In the interconnected global economy, foreign exchange rates play a pivotal role in international trade and financial transactions. As a currency trader with a keen eye for market movements, I have witnessed firsthand the significance of understanding the exchange rate between the US dollar (USD) and the euro (EUR), the two prominent currencies in the world.

Image: www.qarya.org

The USD to EUR Currency Pair

The USD to EUR currency pair, denoted as EUR/USD, represents the value of the euro relative to the US dollar. It indicates how many US dollars are required to purchase one euro at a specific point in time. This exchange rate undergoes constant fluctuations driven by a multitude of economic factors, including interest rates, inflation, political stability, and global events.

Factors Influencing the EUR/USD Rate

- Interest Rates: Central bank interest rate decisions significantly impact the value of currencies. Higher interest rates in a country tend to strengthen its currency as they make it more attractive for investors seeking higher returns.

- Inflation: When inflation is high, purchasing power decreases, which can weaken a currency. Maintaining low and stable inflation is crucial for currency stability.

- Political Stability: Economic and political stability plays a significant role in currency value. Uncertainty or instability can lead to investors selling off currencies and seeking safety in more stable markets.

- Global Events: Major global events, such as wars, natural disasters, and economic crises, can have a profound impact on currency exchange rates.

Tracking the EUR/USD Exchange Rate

Monitoring the EUR/USD exchange rate is essential for currency traders, businesses engaged in international trade, and individuals making financial transactions across borders. Real-time data from reputable sources like Forex brokers or financial news websites provide up-to-date information on the current exchange rate.

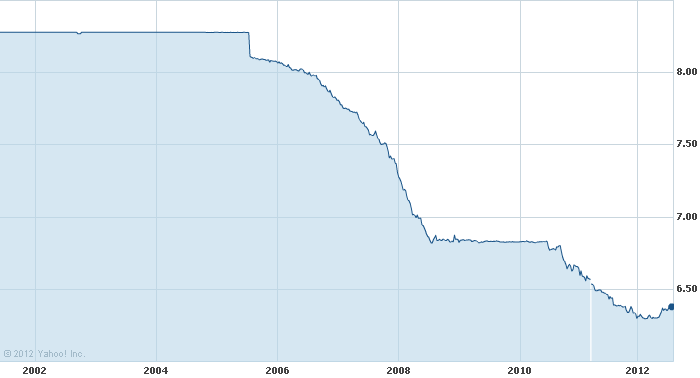

Understanding the historical trends and technical analysis of the currency pair can assist traders in making informed decisions. Charts and graphs depicting the EUR/USD rate over time provide valuable insights into support and resistance levels, enabling traders to identify potential trading opportunities.

Image: tujogim.web.fc2.com

Tips for Converting USD to EUR

- Compare Exchange Rates: Shop around for the most favorable exchange rate from multiple currency exchange companies or banks.

- Consider Transaction Fees: Be aware of any hidden fees or charges associated with currency conversion transactions.

- Utilize Mid-Market Rates: Aim for the mid-market rate, which represents the average of the bid and ask prices, to minimize transaction costs.

- Use Online Currency Converters: Leverage online currency converters to quickly calculate the approximate amount of euros you will receive for a given amount of US dollars.

FAQs on EUR/USD Conversion

- Q: What affects the EUR/USD exchange rate?

- Q: How can I track the EUR/USD exchange rate?

A: Real-time data and historical charts from reputable sources like Forex brokers or financial news websites provide up-to-date information on the exchange rate.

A: Interest rates, inflation, political stability, and global events are key factors that influence the EUR/USD exchange rate.

Forex Rate Usd To Euro

Summary

The USD to EUR currency pair is fundamental in international finance. Understanding the factors that drive exchange rate fluctuations and employing effective conversion strategies can benefit currency traders, businesses, and individuals alike. Whether you are new to foreign exchange or a seasoned trader, staying informed and making wise decisions are key to navigating the complexities of global currency markets.

I encourage readers to explore this topic further and delve into the dynamics of currency exchange. Are there any specific aspects of the USD to EUR exchange rate that you would like me to cover in-depth? Share your thoughts and questions in the comments section below.