Navigating the complexities of foreign exchange rates can be overwhelming, especially when you’re planning an international transaction. ICICI Bank, one of India’s leading financial institutions, offers competitive forex rates for various currencies. This comprehensive guide will equip you with the knowledge to understand and utilize ICICI Bank’s forex services effectively.

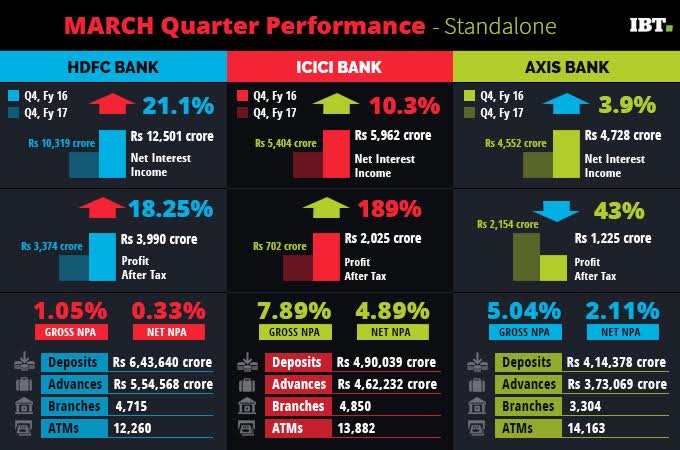

Image: www.ibtimes.co.in

Defining Forex Rates: The Language of Global Finance

A forex rate, short for foreign exchange rate, represents the value of one currency in relation to another. Currencies fluctuate in value based on economic conditions, political events, and global demand. ICICI Bank offers real-time forex rates, providing customers with up-to-date information to make informed decisions.

Impact on Your Wallet: How Forex Rates Affect Transactions

Whether you’re a frequent traveler, a business owner, or an investor, forex rates can significantly impact your financial dealings. A favorable exchange rate can save you money on international purchases, while an unfavorable rate can increase the cost of your transactions. Understanding forex rates is crucial for planning and budgeting your foreign exchange activities.

ICICI Bank Forex Services: Your Partner in International Transactions

ICICI Bank offers a comprehensive range of forex services tailored to meet your diverse needs. From cash currency exchange to international remittances, their services are designed to make your foreign exchange transactions hassle-free.

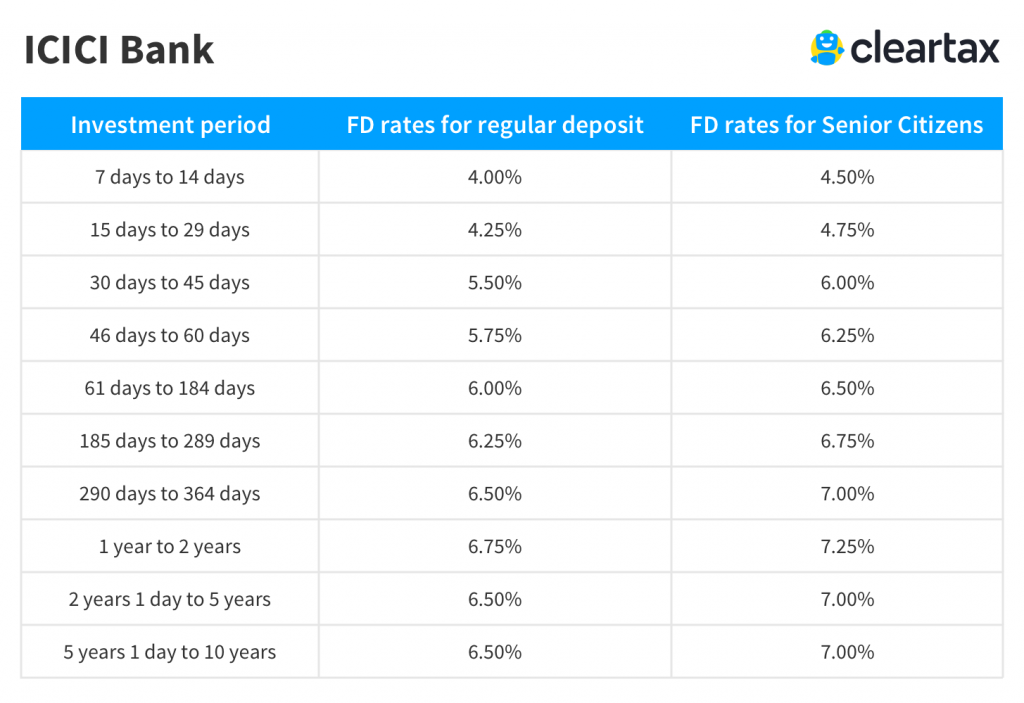

Image: cleartax.in

1. Cash Currency Exchange: Convenience at Your Doorstep

ICICI Bank’s extensive network of branches and currency exchange outlets provides easy access to foreign currency exchange. You can exchange major currencies like the US dollar, British pound, and Euro, as well as lesser-known currencies, ensuring convenience for your international travel.

2. International Remittances: Transferring Funds Across Borders

Whether you need to send money abroad for business or personal reasons, ICICI Bank’s international remittance services offer secure and efficient options. You can transfer funds to over 200 countries and territories, ensuring that your money reaches its destination swiftly and securely.

How to Get the Best Forex Rates: Tips for Savvy Transactors

To maximize the value of your foreign exchange transactions, follow these expert tips:

1. Monitor Currency Trends:

Stay informed about global economic news and events that can influence currency fluctuations. Use ICICI Bank’s online platforms to track real-time forex rates and identify favorable exchange rates.

2. Shop Around for Competitive Rates:

Compare forex rates offered by different banks and financial institutions to find the best deal. ICICI Bank’s competitive rates ensure that you get the most value for your money.

3. Utilize Stop-Loss Orders:

Protect your transactions from unfavorable currency movements by setting up a stop-loss order. This order automatically executes a trade if the exchange rate falls below a predetermined level, limiting your losses.

Forex Rate In Icici Bank Today

Conclusion: Empowering Transactors with Currency Knowledge

Understanding forex rates in ICICI Bank today empowers you to make informed financial decisions and maximize the value of your international transactions. Whether you’re a seasoned traveler, a savvy investor, or an entrepreneur navigating foreign markets, this guide provides the knowledge and tools to confidently navigate the world of foreign exchange.