Embark on an enlightening journey into the fascinating world of foreign exchange, specifically delving into the intricacies of the State Bank of India’s (SBI) forex rates. This article aims to empower you with a comprehensive understanding of forex dynamics, unraveling the complexities of currency exchange and empowering you with actionable insights.

Image: fuwababe.web.fc2.com

Forex: The Lifeline of Global Commerce

Foreign exchange, commonly known as forex, plays a pivotal role in international trade and investment. It facilitates the seamless exchange of currencies, enabling businesses to import and export goods and services, and individuals to travel and invest abroad. The foreign exchange market is a decentralized global network where currencies are bought, sold, and traded 24 hours a day, five days a week.

Introducing SBI: A Trusted Name in Indian Forex

As India’s largest public sector bank, SBI holds a commanding position in the country’s forex market. With its vast network of branches and unparalleled reputation for reliability, SBI offers a broad range of forex services, catering to both individuals and businesses. Understanding SBI’s forex rates is crucial for making informed decisions when engaging in foreign exchange transactions.

Decoding Forex Rates: A Balancing Act

Forex rates, simply put, represent the value of one currency in relation to another. They are constantly fluctuating, influenced by a multitude of factors, including economic conditions, political stability, and global events. These fluctuations create opportunities for currency exchange, allowing individuals and businesses to benefit from favorable rates.

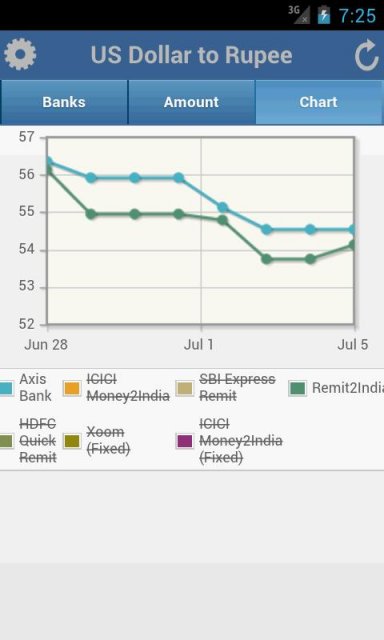

Image: forexrateindia.com

Navigating the Nuances of SBI Forex

SBI’s forex rates are determined by market forces and are subject to constant change. Factors such as supply and demand, interest rate differentials, and geopolitical events impact the value of currencies, leading to fluctuations in forex rates. It is prudent to stay updated on the latest market trends and consult with experts to make judicious decisions.

Unveiling the Secrets of Profitable Forex Transactions

Successfully navigating the complexities of forex requires a combination of knowledge, vigilance, and strategic planning. Understanding the basics of forex, closely monitoring market movements, and seeking expert advice can significantly increase the likelihood of profitable currency exchange outcomes. Remember, forex trading involves potential risks, so it is essential to proceed with informed decision-making and manage risks appropriately.

Empowering You with Expert Guidance

Renowned forex experts advise staying informed about economic data, political developments, and central bank announcements. These factors have a profound impact on currency valuations. Additionally, utilizing reputable forex brokers and platforms can provide access to valuable market insights and trading tools. Technological advancements have made it easier than ever to stay connected to the forex market, allowing you to monitor rates and trends in real-time.

Harnessing the Power of SBI Forex

Embracing the services of SBI can simplify your forex transactions. SBI offers a suite of services, including currency exchange, wire transfers, travel cards, and remittances, tailored to diverse forex needs. By leveraging SBI’s expertise and competitive rates, you can make your international financial endeavors effortless.

Forex Rate Of Sbi In India

Taking Control of Your Forex Journey

Embarking on the forex exchange path can be empowering, granting you the freedom to navigate global markets with confidence. Educate yourself, consult with experts, stay alert to market dynamics, and embrace the resources provided by trusted institutions like SBI. By mastering the art of forex, you hold the key to unlocking a world of financial opportunities.