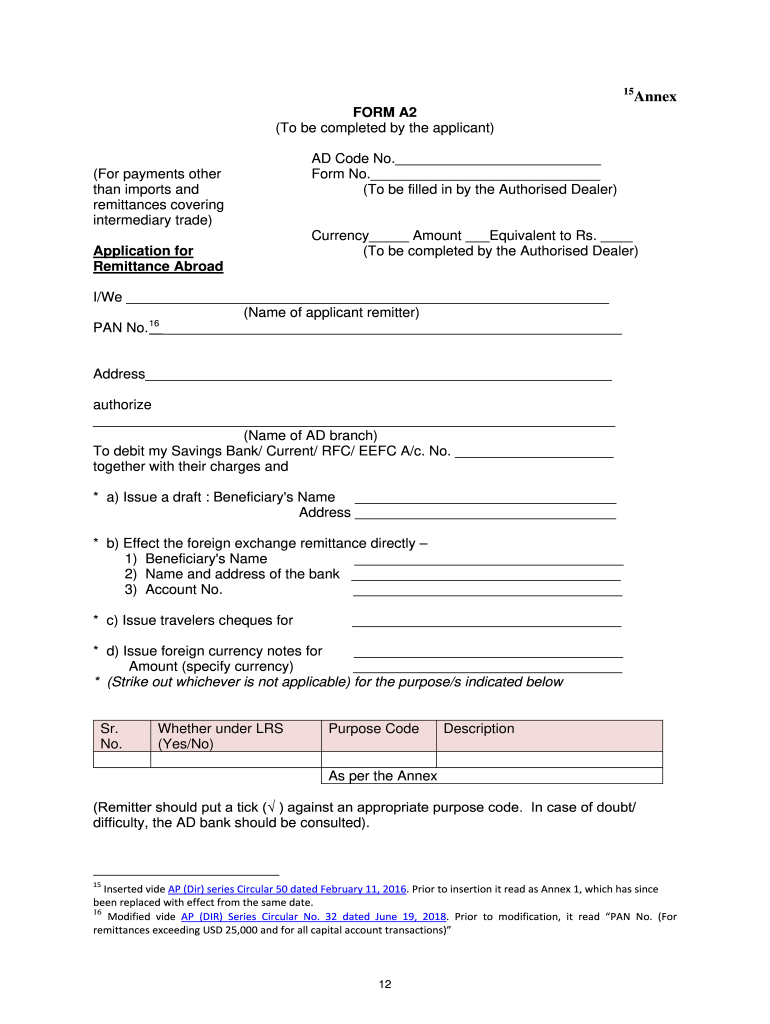

Forex Remittance Form for Andhra Bank

Andhra Bank provides a specific forex remittance form designed to facilitate the smooth transfer of funds abroad. This form captures pertinent details about the transaction, ensuring compliance with regulations and streamlining the process.

Details Required in the Forex Remittance Form

- Remitter’s personal information: Name, address, contact details

- Beneficiary’s information: Name, address, bank account details

- Transaction details: Amount to be remitted, currency, purpose of remittance

- Bank details: Andhra Bank branch, account details

- Supporting documents: As required for the specific type of remittance

Steps to Complete the Forex Remittance Form

- Obtain the forex remittance form from your Andhra Bank branch or download it from their website.

- Fill in the form accurately and completely as per the required details mentioned above.

- Attach any necessary supporting documents.

- Submit the completed form along with the supporting documents to your Andhra Bank branch.

- Review and confirm the remittance details with the bank representative.

- Make the payment as per the prescribed method and obtain a transaction receipt.

Image: www.signnow.com

Types of Forex Transactions Covered by the Form

- Personal remittances: Supporting family members, education expenses, medical expenses

- Business remittances: Import payments, export proceeds

- Investment remittances: Purchasing stocks, bonds, or real estate overseas

Tips for Using the Forex Remittance Form

To enhance your experience and ensure a seamless remittance process, consider these expert tips:

Verify Beneficiary Details

Meticulously check the beneficiary’s name, account number, and bank details to avoid any errors that could delay or hinder the transfer.

Document Requirements

Ensure you have all the necessary supporting documents, such as invoices, proof of identity, or residence permits, as required for your specific type of remittance.

Exchange Rates and Fees

Inquire about the prevailing exchange rates and any applicable remittance fees before initiating the transaction to avoid any surprises or discrepancies.

Review and Confirmation

Thoroughly review the completed form and transaction details with the bank representative to ensure accuracy and eliminate any potential misunderstandings.

Frequently Asked Questions

Here are some commonly asked questions regarding forex remittance forms and Andhra Bank’s services:

Q: What is the processing time for forex remittances?

A: Processing times may vary depending on the destination country and the type of transaction. Typically, it ranges from 2 to 5 business days.

Q: Are there any limits on the amount I can remit?

A: Yes, there may be limits imposed by Andhra Bank or regulatory authorities depending on the purpose of the remittance and the country of destination.

Q: Can I track the status of my remittance?

A: Yes, you can track the status of your remittance by providing the transaction reference number to your Andhra Bank branch or through online banking services.

Forex Remittance Form Andhra Bank

Conclusion

Understanding the forex remittance form provided by Andhra Bank empowers you to manage your international fund transfers effectively. By adhering to the steps outlined, gathering the required documents, and utilizing the expert tips shared, you can ensure smooth and hassle-free remittances, enabling you to support loved ones, grow your business, or explore global investment opportunities.

If you have found this article informative and would like to delve deeper into the realm of forex remittances, I encourage you to visit Andhra Bank’s website or consult with a financial expert at your local branch.